Statistical data> Registrations Publication period: 01 October 2021 Data reference period: September 2021 Analysis by brand and group of car registrations in Italy. Download attachment: 03 Groups September 2021_615715c5a5c58.pdf To view the content is required accept the installation of Calameo cookies TAG: registrations, passenger cars, groups, 2021, August Go to Source

Category: Trade Body Site

Car and off-road vehicle registrations in Italy: Top 50 models – September 2021

Statistical data> Registrations Publication period: 01 October 2021 Data reference period: September 2021 Ranking of the 50 best-selling car models in Italy. Download attachment: 06 Top 50 September 2021_6156d805af4e8.pdf To view the content is required accept the installation of Calameo cookies TAG: passenger cars, registrations, template, 2021, September Go to Source

Market structure – September 2021

Statistical data> Registrations Publication period: 01 October 2021 Data reference period: September 2021 Analysis of the structure of the Italian car market with details by power supply, user, segment, bodywork and geographical area. Download attachment: 04 Market structure september_2021_6156d0c35b7f2.pdf To view the content is required accept the installation of Calameo cookies TAG: registrations, passenger cars,… Continue reading Market structure – September 2021

Car registrations by CO2 levels – September 2021

Who is UNRAE UNRAE is the Association that represents the foreign manufacturers operating on the Italian market of cars, commercial and industrial vehicles, buses and caravans and motor homes. Who we are Structure President General manager Associative bodies Institutional Relations Statute Ethical code Go to Source

Car sales in September 2021

In September, 17,992 new passenger cars were registered, 2440 more (+ 15.7%) than in September 2020. Among the new passenger cars, the zero-emission cars had a 77.5 per cent market share in September. All figures from OFV Here are the key figures for September and so far in 2021: Passenger cars Number September 2021 Change… Continue reading Car sales in September 2021

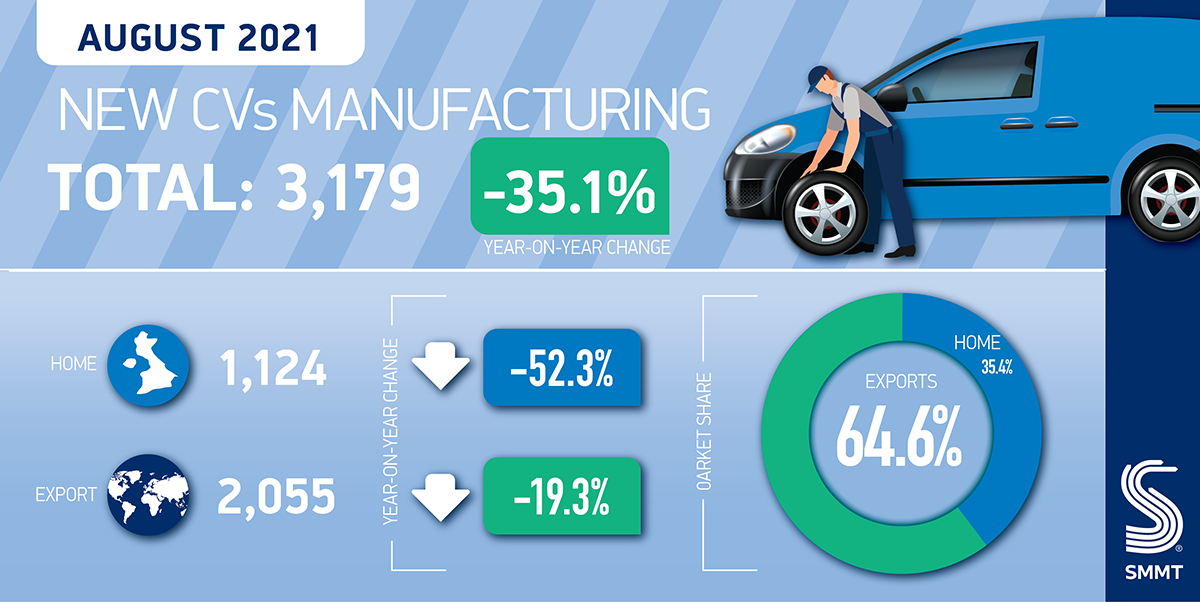

Commercial vehicle output stalls in August with a -35.1% fall

30 September 2021 #UK Manufacturing 3,179 commercial vehicles produced during August, a decrease of -35.1% on 2020, as output remains-20.0% below the five-year average for the month.1 Exports of commercial vehicles drop by -19.3%, while domestic demand saw a more significant decline of -52.3%. Given previous robust increases, year-to-date production remains 18.2% up on a… Continue reading Commercial vehicle output stalls in August with a -35.1% fall

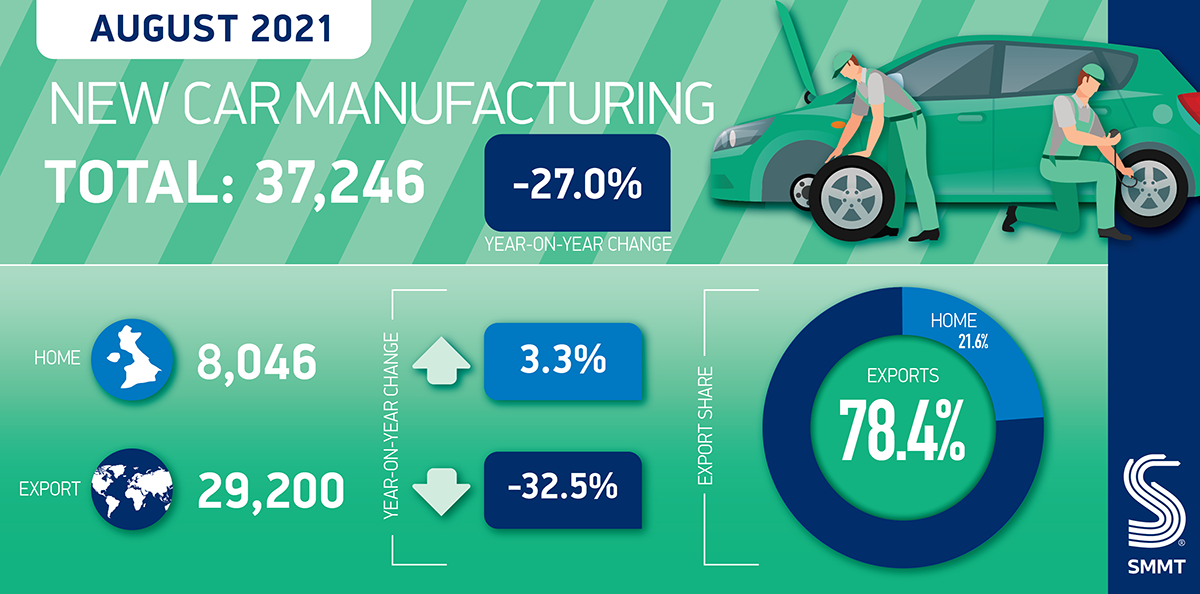

August car production falls as global chip shortage continues to bite

British car production falls -27.0% in August with 37,246 units leaving factory gates. Global chip shortage and some extended summer factory shutdowns dent overall performance. Battery electric and hybrid car manufacturing output hits record 27.6% production share. UK car production fell -27.0% in August, the second consecutive month of decline, with 37,246 cars manufactured, according… Continue reading August car production falls as global chip shortage continues to bite

August 2021 new car pre-registration figures

27 September 2021 #Pre-Registration SMMT released figures for August pre-registrations in the UK new car market. The data shows the number of cars disposed of by vehicle manufacturers in August 2021 that were defined as pre-registrations. Download the August 2021 release Go to Source

Car registrations in Europe – July / August 2021

Statistical data> Registrations Publication period: September 16, 2021 Data reference period: July 2020 / August 2020 Analysis of car registrations in the European Union and EFTA markets, with details by country, brand and group. Download attachment: marketeu_6142fe92e9c82.pdf To view the content is required accept the installation of Calameo cookies TAG: registrations, passenger cars, Europe, July,… Continue reading Car registrations in Europe – July / August 2021

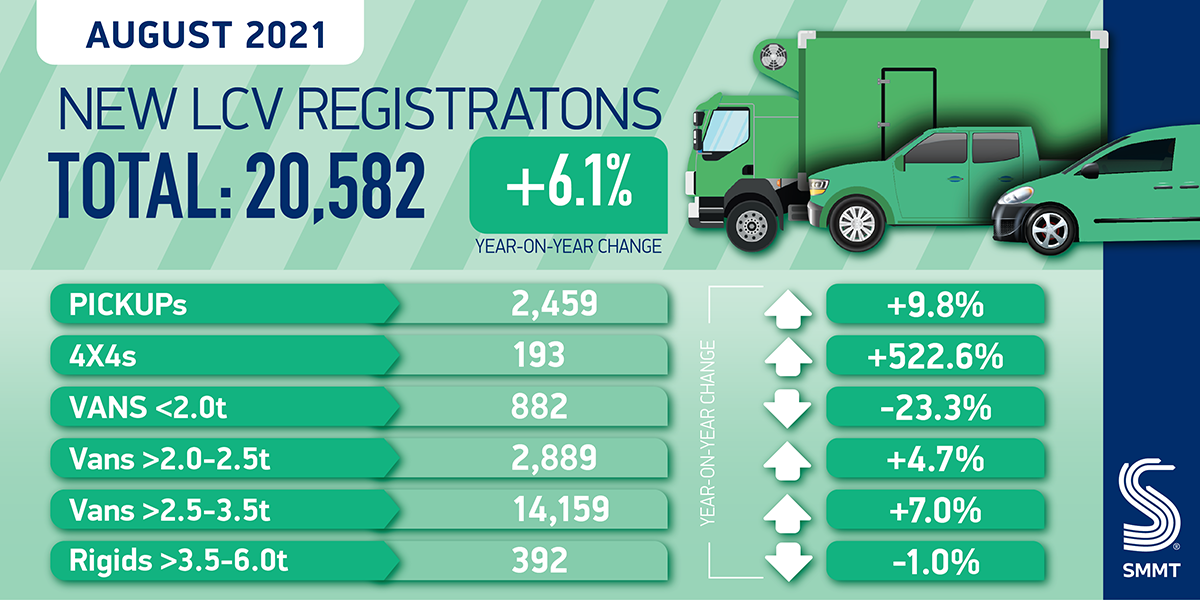

Van registrations swell for summer but semi-conductor shortage concerns loom

Industry records second best ever August with 20,582 new van registrations during typically one of the quietest month in the year. New van uptake up 2.6% year to date on pre-pandemic average. Semi-conductor shortages in manufacturing still threaten production and market. SEE LCV REGISTRATIONS BY BRAND DOWNLOAD PRESS RELEASE AND DATA TABLE The new light… Continue reading Van registrations swell for summer but semi-conductor shortage concerns loom