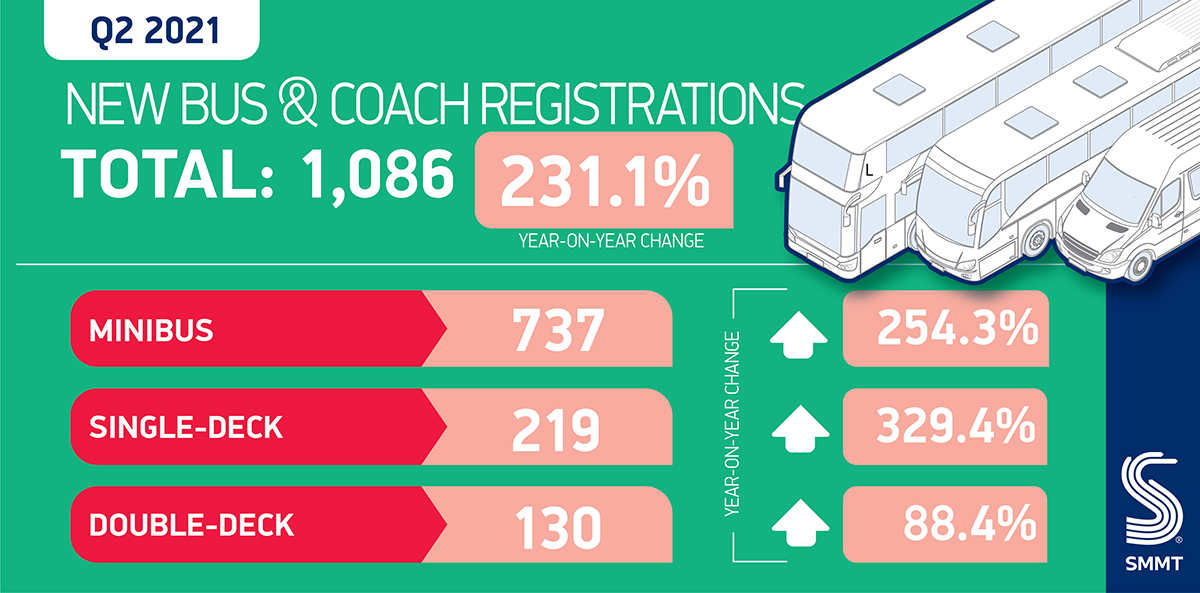

16 August 2021 #Bus & Coach #Registrations #SMMT News 1,086 vehicles registered in Q2 2021, up 231.1% on 2020, but 347 units or -24.2% short of 2019 outturn. Market fell -3.6% on first half of 2020, with 1,668 vehicles registered year-to-date – less than half the pre-pandemic average.1 Sector calls for longer-term planning from government… Continue reading Q2 bus and coach registrations halve in five years, even after post-pandemic increase

Category: Trade Body Site

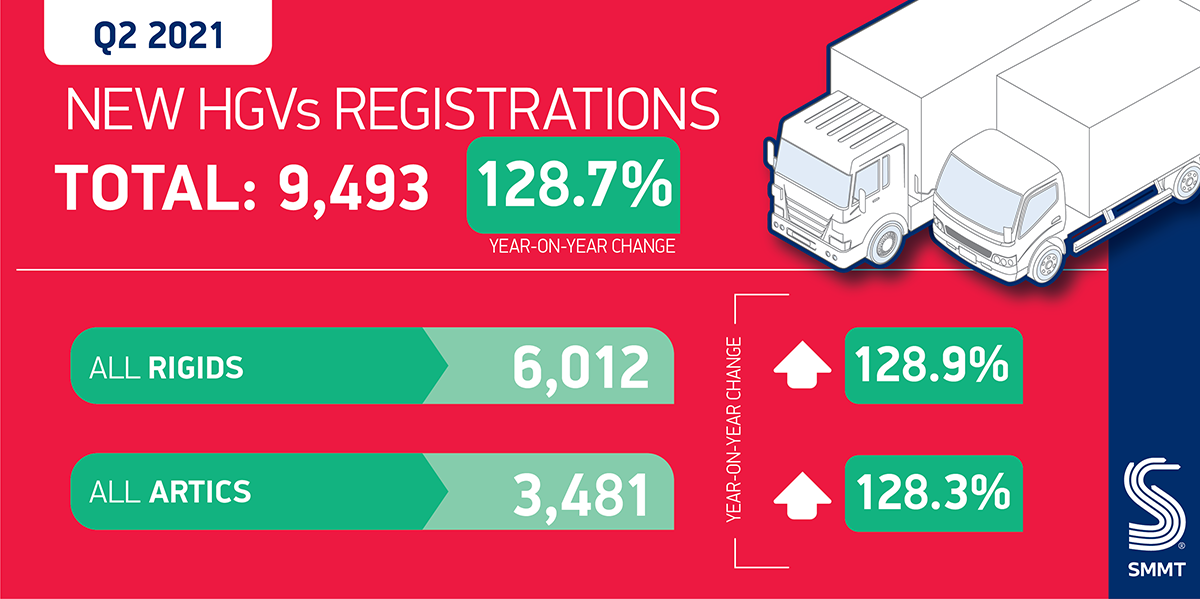

HGV market in Q2 post-Covid boost, but full recovery still awaited

UK HGV market shows signs of recovery after Covid-impacted Q2 2020, with 9,493 vehicles registered. New truck registrations up significantly on lockdown-affected Q2 2020 and remain down by -20.1% on pre-pandemic five-year average.1 Almost 20,000 trucks registered in the first six months of the year, down -28.8% on 2019. SEE HGV REGISTRATIONS BY BRAND DOWNLOAD… Continue reading HGV market in Q2 post-Covid boost, but full recovery still awaited

CAR at Arendalsuka

CAR is busy on the organizer side in Arendalsuka; debate on car taxes and electric car VAT, conversation about the car’s future and debate on new NTP with politicians and agency leaders. The election campaign starts in earnest with Arendalsuka, and the car is a hot topic. Together with NBF and NAF, BIL is behind… Continue reading CAR at Arendalsuka

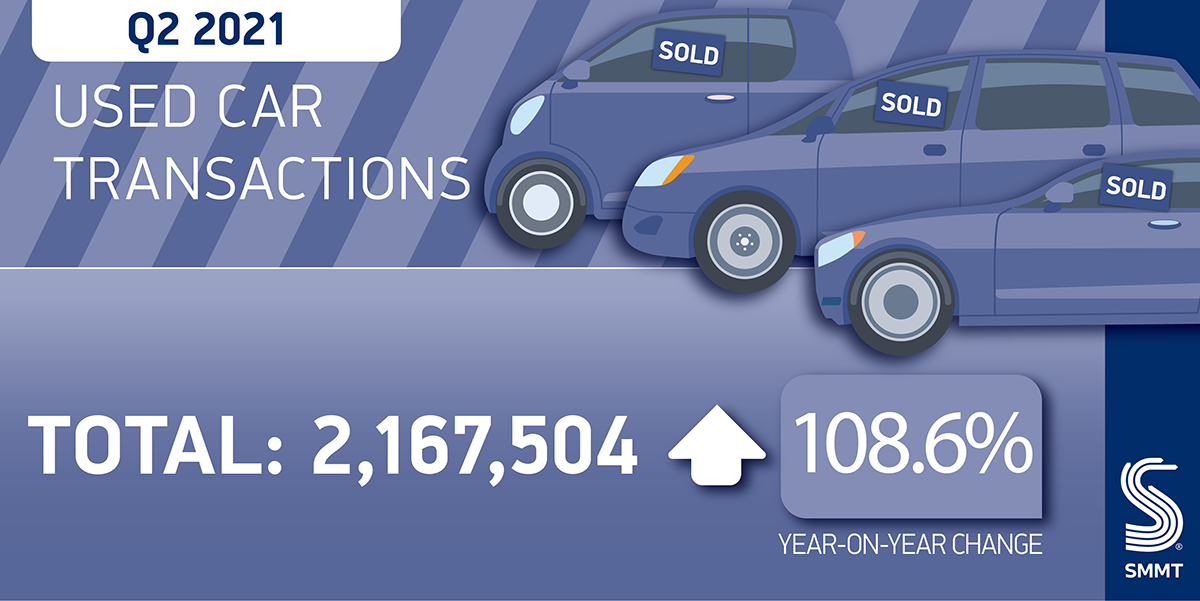

Best ever second quarter for used car market as nation emerges from lockdown

UK used car transactions rose 108.6% on weak Q2 2020 to 2,167,504 units. April saw growth of 307.4%, followed by the best May and June since records began.1 Popularity of used plug-in vehicles soared as transactions increased 351.4% in Q2, although equal to only 1.3% of the used car market. The UK’s used car market… Continue reading Best ever second quarter for used car market as nation emerges from lockdown

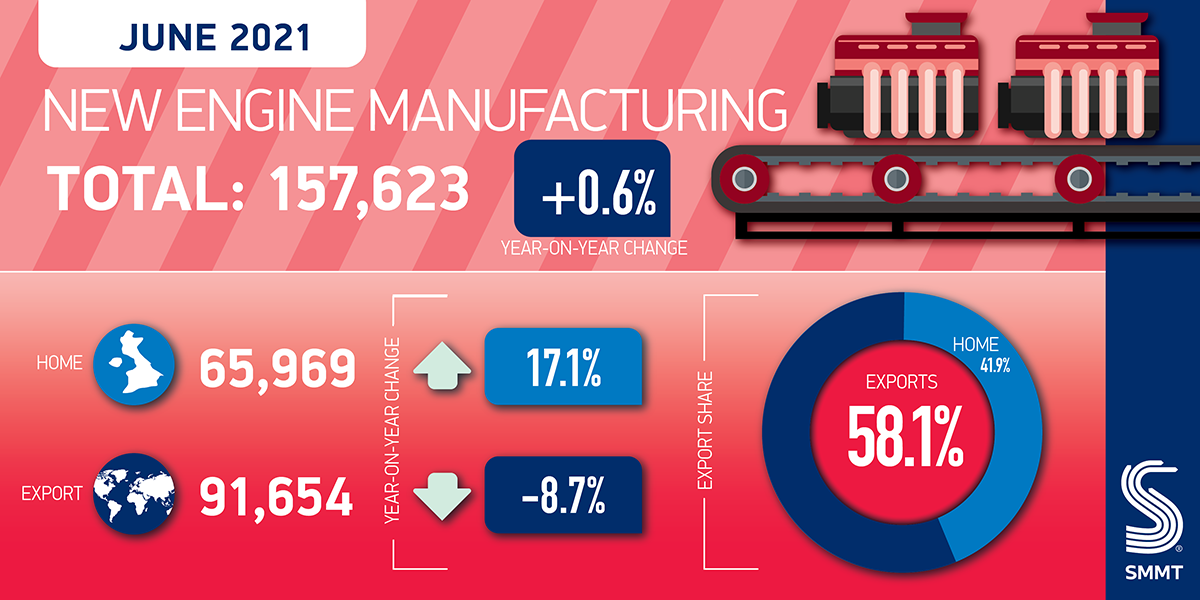

June engine production struggles to recover

29 July 2021 #SMMT News #UK Manufacturing UK factories made 157,623 engines in June, just 0.6% more than June 2020’s weak performance. June 2021 output down -30.9% on five-year average for the month.1 First-half production rises 15.3% yet remains -31.5% below pre-pandemic levels.2 Mike Hawes, SMMT Chief Executive, said, Despite seeing a marginal rise on… Continue reading June engine production struggles to recover

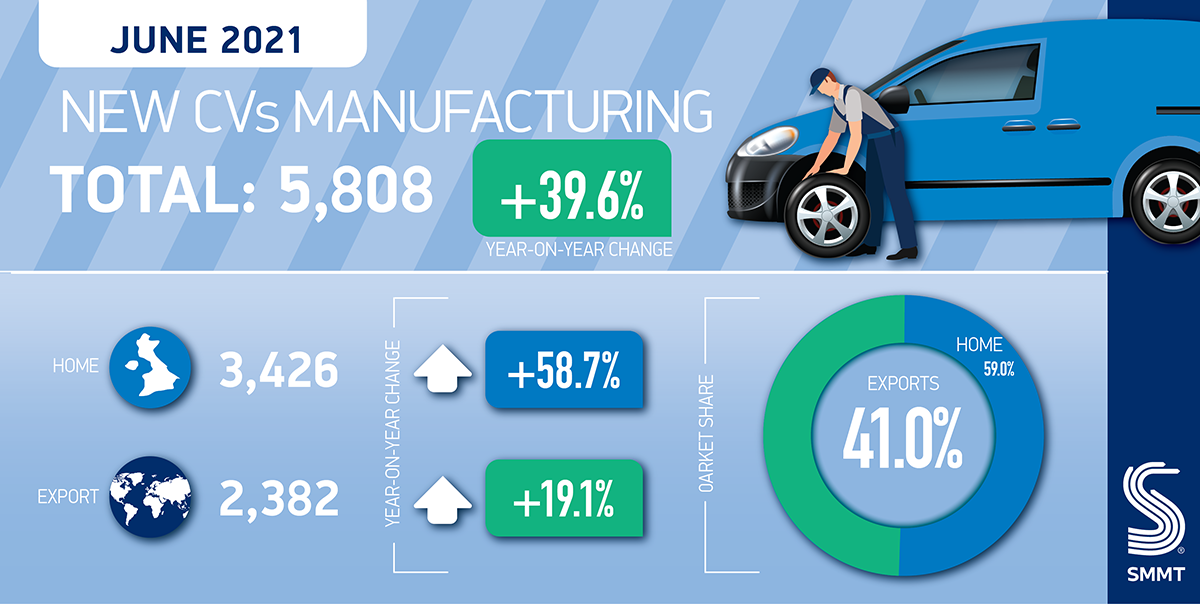

UK commercial vehicle production up for fourth consecutive month

29 July 2021 #SMMT News #UK Manufacturing 5,808 units produced during June, up 39.6% on same month in 2020. Overall commercial vehicle production for first six months of the year down -20.9% on pre-pandemic average.1 Export share of production falls to 48.1% for the year so far, down from 57.4% on pre-pandemic average for first… Continue reading UK commercial vehicle production up for fourth consecutive month

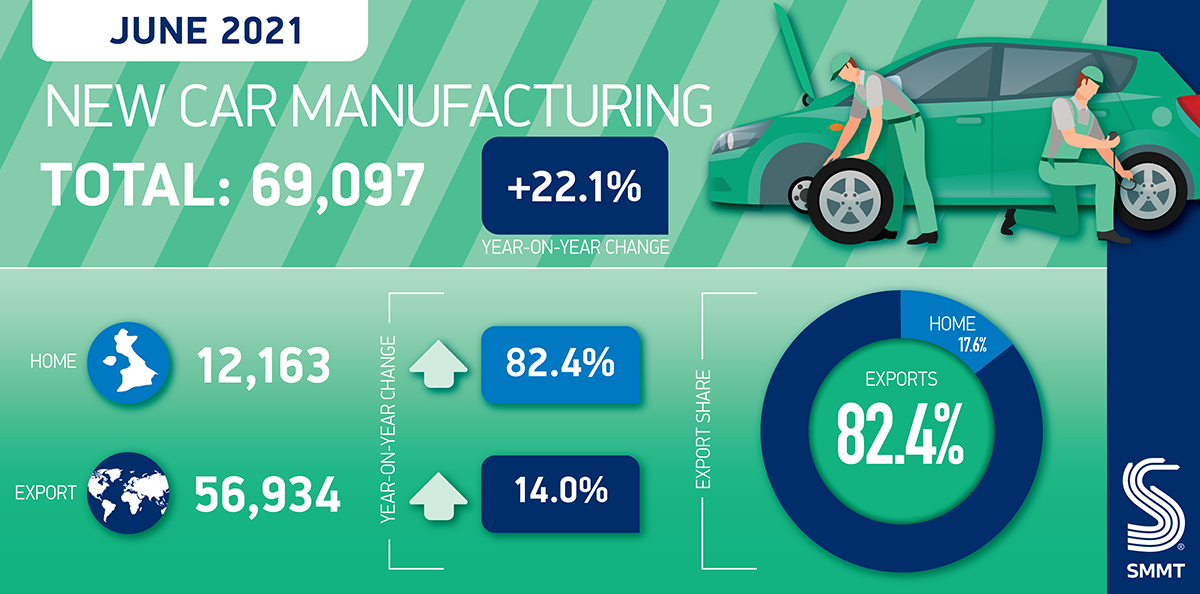

Staff and supply shortages threaten UK car production revival

69,097 cars roll off production lines in June, weakest total since 1953, bar Covid hit June 2020. UK factories turn out 498,923 cars in first half of year, down -38.4% on five-year average. Latest forecast suggests global chip shortage could negatively impact planned UK production volumes by up to 100,000 units. Industry calls for immediate… Continue reading Staff and supply shortages threaten UK car production revival

UK’s specialist vehicle sector most varied in the world

UK’s unique low volume and specialist vehicle sector is world’s most diverse according to new report. Companies nationwide make everything from 250mph hypercars to wheelchair accessible taxis. Sector turns over some £4bn annually and employs more than 15,000 people in highly-skilled, well paid roles. Industry calls for government to support specific needs of these manufacturers… Continue reading UK’s specialist vehicle sector most varied in the world

Car registrations in Europe – June 2021

Statistical data> Registrations Publication period: July 16, 2021 Data reference period: June 2021 Analysis of car registrations in the European Union and EFTA markets, with details by country, brand and group. Download attachment: marketeu_60f13861be7da.pdf To view the content is required accept the installation of Calameo cookies TAG: Europe, passenger cars, registrations, 2021, June Go to… Continue reading Car registrations in Europe – June 2021

Commercial vehicle registrations – June 2021

Statistical data> Registrations Publication period: July 15, 2021 Data reference period: June 2021 UNRAE communicates the estimate of the registrations of commercial vehicles (trucks with PTT up to 3.5 t) Download attachment: TRUCKS_JUNE_2021_60eff34844da6.pdf To view the content is required accept the installation of Calameo cookies TAG: Italy, commercial vehicles, registrations, trucks, 2021, June Go to… Continue reading Commercial vehicle registrations – June 2021