Brussels, 19 May 2020 – In April 2020, registrations of new passenger cars in the European Union posted a year-on-year decline of 76.3%. The first full month with COVID-19 restrictions in place resulted in the strongest monthly drop in car demand since records began. In April 2020, registrations of new passenger cars in the European… Continue reading Press Releases – Passenger car registrations: -38.5% four months into 2020; -76.3% in April

Category: Trade Body Site

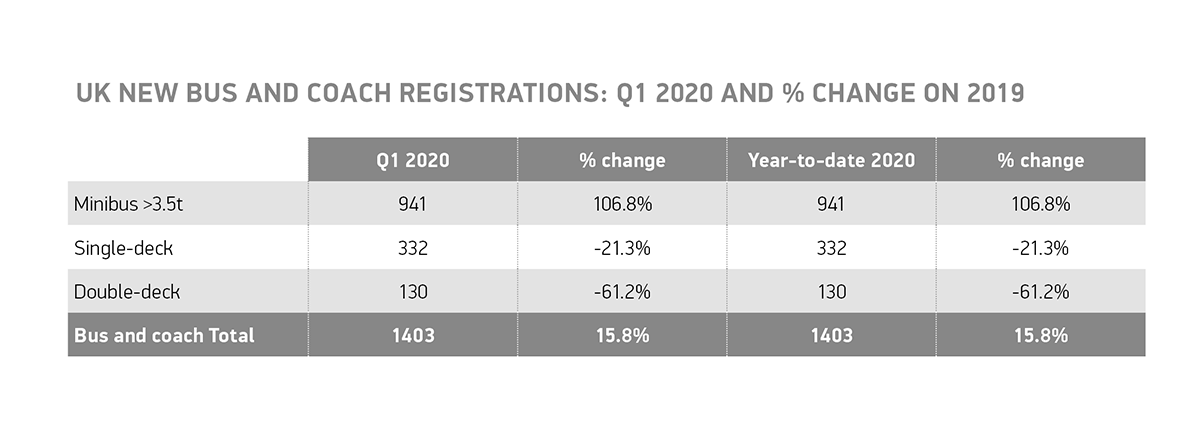

Growth in UK bus and coach market suspended at 15.8%, as March lockdown measures halt new orders

18 May 2020 #Bus & Coach #Registrations #SMMT News Bus and coach registrations up 15.8% in Q1 with 1,403 units joining UK roads. Minibus demand drives overall increase, as registrations more than double to 941. Overall growth comes off back of particularly weak first quarter in 2019. UK new bus and coach registrations rose 15.8%… Continue reading Growth in UK bus and coach market suspended at 15.8%, as March lockdown measures halt new orders

Press Releases – Personal data: Connected vehicles not the same as smartphones, says auto industry

Brussels, 15 May 2020 – The European Automobile Manufacturers’ Association (ACEA) welcomes the publication of guidelines on personal data relating to connected vehicles, drafted by the European Data Protection Board (EDPB), but believes they are too broad in scope and should not be rushed through. “The automobile industry is committed to providing its customers with… Continue reading Press Releases – Personal data: Connected vehicles not the same as smartphones, says auto industry

Publications – ACEA comments on EDPB guidelines 1/2020

The European Automobile Manufacturers’ Association (ACEA) welcomes the publication of the European Data Protection Board’s (EDPB) draft guidelines on processing personal data in the context of connected vehicles and mobility related applications. Click here to read ACEA’s comments on EDPB guidelines 1/2020. Go to Source

The training at Arcelormittal and Accumotive continues

Learn at home at Arcelormittal in Eisenhüttenstadt The time off for the trainees from Arcelormittal in Eisenhüttenstadt lasted seven weeks. Instead of the training Learning at home was the order of the day in the company and vocational school. All because of corona. “Every week we were given tasks that we were supposed to do… Continue reading The training at Arcelormittal and Accumotive continues

Automotive manufacturing sector ready to ramp up production, as SMMT publishes safe restart guidance

New sector-specific guidance for UK automotive manufacturing industry released by SMMT today. Manufacturers nationwide begin to welcome back staff, with comprehensive safety measures covering workstations, in and outbound logistics, communal areas and staff entrances. Some major automotive plants already working, with more due back before end of May, as global markets exit lockdown ahead of… Continue reading Automotive manufacturing sector ready to ramp up production, as SMMT publishes safe restart guidance

Automotive aftermarket sector ready to keep millions of British vehicles roadworthy as SMMT launches COVID-19 guidance

New automotive sector-specific guidance for aftermarket providers published by GEA, IAAF, IMI, SMTA and SMMT today. MOT testers and service and repair sector ready to welcome back more customers with comprehensive COVID-19 safety measures across all points of interaction. Sector can cope with significant ramp-up in demand but calls for end of six-month MOT extension… Continue reading Automotive aftermarket sector ready to keep millions of British vehicles roadworthy as SMMT launches COVID-19 guidance

Press Releases – Automotive CEOs and European Commission discuss recovery plan that bolsters economy and Green Deal

Brussels, 14 May 2020 – CEOs from across the automotive value chain came together for a meeting with the European Commission to align on the priorities for a solid recovery plan for the automotive sector, with a view to stimulating the wider economy and bolstering the transformation to a carbon-neutral society. CEOs of vehicle manufacturers… Continue reading Press Releases – Automotive CEOs and European Commission discuss recovery plan that bolsters economy and Green Deal

Auto retail sector ready to get Britain moving again, as NFDA and SMMT publish safe restart guidance

New automotive sector-specific guidance for vehicle retailers published by NFDA and SMMT today. Dealerships ready to welcome back staff and customers, with comprehensive safety measures covering showroom interactions, vehicle demos and test-drives. Industry welcomes clarification on auto retail click & collect, and calls for showrooms to be re-opened urgently to help reboot manufacturing and support… Continue reading Auto retail sector ready to get Britain moving again, as NFDA and SMMT publish safe restart guidance

SMMT statement on ‘click and collect’ services

13 May 2020 #SMMT News Mike Hawes, chief executive at SMMT said: We welcome today’s clarification that automotive retailers can now operate contactless ‘click and collect’ services from outside their premises, although note that showrooms themselves must still remain closed. There is pent up demand in the market, and the sector is committed to ensuring… Continue reading SMMT statement on ‘click and collect’ services