Brussels, 12 May 2020 – In the first quarter of 2020, the electrically-chargeable vehicle segment significantly increased its market share, rising to 6.8% (from 2.5% in Q1 2019) against the backdrop of the overall decline in passenger car registrations due to the COVID-19 outbreak. By contrast, demand for diesel and petrol vehicles tumbled dramatically, although… Continue reading Press Releases – Fuel types of new cars: petrol 52.3%, diesel 29.9%, electric 6.8% market share first quarter of 2020

Category: Trade Body Site

Press Releases – 298 automobile factories operating across Europe, new data shows

Brussels, 6 May 2020 – 298 automobile assembly and engine production plants operate in Europe today, according to freshly-updated data from the European Automobile Manufacturers’ Association (ACEA). Cars, vans, trucks, buses and engines are manufactured at these factories, 196 of which are situated within the European Union (EU27). ACEA is publishing this data in the… Continue reading Press Releases – 298 automobile factories operating across Europe, new data shows

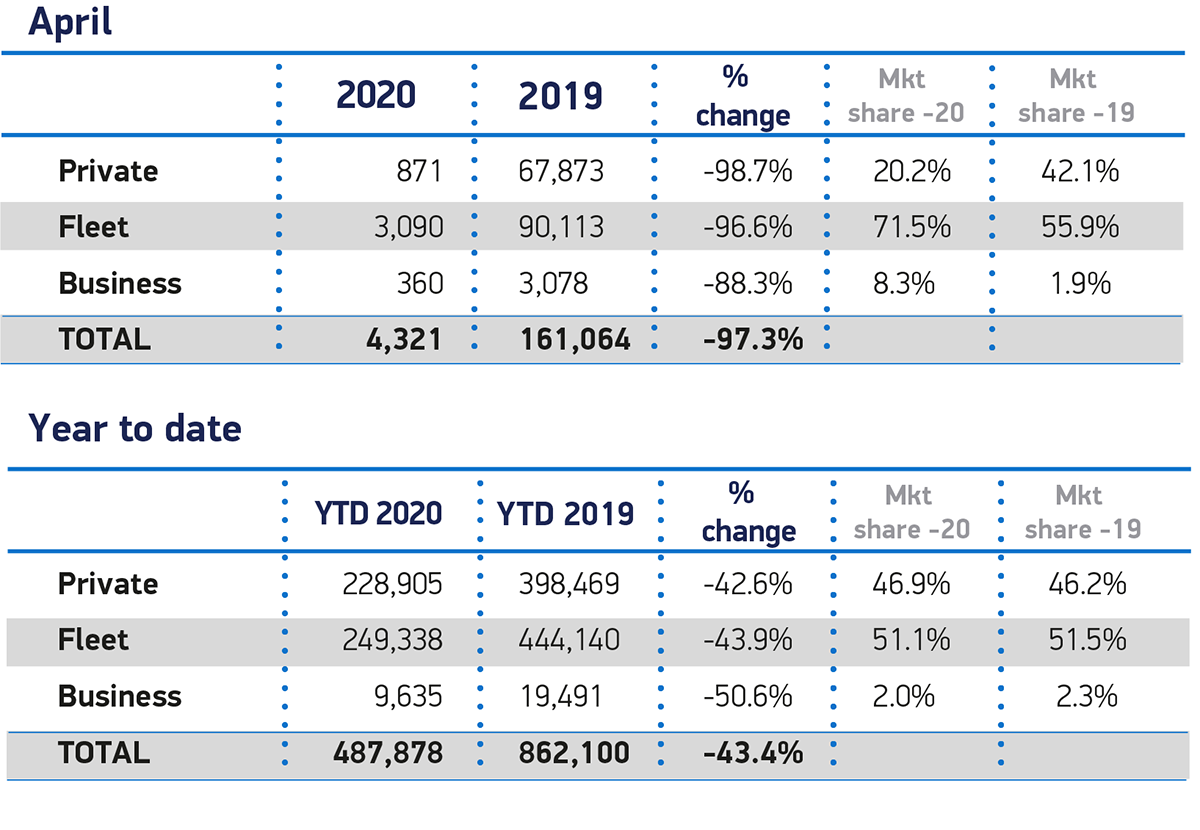

Record -97.3% fall for UK new car market in April as coronavirus shuts showrooms

UK new car market falls by precipitous -97.3% in April as coronavirus crisis shuts showrooms. 4,321 new cars registered in the month as deliveries continue to frontline workers and organisations. Latest SMMT outlook expects 1.68 million new car registrations this year, the lowest since 1992. Sector calls for auto retail to be in first wave… Continue reading Record -97.3% fall for UK new car market in April as coronavirus shuts showrooms

Press Releases – COVID-19: Automotive sector calls for vehicle renewal incentives to kickstart economic recovery

Brussels, 5 May 2020 – COVID-19 is having a major impact on the economy, with retail and manufacturing activity crippled without precedence and concerns mounting on consumer sentiment. The European automotive sector, which has been hit particularly badly, proposes a plan comprised of 25 key actions to ensure a strong restart of the sector and… Continue reading Press Releases – COVID-19: Automotive sector calls for vehicle renewal incentives to kickstart economic recovery

Publications – Paper: 25 actions for a successful restart of the EU’s automotive sector

The European automotive sector wants to contribute to a policy response to COVID-19 that ensures public health, minimises the impact on the economy and maintains a focus on the overarching objectives of our time: the digital and carbon-neutral society. This paper, issued jointly by the four associations representing the EU automotive sector (ACEA, CECRA, CLEPA… Continue reading Publications – Paper: 25 actions for a successful restart of the EU’s automotive sector

Car registrations by brand – April 2020

Statistical data> registrations Publication period: 04 May 2020 Data reference period: April 2020 Analysis by brand of registrations of cars in Italy. Download attachment: 02 April 2020_UNRAE marca_5eb0185bf2890.pdf To view the content you need accept the installation of Calameo Cookies TAG: brand, cars, registrations, 2020, April Go to Source

Registration of cars for groups – April 2020

Statistical data> registrations Publication period: 04 May 2020 Data reference period: April 2020 Analysis by brand and group of registrations of cars in Italy. Download attachment: April 02, 2020_UNRAE groups_5eb02d8d8fd4e.pdf To view the content you need accept the installation of Calameo Cookies TAG: registrations, cars, groups, 2020, April Go to Source

Registration of cars and off-road vehicles in Italy: Top 50 models – April 2020

Statistical data> registrations Publication period: 04 May 2020 Data reference period: April 2020 Ranking of the 50 best-selling car models in Italy. Download attachment: April 05, 2020_UNRAE Top 50_5eb0183d74558.pdf To view the content you need accept the installation of Calameo Cookies TAG: cars, registrations, template, 2020, April Go to Source

Market structure – April 2020

Statistical data> registrations Publication period: 04 May 2020 Data reference period: April 2020 Analysis of the structure of the Italian car market with details of supply, user, segment, bodywork and geographic area. Download attachment: April 2020_UNRAE Market structure_5eb0182cc6bdb.pdf To view the content you need accept the installation of Calameo Cookies TAG: registrations, cars, Market structure,… Continue reading Market structure – April 2020

March 2020 new car pre-registration figures

01 May 2020 #Pre-Registration SMMT released figures for March pre-registrations in the UK new car market. The data shows the number of cars disposed of by vehicle manufacturers in March 2020 that were defined as pre-registrations. Download the March 2020 release Go to Source