Statistical data> registrations Publication period: 04 May 2020 Data reference period: April 2020 Ranking of the 50 best-selling car models in Italy. Download attachment: April 05, 2020_UNRAE Top 50_5eb0183d74558.pdf To view the content you need accept the installation of Calameo Cookies TAG: cars, registrations, template, 2020, April Go to Source

Category: Trade Body Site

Market structure – April 2020

Statistical data> registrations Publication period: 04 May 2020 Data reference period: April 2020 Analysis of the structure of the Italian car market with details of supply, user, segment, bodywork and geographic area. Download attachment: April 2020_UNRAE Market structure_5eb0182cc6bdb.pdf To view the content you need accept the installation of Calameo Cookies TAG: registrations, cars, Market structure,… Continue reading Market structure – April 2020

March 2020 new car pre-registration figures

01 May 2020 #Pre-Registration SMMT released figures for March pre-registrations in the UK new car market. The data shows the number of cars disposed of by vehicle manufacturers in March 2020 that were defined as pre-registrations. Download the March 2020 release Go to Source

News – ACEA letter to Euro NCAP Secretary General

The European Automobile Manufacturers’ Association (ACEA) wrote a letter to the Secretary General of the European New Car Assessment Programme (Euro NCAP) about the COVID-19 crisis. The letter can be found here. Categories Competitiveness, Market and Economy Coronavirus / COVID-19 Safety Files Download ACEA letter to Euro NCAP Secretary General Go to Source

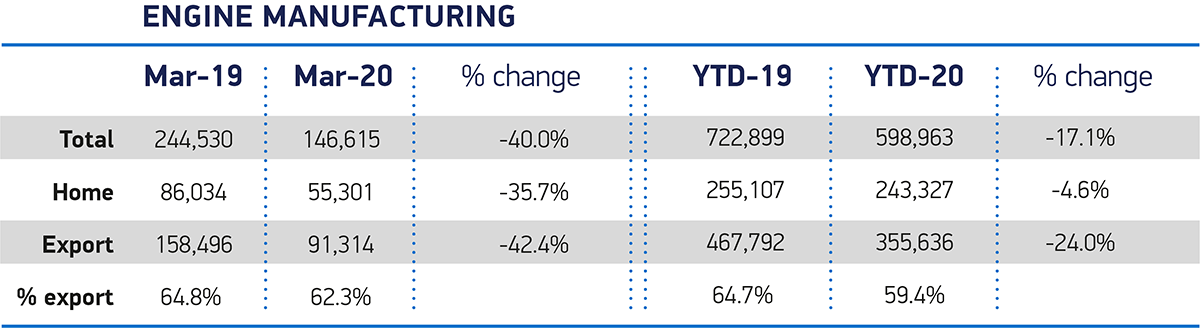

UK engine production declines -40.0% in March as coronavirus hits output

30 April 2020 #SMMT News #UK Manufacturing 146,615 engines produced in March as UK production declines -40.0%.1 Production for domestic car plants decreases -35.7%, with steeper fall for exports, down -42.4%. More than 598,000 engines built in Britain in first three months, with 59.4% exported. Mike Hawes, SMMT Chief Executive, said, These figures show the… Continue reading UK engine production declines -40.0% in March as coronavirus hits output

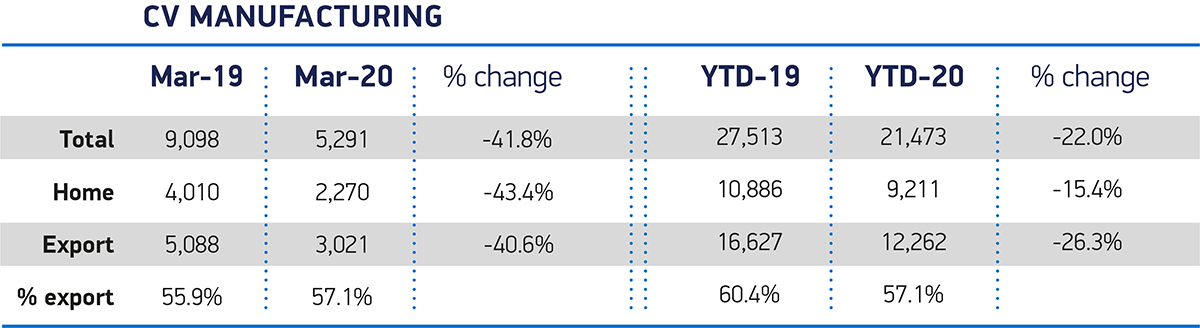

Commercial vehicle production down -41.8% as coronavirus takes toll on UK manufacturing

British commercial vehicle output falls -41.8% in March, as coronavirus lockdown measures cause plant closures nationwide.1 Production falls for both domestic and overseas markets, down -43.4% and -40.6% respectively. £82 billion auto manufacturing sector calls on government to support safe and sustainable restart to drive UK economic recovery. New SMMT survey reveals 42.1% of CV… Continue reading Commercial vehicle production down -41.8% as coronavirus takes toll on UK manufacturing

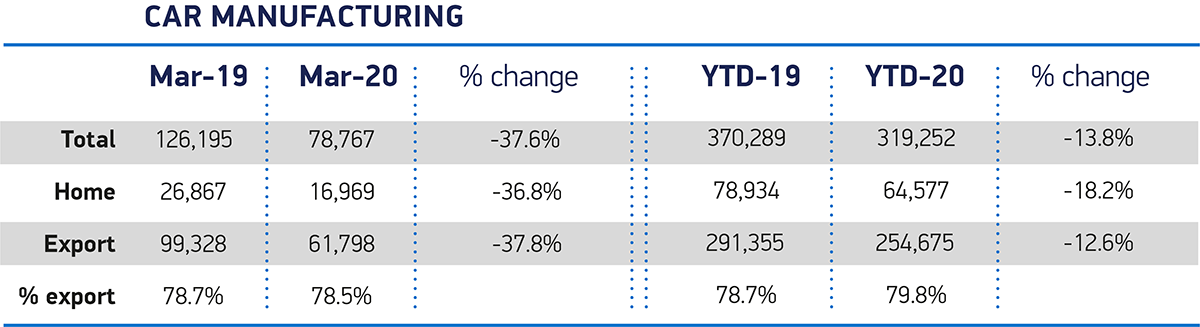

UK car production falls -37.6% in March as coronavirus halts automotive manufacturing

British car production falls -37.6% in March as coronavirus crisis shuts factories. Output for UK and overseas markets down, -36.8% and -37.8% respectively. New independent outlook reveals at least £8.2bn cost to industry if factories closed until mid-May.1 £82 billion auto manufacturing sector calls on government to support safe and sustainable restart to drive UK… Continue reading UK car production falls -37.6% in March as coronavirus halts automotive manufacturing

News – Even if we manage to overcome COVID-19, a no-deal Brexit might be the next threat to the auto sector

While Europe still grapples with the health, social and economic impacts of the coronavirus, and EU automobile manufacturers battle for survival, the second round of negotiations on the future relationship between the United Kingdom and the European Union took place last week. This is not something we can overlook, because a no-deal Brexit at the… Continue reading News – Even if we manage to overcome COVID-19, a no-deal Brexit might be the next threat to the auto sector

News – EU auto industry actions to fight COVID-19

Automobile manufacturers right across Europe have been playing a key role in the fight against COVID-19, using their resources to manufacture much-needed medical equipment, making employees available, as well as donating vehicles, supplies and money. The European Automobile Manufacturers’ Association (ACEA) has made an overview of some of the key actions undertaken by its members… Continue reading News – EU auto industry actions to fight COVID-19

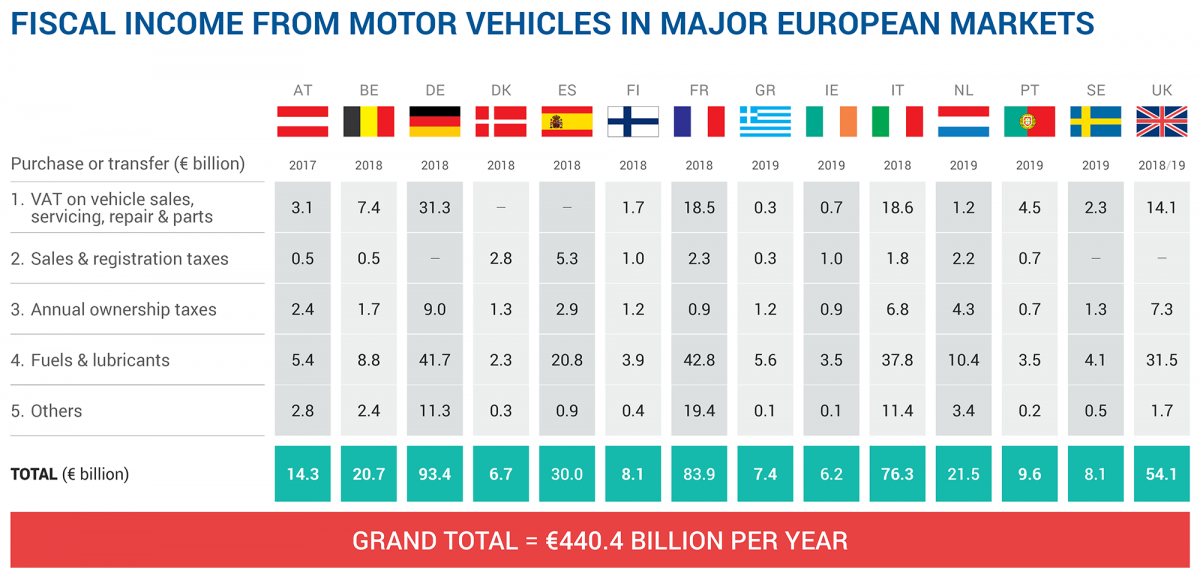

Press Releases – Motor vehicle taxation brings in €440.4 billion for governments in major European markets

Brussels, 28 April 2020 – New data shows that motor vehicles generate more than €440 billion in taxation for national governments in the major EU markets plus the UK, the European Automobile Manufacturers’ Association (ACEA) reports. Motor tax revenues collected by governments have increased by almost 3% compared to the previous year, and the grand… Continue reading Press Releases – Motor vehicle taxation brings in €440.4 billion for governments in major European markets