8 February 2018

New figures released today by the Finance & Leasing Association (FLA) show that the number of second charge mortgage repossessions in 2017 was 105, 27% lower than in 2016. In the final quarter of 2017, the number of repossessions was 27, down by almost 31% compared with the same period in 2016.

The rate of second charge mortgage repossessions, as a percentage of average outstanding agreements, has fallen from 0.34% in 2009 to just 0.06% in 2017.

Commenting on the figures, Fiona Hoyle, Head of Consumer and Mortgage Finance at the FLA, said:

“Helping customers in financial difficulty to get back on track is a priority for the second charge mortgage market. This is reflected in the low number of repossessions reported in 2017.

“If customers think they may experience payment difficulties, they should contact their lender at an early stage to explore alternative options. The sooner contact is made, the easier it is to find a solution.”

Table 1: The number of actual properties taken into possession by FLA second charge mortgage providers1

Time period

Number of possessions

in the quarter

% change on the same quarter in the

previous year

Annual total

% change on the previous year

2008 Total

2009 Total

2010 Total

2011 Total

2012 Total

2013 Total

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Q2 2015

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Q1 2017

Q2 2017

Q3 2017

Q4 2017

128

133

107

79

72

67

56

33

34

40

31

39

19

36

23

27

-43.4%

-27.3%

-25.7%

-35.8%

-43.8%

-49.6%

-47.7%

-58.2%

-52.8%

-40.3%

-44.6%

18.2%

-44.1%

-10.0%

-25.8%

-30.8%

1,612

1,467

864

827

6282

676

447

228

144

105

-9.0%

-41.1%

-4.3%

-24.1%2

7.6%2

-33.9%

-49.0%

-36.8%

-27.1%

Possession proceedings arising from FLA members’ second charge mortgage books, which have led to actual possession by the second mortgage provider.There were changes to the sample in Q1 2012 and Q1 2013 due to changes in FLA membership.Notes to Editors

FLA members in the consumer finance sector include banks, credit card providers, store card providers, second-charge mortgage lenders, motor finance providers, personal loan and instalment credit providers.In 2017, FLA members provided £128 billion of new finance to UK businesses and households. £96 billion of this was in the form of consumer credit representing over a third of total new consumer credit written in the UK in 2017.For media enquiries, please contact the FLA press office on 020 7420 9656.

Category: Trade Body Site

Car registrations by brand – January 2018

Analysis by brand of car registrations in Italy.

Car registrations for groups – January 2018

Analysis by brand and group of car registrations in Italy.

Market structure – January 2018

Analysis of the structure of the Italian car market with details for power, user, segment, bodywork and geographic area.

News – Video – In-vehicle data access “creates major safety and security risks”

Marc Greven (Legal Affairs Director, ACEA) talks about the connected car and access to vehicle data.

Press Releases – Alternative fuel vehicle registrations: +35.1% in fourth quarter; +39.7% in 2017

Brussels, 1 February 2018 – In the fourth quarter of 2017, demand for alternative fuel vehicles (AFVs) in the European Union continued to grow –…

Press Releases – Safeguarding auto industry competitiveness, amidst Brexit and CO2 policy concerns

Brussels, 31 January 2018 – While the EU passenger car market grew by 3.4% in 2017, with over 15 million cars sold, the European Automobile…

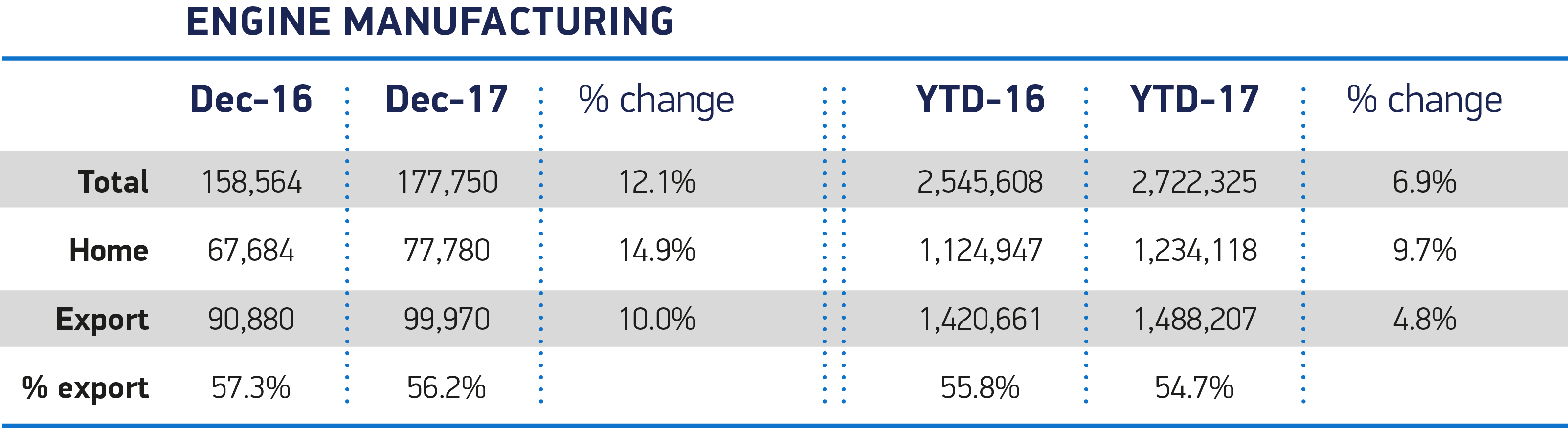

Record engine production in 2017 as demand grows, home and abroad

British engine manufacturing rises 6.9% to all-time high of 2.7 million units in 2017.1 Home demand sees fastest growth – up 9.7%, while global demand rises to almost 1.5 million units. UK engine manufacturing now worth £8.5bn, supporting 8,000 British jobs – 3,350 in diesel engine production alone. Mike Hawes, SMMT Chief Executive, said, This… Continue reading Record engine production in 2017 as demand grows, home and abroad

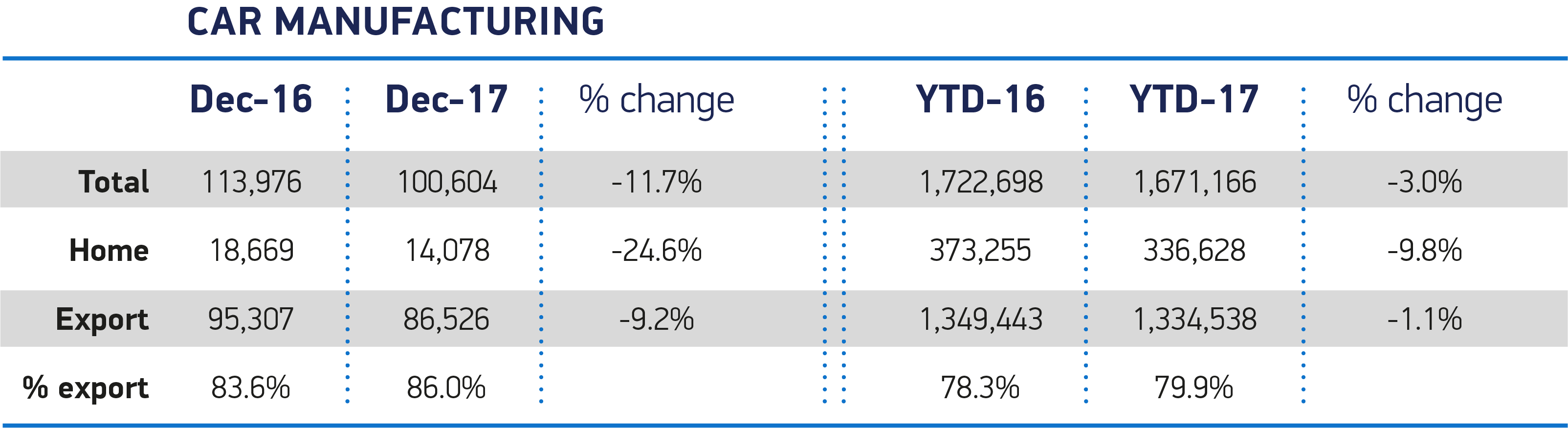

2017 UK car manufacturing declines by -3% but still second biggest output since turn of the century

1.67m cars built in the UK in 2017, a decline of -3.0% with production for domestic demand down -9.8%. Car exports remain at historically high level, down just -1.1% with 1.34m shipped worldwide – 79.9% of total production. British engine manufacturing at record-ever levels, with 2.72m produced, up 6.9% on 2016. SMMT restates need for… Continue reading 2017 UK car manufacturing declines by -3% but still second biggest output since turn of the century

Statistics – Main destinations of EU car exports in 2017

From January to September 2017, EU passenger car exports increased compared to a year ago, both in value (+2.3%) and in volume terms (+4.7%). The…