Allianz Partners’ 14th Annual Vacation Confidence Index Finds Almost Half of Americans Plan to Use Sharing Economy Services This Summer

RICHMOND, Va., Aug. 2, 2022 /PRNewswire/ — The sharing economy industry shifted dramatically in 2020 when the COVID-19 pandemic hit, impacting ride-share services and non-traditional lodging businesses. Now that travel has returned with a vengeance in the Summer of 2022, Americans have jumped back into the sharing economy with both feet.

Link to download infographic: HERE

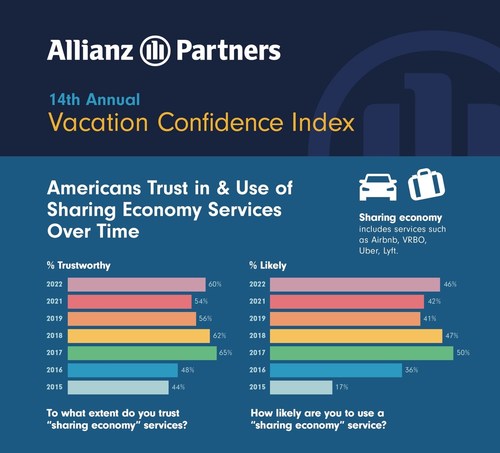

According to Allianz Partners‘ 14th Annual Vacation Confidence Index, 46% of Americans are likely to use sharing economy services during their summer vacations this year, four points higher than last year and a five-point increase compared to pre-pandemic 2019. The survey found that overall trust in the sharing economy continues to trend upward as well, with 60% of Americans deeming the services trustworthy, a six-point increase from 2021 and four-point increase from 2019.

Younger age groups are more likely to use shared services during their summer vacations, with 70% of 18–34-year-olds and 52% of 34–54-year-olds noting they are likely to take advantage, a seven-point increase from last year and notable 12-point jump from three years ago. The age groups also are more likely to trust the services, with 76% of 18–34-year-olds and 65% of 34–54-year-olds deeming them trustworthy, up five points from 2021 and up 10 points from 2019.

Unsurprisingly, travelers age 55+ who have been more vulnerable to health risks and may not rely as frequently on technology are ranking the services lower now than they did before the pandemic, with a slight one-point decrease in both trust (43%) and likelihood to use (23%) compared to 2019.

“Americans have grown accustomed to the conveniences afforded by the sharing economy during their summer vacations – from booking vacation rentals to requesting rideshares to explore their destination or simply go out to dinner – and our findings support that young travelers will continue to play a large role in keeping the trend alive,” said Daniel Durazo, director of external communications at Allianz Partners USA. “While the increased pricing for these services can be a deterrent, even among sharing economy fans, one thing travelers likely won’t regret this summer is purchasing a travel insurance policy to protect their perfectly-planned summers.”

The travel and assistance company found that yearly earnings significantly affect the likelihood of using shared economy as well. Americans who make more than $100K annually are more likely to use sharing economy compared to those who make less than $50K (55% vs. 40% respectively). Despite rising costs of services, both income level earners are more likely to use sharing economy this summer than the year prior, with likelihood increasing six points for Americans making more than $100K and a seven-point increase for those who make less than $50K.

The Vacation Confidence Index has been conducted each summer since 2009 by national polling firm Ipsos Public Affairs on behalf of Allianz Partners USA.

In March 2021, Allianz Partners announced enhancements** to many of its travel insurance products in most states through an Epidemic Coverage Endorsement. Products that include this endorsement may provide coverage to customers who become ill with COVID-19 or a future epidemic, are individually ordered to quarantine, or are denied boarding due to a suspected illness. These products also may cover emergency medical care and transportation or provide reimbursement for change fees and loyalty points deposit fees if the customer becomes ill with an epidemic disease. Availability of the Epidemic Coverage Endorsement, and specific covered reasons under that endorsement, varies by product and by state. See your plan for details.

Allianz Partners offers travel insurance through most major U.S. airlines, leading travel agents, online travel agencies, hotel companies, cruise lines and directly to consumers. For more information on Allianz and available travel policies, please visit http://www.allianztravelinsurance.com/.

*Methodology: These are the findings of an Ipsos poll conducted on behalf of Allianz Partners USA. For this survey, a sample of 2,011 Americans aged 18+ was interviewed from May 2 to 4, 2022, via the Ipsos Online Omnibus. The precision of Ipsos online polls is measured using a credibility interval. In this case, the results are accurate to within +/- 2.5 percentage points, 19 times out of 20, of what the results would have been had all American adults been polled. Quota sampling and weighting were employed in order to balance demographics and ensure that the sample’s composition reflects that of the actual U.S. population, according to data from the U.S. Census Bureau. Credibility intervals are wider among subsets

About Allianz Partners

In the United States, Allianz Partners USA (AGA Service Company) offers Allianz Travel-branded travel protection plans and serves millions of customers each year. In addition to travel protection, the company offers event ticket protection, registration protection for endurance events and unique travel assistance services such as international medical assistance and concierge services. AGA Service Company is doing business as Allianz Global Assistance Insurance Agency in California (License # 0B01400) and Massachusetts. Allianz Partners USA is part of the Allianz Partners group. Allianz Partners is a world leader in B2B2C insurance and assistance, offering global solutions that span international health and life, travel insurance, mobility and assistance. Customer driven, our innovative experts are redefining insurance services by delivering future-ready, high-tech, high-touch products and solutions that go beyond traditional insurance. Present in over 75 countries, our 19,400 employees speak 70 languages, handle over 58 million cases each year, and are motivated to go the extra mile to offer peace of mind to our customers around the world.

** While the new Epidemic Coverage Endorsement adds certain covered reasons that apply to specific epidemic-related situations, products otherwise generally do not cover claims due to known, foreseeable, or expected events, epidemics, government prohibitions, warnings, or travel advisories, or fear of travel, and coverage can vary by state. Please see our Coverage Alert for information about other temporary accommodations that may be available. Benefits for quarantines only apply when an eligible traveler is specifically named and individually ordered to quarantine by order or official directive of a government, public regulatory authority, or the captain of a commercial vessel on which that eligible traveler is booked to travel during the covered trip, based on that eligible traveler’s exposure to COVID-19. The benefit does not cover travel restrictions (whether or not they are referred to as “quarantine”) that apply generally or broadly (a) to some segment or all of a population, geographical area, building, or vessel (including without limitation shelter-in-place, stay-at-home, safer-at-home, or other similar restriction), or (b) based on to, from, or through where the person is traveling. Coverage may not cover the full cost of your quarantine and is subject to applicable benefit limits. See your plan for details.

For Allianz Partners USA products offered and sold in the U.S.: Terms, conditions, and exclusions apply to all plans. Plans are available only to U.S. residents. Not all plans are available in all jurisdictions. Availability of Epidemic Coverage Endorsement, including specific benefits and covered reasons described here, varies by product and by state. Products may not include all benefits or covered reasons described here. All benefits are subject to maximum limits of liability, which may in some cases be subject to sublimits and daily maximums. Benefits and limits vary by plan. For a complete description of the coverage and benefit limits offered under your specific plan, carefully review your plan’s Letter of Confirmation/Declarations and Certificate of Insurance/Policy. Insurance coverage is underwritten by BCS Insurance Company (OH, Administrative Office: Oakbrook Terrace, IL), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: Richmond, VA), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101–C series or 101–P series, depending on state of residence. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Except as otherwise specified, AGA Service Company d/b/a Allianz Global Assistance is the licensed producer and administrator of Allianz Travel-branded travel protection plans in the U.S. and an affiliate of Jefferson Insurance Company. Allianz Global Assistance, TravelSmart, and AgentSmart are marks of AGA Service Company or its affiliates. The insured shall not receive any special benefit or advantage due to the affiliation between Allianz Global Assistance and Jefferson Insurance Company. Plans include insurance and assistance services. Noninsurance benefits/products are provided and serviced by Allianz Global Assistance. SmartBenefits proactive payments and “no receipts” payments available only on certain plans. For plans that include proactive payments: when you opt in and provide flight information, Allianz Global Assistance will monitor flights and send flight status and benefit alerts, including alerts about flight delays that qualify for automated travel delay payments. Standard message/data rates apply to SMS alerts. Automated claims and payment system availability is not guaranteed and is subject to our sole discretion. All claims subject to policy terms, conditions, and exclusions.

SOURCE Allianz Partners