- Britain’s light commercial vehicle market falls -20.7% in July, the seventh consecutive month of year-on-year decline, with 18,722 new units registered.

- Battery electric van (BEV) registrations rise 21.2% in the month and 55.7% in year to date amid industry investment towards Net Zero, but sector’s transition still two years behind cars.1

- Industry outlook revised downwards, now expecting year to finish -13.7% behind robust 2021.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

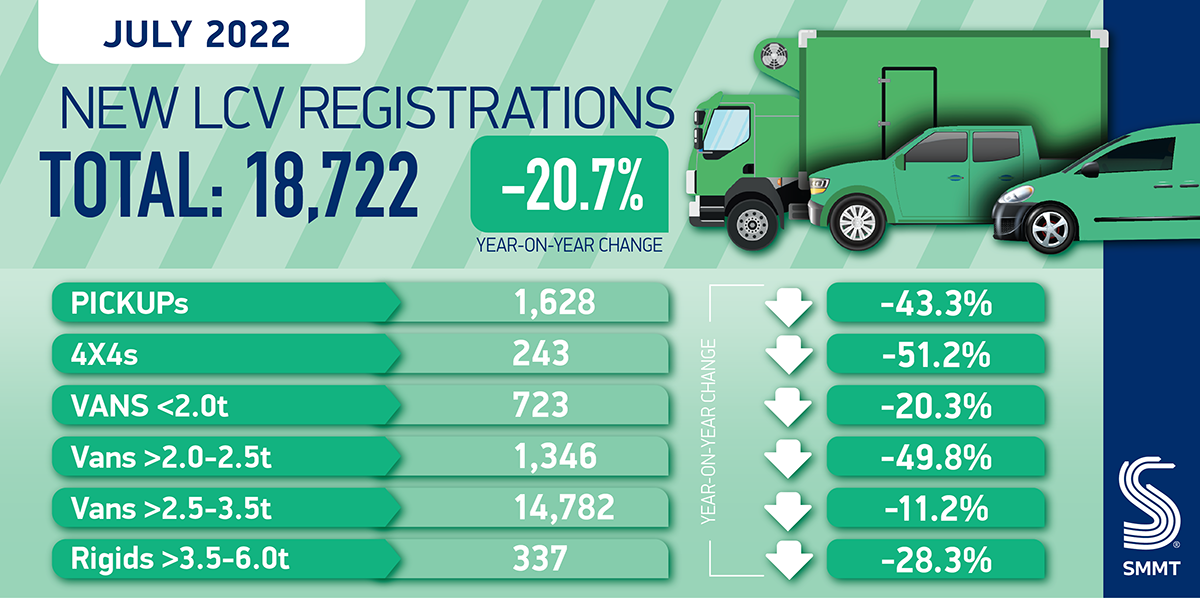

The UK’s new light commercial vehicle (LCV) market declined for the seventh consecutive month in July, down -20.7% to 18,722 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).2 The decline, despite strong order books, is the result of ongoing global supply shortages caused by the Covid-19 pandemic, with last month’s registrations total some -23.9% below the pre-pandemic five-year average for July.3

July saw a fall in registrations across all LCV segments, with some 14,782 new vans weighing above 2.5 tonnes up to 3.5 tonnes registered in the month, -11.2% below 2021. The number of lighter vans weighing less than or equal to 2.0 tonnes dropped by -20.3%, while those weighing more than 2.0 tonnes to 2.5 tonnes declined by -49.8%.

As industry investment in battery electric vans (BEVs) continues, with one in three models on the market now available with a plug, demand continues to increase with 765 BEVs registered in July, up 21.2%, and a continuation of increased uptake seen in the first six months of 2022, as van buyers take advantage of new electric models that offer longer ranges, efficiency savings and fast charge times. As a result, there have been 8,865 BEVs registered in the year to date, an increase of 55.7%. This still represents only one in 18 of all vans registered so far in 2022 but is up from one in 37 a year ago.

With total registration volumes remaining weak, the industry outlook has been downgraded from 328,000 to 307,000 new registrations for the year, a decline of -6.5% on the previous outlook published in April. As a result, the market is now expected to finish -13.7% down on 2021, which saw uptake almost reach pre-pandemic levels.4 With the semiconductor shortage expected to begin to ease during 2023, volumes for that year are anticipated to reach 357,000 units, a 16.4% rise. BEVs are still expected to account for 6.4% of registrations this year, while 2023’s outlook has been revised downwards slightly, from 9.6% to 9.2%.

The shortage of dedicated electric charge points for this sector remains a critical obstacle to the achievement of ambitious timescales for the decarbonisation of the commercial vehicle fleet. Petrol and diesel vans have the same end of sale date as cars in 2030, yet new electric LCV registrations are currently at levels seen in the new car market in 2020, with a majority of van buyers citing charging infrastructure as their major concern over whether an EV can meet their professional and daily needs.5 As energy costs and inflation impact business and consumer confidence, it is crucial that barriers to infrastructure access are immediately addressed.

Mike Hawes, SMMT Chief Executive, said,

The LCV market is struggling to recover post-Covid as global supply chain shortages and economic headwinds make the business environment even more challenging for both manufacturers and operators. In these circumstances, the continued growth in electric van uptake is admirable as the industry strives to deliver its Net Zero commitments. Given the importance of the commercial vehicle sector to Britain’s economy, its environmental ambitions and the need to keep society on the move, the next Prime Minister must look to restore economic confidence and support the sector’s transition to zero emission mobility.

Notes to editors

1. Car BEV market share in Jan-July 2020: 4.7%

2. July’s figures reflect a short interruption to registrations processing at one manufacturer due to a planned systems upgrade affecting a limited number of vehicles. This does not materially affect the overall market performance.

3. Pre-pandemic five-year average for July: 24,598

4. 2021 LCV registrations: 355,380 (-2.8% on 2019)

5. Savanta poll of 500 van owners, conducted between 11-18 May 2022: https://media.smmt.co.uk/uk-van-owners-and-operators-survey/