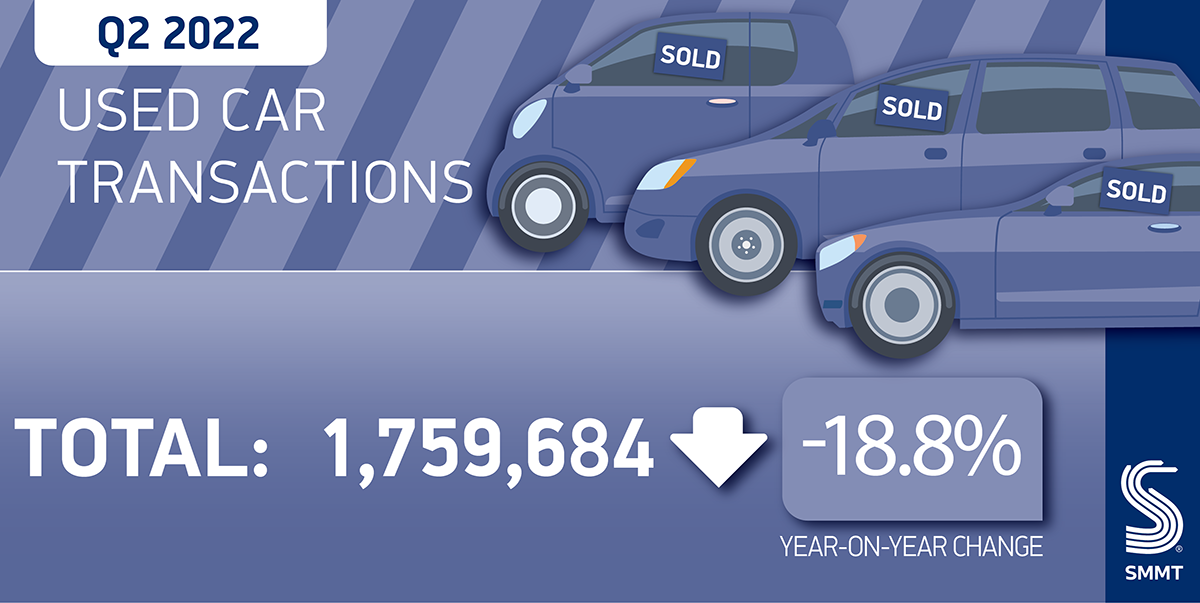

- UK used car market falls -18.8% in Q2 2022 with 1,759,684 cars changing hands.

- First half transactions down -8.3% on last year and market now -12.8% year to date behind pre-pandemic 2019.

- Battery electric vehicles (BEVs) see boost of 57.1% to reach one in 105 transactions.

Download the used car sales report for Q2 2022

The UK’s used car market shrank by -18.8% during the second quarter of 2022, with 1,759,684 transactions taking place, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). Some 407,820 fewer vehicles changed hands compared with the same period last year, although the scale of this decline was artificially inflated by comparison with 2021 when the easing of Covid restrictions saw the busiest second quarter since records began. By comparison, Q2 2022 was -13.5% behind pre-pandemic 2019.1

The ongoing shortage of semiconductors continued to impact new car market supply, with an inevitable knock-on effect on used transactions. Declines were recorded in each month, with falls in April, May and June of -16.8%, -20.9% and -18.6% respectively. As a result, the market is down -8.3% year to date on 2021, and -12.8% on pre-pandemic 2019.

However, battery electric vehicle (BEV) sales rose 57.1% to reach 16,782 units, doubling market share to 1.0%, while plug-in hybrids held relatively stable with 1.0% growth and 0.9% of the market. Hybrids (HEVs), meanwhile, declined by -4.0% with 2.4% of the market. As a result, used petrol and diesel vehicles remained dominant, totalling 1,682,280 units and accounting for 95.6% of sales.

Reflecting the new car market, the most popular segment types were supermini (31.4%), lower medium (26.5%) and dual purpose (14.7%). Black cars proved the most popular, accounting for more than one in five (21.5%) sales, followed by blue and grey. Pink cars proved the least popular overall, comprising 1,135 units.

Mike Hawes, SMMT Chief Executive, said,

It was inevitable that the squeeze on new car supply would filter through to the used market. Despite this, Britain’s used car buyers clearly have a growing appetite for the latest low and zero emission cars, and we need a thriving new car market to feed it. The next Prime Minister must create the conditions to drive consumer confidence, especially in EVs, to drive the fleet renewal necessary to meet our decarbonisation goals.

Notes to editors

1. Q2 2019: 2,034,236