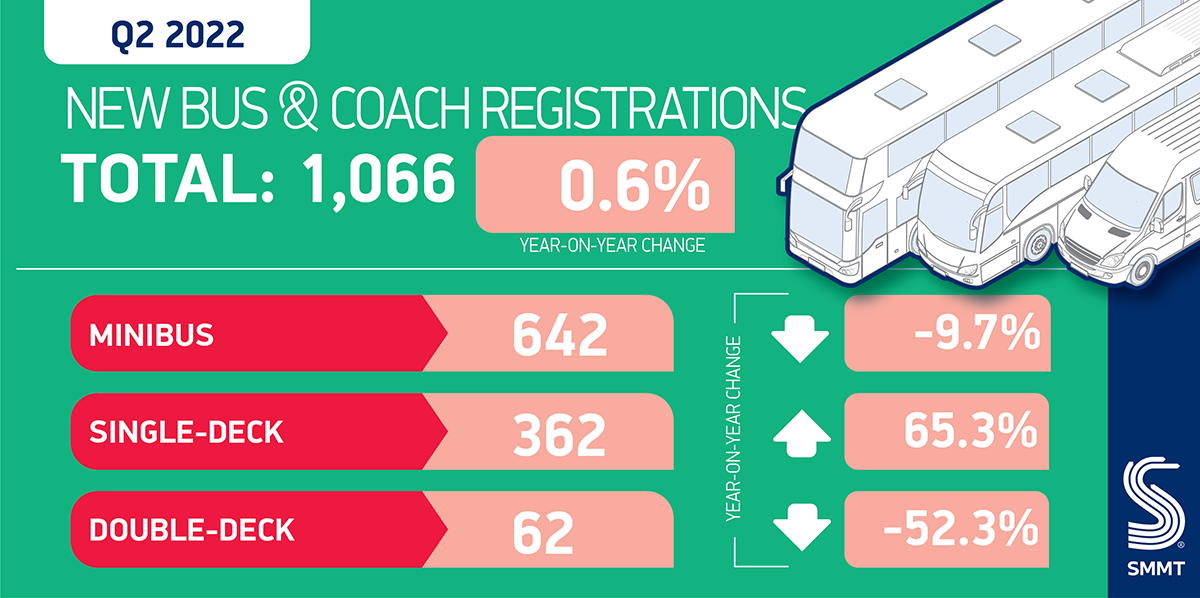

- 1,066 new buses and coaches registered in Britain from April to June, up 0.6% on the same period last year.

- Q2 performance puts first half of 2022 up 17.9% year-on-year, with 2,040 vehicles registered – but market remains down -46.4% on the pre-pandemic five-year average.

- Ongoing weak ridership levels acting as discouragement to investment.

SEE BUS & COACH REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new bus and coach market grew by 0.6% to 1,066 units in the second quarter, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). Bus and coach sales so far this year stand at 2,040 units, up 17.9% on last year thanks to the recovery in Q1, but still down -46.4% on the pre-pandemic five-year average.1

The slight growth in Q2 saw single-deck buses up 65.3%, while minibuses weighing up to six tonnes and with up to 17 seats – the largest segment by volume – fell by -9.7%. Registrations of double-deck buses, meanwhile, declined by -52.3%. In the year to date, the overall sector is up 17.9%, with minibus registrations increasing by 8.9% and single-deck buses by 84.8%, while double-deck buses fell by -24.9%.

While ridership levels have gradually been improving since the end of lockdowns, they remain below pre-pandemic levels, reducing operator confidence to invest in their fleets. Although around £270 million of Zero Emission Bus Regional Areas (ZEBRA) funding has been announced since October 2021, this has yet to be reflected in registrations. Delivering bus fleet renewal is essential for achieving decarbonisation goals, given the sector already currently exceeds the car sector in its embrace of zero emission technology, and plays a vital role in affordable mass mobility.2

Mike Hawes, SMMT Chief Executive, said,

The bus and coach sector is key to ensuring everyone in British society can be on the move, with a critical role to play in the UK’s Net Zero targets. Growth is therefore essential to get the cleanest and greenest buses and coaches on Britain’s roads. However, ridership levels are struggling to recover to pre-pandemic levels, to the detriment of operators’ confidence in renewing their fleets.

Notes to editors

1. First-half pre-pandemic five-year average: 3,806 units.

2. SMMT motorparc data 2021: BEVs comprise 1.3% of buses on the road, 1.1% of cars