The second-quarter 2022 results of Rivian Automotive RIVN, Workhorse Group WKHS, Hyliion Holdings HYLN, Canoo Inc. GOEV and Blink Charging BLNK dominated last week’s key stories in the electric vehicle (EV) space. Each of these companies incurred a loss for the quarter under review amid high research & development (R&D) and selling, general & administrative (SG&A) costs. Being in the nascent stages of development, the firms’ operating expenses are taking a toll on margins.

Here are the key takeaways from the quarterly reports of these companies.

Rivian incurred an net adjusted loss of $1.89 a share in the second quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $1.67. The bottom line, however, improved from the year-ago loss per share of $5.74. Total revenues came in at $364 million, surpassing the consensus mark of $338 million. In the year-ago quarter, this EV maker didn’t generate any revenues. Second-quarter 2022 revenues improved significantly from $95 million generated in the first quarter of 2022.

The company produced 4,401 vehicles during the quarter under review, up from 2,553 in the first quarter of 2022. Deliveries jumped 264% sequentially to 4,467 units. The company’s net R1 preorder backlog in the United States and Canada was around 98,000 units as of Jun 30. Rivian ended the quarter with $14.9 billion in cash and cash equivalents. Long-term debt totaled $1.22 billion as of Jun 30. RIVN reaffirmed its target to produce 25,000 vehicles this year. In the light of the current supply chain environment and commodity cost inflation, Rivian now forecasts a negative adjusted EBITDA of $5,450 million for 2022, marking a deterioration from the previous forecast of $4,750 million.

Hyliion recorded second-quarter adjusted loss per share of 19 cents, in line with the Zacks Consensus Estimate. The loss widened from the year-ago figure of 13 cents a share. This Texas-based hybrid truck powertrain maker generated revenues of $172,000. R&D and SG&A expenses for the quarter totaled $20 million and $12 million, higher than $13 million and $10 million recorded in the year-ago period, respectively.

During the quarter under review, HYLN continued the design-verification phase of its Hypertruck ERX development with the start of on-road testing. Hyliion secured additional orders for Hypertruck ERX production slots, bringing the total orders to 200. It has received reservations of nearly 2,000 units to date. Hyliion expects full-year 2022 revenues and operating expenses in the band of $2-$3 million and $130-$140 million, respectively. As of Jun 30, the firm had cash and cash equivalents of $199.9 million.

Canoo incurred second-quarter 2022 adjusted loss of 68 cents a share, wider than the Zacks Consensus Estimate of 53 cents and also deteriorating from the prior-year loss of 50 cents. The company is not generating any meaningful revenues yet. For the quarter under review, the firm incurred operating expenses (R&D and SG&A) of $170.6 million, up from $102.2 million in second-quarter 2021.

Net cash used in operating activities was $117.2 million during the quarter under discussion compared with $54.8 million in the comparable year-ago period. As of Jun 30, Canoo had cash and cash equivalents of $33.8 million. For second-half 2022, GOEV projects operating expenses in the $200-$245 million range. Capital expenditure is projected in the band of $100-$125 million.

Canoo currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Workhorse incurred second-quarter adjusted loss of 13 cents a share, in line with the Zacks Consensus Estimate. This Ohio-based firm had posted a loss per share of 35 cents in the year-ago quarter. Sales (net of returns and allowances) came in at $12,555, down from $1.2 million in the year-ago period. Gross loss in the second-quarter came in at $3 million. SG&A and R&D expenses for the quarter under review totaled $13 million and $5 million, jumping from the year-ago period’s $7 million and $2.1 million, respectively. Workhorse anticipates to produce/deliver 150-250 vehicles in 2022. Full-year revenues are forecast in the band of $15-25 million.

Workhorse is on track to commence the production of W750 and W4CC delivery vehicles in the fourth quarter of 2022 and third quarter 2022, respectively. Production of the W56 vehicle is set to commence in the third quarter of next year. Final design and testing protocols for the W56 are set to be completed by the second quarter of 2023. It plans to start manufacturing W34 vehicles in late 2024. As for C1000, WKHS is on track to repair all previously manufactured vehicles produced to date by the end of this year. It will also build an additional 50-75 C1000s by year-end. As of Jun 30, Workhorse had approximately $140 million in cash and cash equivalents.

Blink Charging reported second-quarter 2022 loss of 41 cents per share, wider than the Zacks Consensus Estimate of a loss of 36 cents. The bottom line also deteriorated from the loss of 32 cents reported in the year-ago quarter. The EV charging company reported revenues of $11.5 million in the quarter, which surpassed the Zacks Consensus Estimate by 30.64%. The top line improved 164% on a yearly basis. During the quarter, BLNK completed twin acquisitions of EB Charging and SemaConnect. These deals have strengthened Blink’s portfolio and are set to boost prospects.

Product sales in the second quarter were $8.8 million, jumping 170% from the year-ago quarter, thanks to higher sales of commercial chargers, DC fast chargers, and residential chargers. Service revenues totaled $2.2 million, soaring 154% year over year driven by greater utilization of the company’s chargers, increased number of chargers in the Blink network and positive traction from the Blink Mobility Rideshare program. Other revenues totaled $189,000, up from $114,000 generated in the second quarter of 2021. As of Jun 30, 2022, cash and cash equivalents totaled $85.1 million.

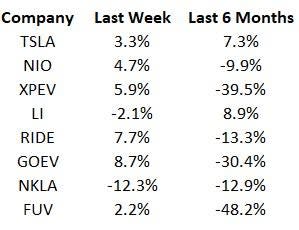

Price Performance

The following table shows the price movement of some of the major EV players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Workhorse Group, Inc. (WKHS) : Free Stock Analysis Report

Blink Charging Co. (BLNK) : Free Stock Analysis Report

Hyliion Holdings Corp. (HYLN) : Free Stock Analysis Report

Canoo Inc. (GOEV) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research