FORT LAUDERDALE, Fla., Aug. 26, 2022 /PRNewswire/ — Haig Partners LLC released its closely followed Q2 2022 Haig Report, which tracks trends in auto retail and their impact on dealership values.General economic indicators have weakened in 2022, but auto dealers continue to experience record-high profits due to pent-up demand and low inventories.

Buy-sell activity flourished in the first half of 2022, with 3% more dealerships sold compared to the record-setting pace of the first half of 2021. Private buying activity is up 28%, while acquisitions by the publicly traded retailers has fallen 62%. The public companies acquired 23 stores in Q2 2022 YTD. Haig Partners served as the exclusive sell-side advisor to the Lehman Family in a transaction with Lithia Motors, which represented 11 of those dealerships.

The outlook for the rest of 2022 is promising for auto retailers. Dealers believe this period of inventory shortages and elevated earnings is likely to continue for the foreseeable future.

Highlights from the Q2 2022 Haig Report include:

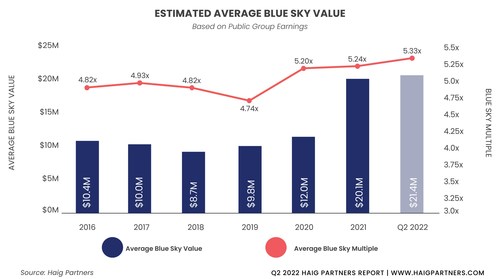

- Blue sky values remain at record levels, 6% higher than at the end of 2021 and at the same level as at the end of Q1 2022

- Pent-up consumer demand continues to grow, providing a bright outlook for future dealership profits

- Auto dealers are still enjoying impressive earnings, but growth in profits might be leveling off

- The number of dealerships sold is 3% higher than the record-setting pace of 2021

- Public company spending on US auto acquisitions remains strong compared to pre-Pandemic times but is down 73% from the same period in 2021

- Fixed operations are up due to higher customer pay, recalls, and higher labor rates

“Thanks to high current and expected future profits many dealers and investors are looking to acquire dealerships, and therefore, it is still a great time for dealers who might be looking to exit,” shared Alan Haig, President of Haig Partners. “That said, we are seeing some indicators that skyrocketing earnings at dealerships may have hit a plateau. The recent financial statements for the publicly traded retailers show their profits per dealership remained flat from Q1. What will happen in future quarters is up for debate. It is possible that costs will continue to increase, and margins will fall, followed by lower profits. But it’s also possible that if supply of new vehicles increases, dealers may make more money since there is still so much pent-up demand that dealers will be able to maintain current margins on higher volume. Either way, our math indicates we will remain in a period of elevated earnings for the next three years or so,” he continued.

Q2 2022 Buy-Sell Trend Highlights

- Blue sky values remain at all-time highs – Haig Partners served as the exclusive advisor on the sale of a majority stake in John Elway’s Crown Toyota to Swickard Auto Group. The total value paid is believed to be the second highest all time for any dealership franchise in the U.S. The highest known price paid for a dealership happened earlier in 2022 when Group 1 reported that it paid $206.5M in blue sky (as reported in their 10Q filing) for Charles Maund Toyota in Austin, TX.

We carefully monitor the buy-sell market to assess the desirability of various auto franchises. We analyze offers for the transactions in which we are engaged and regularly speak with leading buyers and many attorneys, bankers, and CPAs who are involved in other acquisitions. While every transaction varies, we estimate that: - Blue sky value of the average dealership owned by the public companies is 6% higher than at the end of 2021 and about the same level as at the end of Q1 2022

- Lincoln and Infiniti franchises have been updated to a 3.0x-4.0x multiple from a dollar amount in this report compared to our Q1 2022 Haig Report

- Florida and Texas, where there are no state income taxes, are of particular interest to buyers

- Other regions such as the Southeast, the Southwest, and the Mountain States are also highly desirable

- Toyota is one of the most desired brands in the industry – The John Elway’s Crown Toyota and Charles Maund Toyota transactions demonstrate that Toyota is perhaps the most desired brand in the industry today. Toyota is fully committed to supporting its retailers and is not dabbling in the agency model or other ideas that could harm both the retailer and the OEM. Toyota’s long-term commitment to the health of the dealer is a key reason that Toyota sells more vehicles than any other brand. It’s truly a win-win-win for the customer, the dealer, and the OEM.

- Investors and dealers are creating partnerships – There are a number of investment companies and family offices that are seeking to acquire minority or majority equity positions in dealer groups. Some dealers find taking on an investor is preferable to selling out entirely. They retain a portion of the ongoing profits and remain involved in the business until they decide to fully exit. And the investor may help fund additional acquisitions if the dealer is interested in growth capital. Our recent transaction for John Elway’s Crown Toyota is such an example. The parties who sold a majority stake in the dealership wanted to remain involved with Toyota and enjoy ongoing cash flows. Swickard Auto Group, the buyer of the majority stake, will enjoy continuity of management and market knowledge to help them maintain the dealership as one of the best performing dealerships in the US.

- Pent-up consumer demand is still growing, so the outlook for future profits looks bright – The drop in sales today is solely caused by a lack of supply as the level of demand is high. Many in our industry wonder how much longer current conditions will continue. It appears to us as though demand will exceed supply for several more years.

- Inflation remains elevated – The 12-month inflation rate was 8.5% in July 2022. Inflation was 9.1% in June, the highest rate since 1981. Inflation is even higher in the auto industry as the prices of new and used vehicles jumped double digits since last year. If inflation outpaces wage gains, consumers will have a harder time affording vehicles, and dealership profits may suffer.

- GDP declined for a second straight quarter – GDP decreased at an annual rate of 0.9% in Q2 2022, the second consecutive quarter with a GDP decrease after six straight quarters of GDP growth. Dealers should be able to weather a decline in economic activity of this level.

- Unemployment returns to pre-pandemic levels – The unemployment rate dropped to 3.5% in July 2022, the same rate as February 2020. The economy generated 528,000 new jobs, according to the Labor Department. And wages are rising (+5% or more each month this year) as employers fight to remain competitive in this environment.

- The “Chipdemic” continues to plague inventories – Since April 2021, OEMs have struggled with a shortage of microchips. As production continues to get cut and the production outlook remains grim, the SAAR hit 13.4M in July 2022, 9% below the July 2021 level. Many analysts have recently lowered their sales forecasts for 2022 and 2023 due to a protracted production recovery. With continued production issues, demand seems likely to exceed supply for the foreseeable future. Assuming that the OEMs would be ready to produce at this estimated maximum capacity by the beginning of 2023, which seems very unlikely given the ongoing supply chain issues, it would take an estimated three years to catch up with the lost production from 2020-2022 (5.1M lost units / 1.7 M units excess capacity per year = 3 years). By this calculation, we will remain in a period where demand exceeds supply well into 2025. Margins and profits are likely to remain elevated. And even as supply comes back at higher levels and margins begin to drop, the total amount of gross profit from variable ops may remain close to current levels.

- Fixed operations are up due to higher customer pay, recalls, and higher labor rates – Fixed operations are hitting on all cylinders for dealers right now. These three factors of higher customer pay, recalls, and higher labor rates have fixed operations booming for dealers, and gross profits are up an impressive 17.3% in Q2 2022 YTD compared to Q2 2021 YTD. The growth in fixed operations is another example of the strength and flexibility of the auto retail model: when the supply of new vehicles falls, consumers spend more to maintain their current vehicles.

Auto dealerships have proven to be excellent investments in good times and bad, as evidenced by the stock prices of the public companies that have outperformed the S&P 500 Index for many years. CEOs of the public auto retailers have recently stated their intention to continue with acquisitions through the remainder of 2022. Asbury CEO David Hult shared on a recent investor call that they are “looking for strategically aligned opportunities for disciplined growth.” Asbury, Lithia, and Sonic have all posted big revenue goals for 2025, and they will need to consistently add stores to hit their targets.

So far, in 2022, Haig Partners has been involved in the purchase or sale of 31 dealerships nationwide. If you are interested in learning what your business is worth, are seeking acquisitions, or would like to learn more about selling a majority or minority stake in your business, please contact Alan Haig at [email protected] or (954) 646-8921 or any member of the team at Haig Partners to have a confidential conversation.

About The Haig Report

The Haig Report, the leading industry quarterly report that tracks trends in auto retail and their impact on dealership values, includes data and analysis on the performance of auto dealerships, discusses noteworthy events impacting the automotive retail industry, identifies trends in the M&A market for dealerships, provides guidance on estimated value ranges for different franchises, and shares an outlook for the automotive retail buy-sell market. The Haig Report is based on data gathered from reputable public sources and interviews with leading dealer groups and dealers, bankers, lawyers, and accountants who specialize in auto retail.

About Haig Partners

Haig Partners LLC helps dealers maximize the value of their businesses when they are ready to sell. They have unmatched experience with executives from leading retail dealer groups and financial institutions. They have advised on the purchase or sale of more than 575 dealerships for over $9 billion, including 24 on the Top 150 Dealership Groups list published by Automotive News. The team at Haig Partners leverages expertise and relationships to lead clients through a confidential and customizable sales process, yielding the best price successfully. They author the Haig Report, the leading industry quarterly report that tracks trends in auto retail and their impact on dealership values, and are co-author of NADA’s Guide, “Buying and Selling a Dealership.” For more information, visit www.haigpartners.com.

Media Contact:

Aimee Allen

Director of Marketing and Business Development

Haig Partners

[email protected]

(603) 933-2194

SOURCE Haig Partners