- Britain’s light commercial vehicle market falls -24.6%, leaving industry without growth for whole of year to date.

- BEV uptake continues to grow, up 14.7%, reaching 6.1% market share.

- Ongoing supply chain issues lead to worst August since 2017, while year to date market down -27.2% on pre-pandemic 2019.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

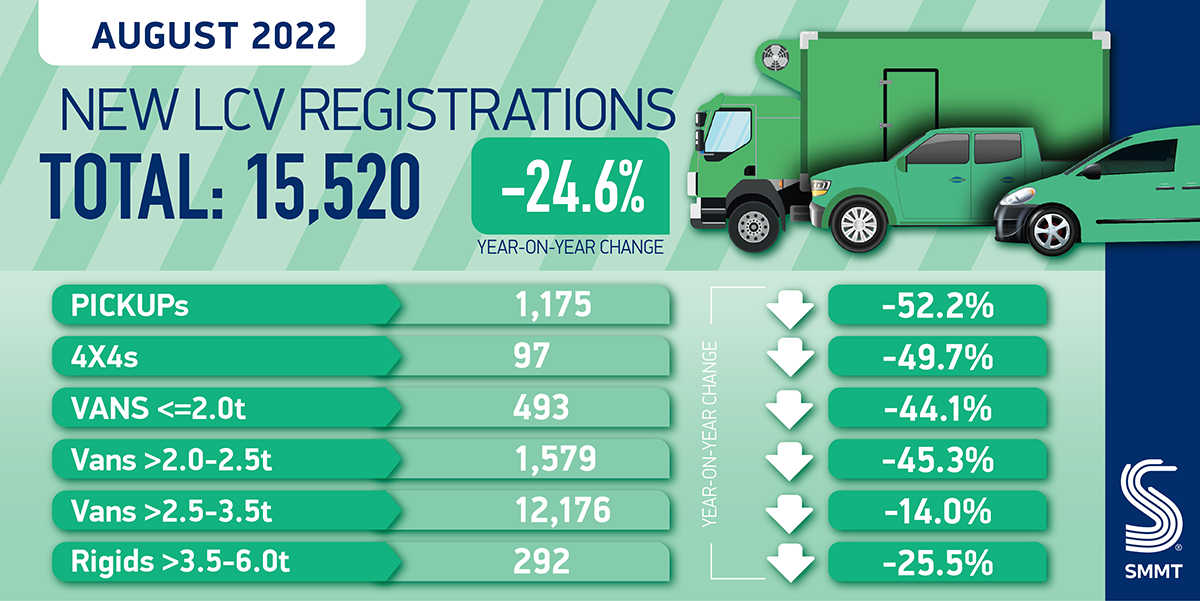

The UK light commercial vehicle (LCV) market fell by -24.6% to 15,520 units during what is traditionally one of the quietest months of the year ahead of the September plate change. The performance means LCV registrations have declined every month of 2022, with August registration volumes the lowest recorded for the month since 2017.1

The scale of the decline is artificially inflated in comparison with last year, however, as August 2021 was the second best performance on record since the introduction of the two-plate system.2 For 2022, however, global supply chain challenges have acted as a handbrake on registrations, albeit the impact has been unevenly distributed across vehicle segments. The growing economic headwinds are also a concern.

Every LCV class recorded a decline, with registrations of vans weighing more than 2.5 tonnes falling by -14.0%; vans weighing more than 2.0 tonnes to 2.5 tonnes down -45.3%; and of those equal to or less than 2.0 tonnes, -44.1%. The biggest decline was recorded in pick-ups, which saw registrations fall by -52.2%, while 4x4s, the smallest segment by volume, declined by -49.7%.

In more positive news, battery electric vehicle (BEV) registrations rose by 14.7% to reach a 6.1% market share (from 4.0% a year ago) as more operators continue to recognise the considerable benefits available, including purchase incentives, lower taxation, exemptions from congestion and clean air zone charges in urban areas, and of course, zero emission mobility. BEV volumes are up 50.6% over the year to date.

With August traditionally being a low volume month as operators choose to delay the acquisition of new vehicles until the ‘new plate month’ in September, next month will be crucial for the industry struggling to repeat the success it saw in 2021. Year to date, LCV registrations are down -24.2% on 2021 and -27.2% on pre-pandemic 2019.3

Mike Hawes, SMMT Chief Executive, said,

Last year’s bumper LCV market meant it was always going to be challenging to repeat that success in 2022, and increasingly strong economic headwinds and supply chain challenges continue to test the market. Good progress is being made in the transition to electric, but accelerating the switch will need action from the new Prime Minister to tackle energy costs and inflation, while also encouraging greater charging infrastructure rollout, so that businesses can have greater confidence to upgrade their van fleets to cleanest, greenest models.

Notes to editors

August’s figures reflect a short interruption to registrations processing at one manufacturer in July due to a planned systems upgrade affecting a limited number of vehicles. This does not materially affect the overall market performance.

1. Registrations August 2017: 15,619

2. Registrations August 2021: 20,582; August 2019: 23,120

3. Registrations Jan-Aug 2019: 245,400