- UK car production rises 34.0% in August to 49,901 units after dismal 2021, but volumes still -45.9% down on pre-pandemic levels.

- Fourth consecutive month of growth fails to offset sustained losses from global supply shortages, with YTD output more than half a million units behind average pre-Covid volumes.

- Sector welcomes business energy price cap, with bills already up by £100 million this year, but warns of spring cliff-edge as seven in 10 firms express concern about future business operations.

- SMMT calls for reforms to secure competitiveness, drive investment and deliver economic growth for the UK.

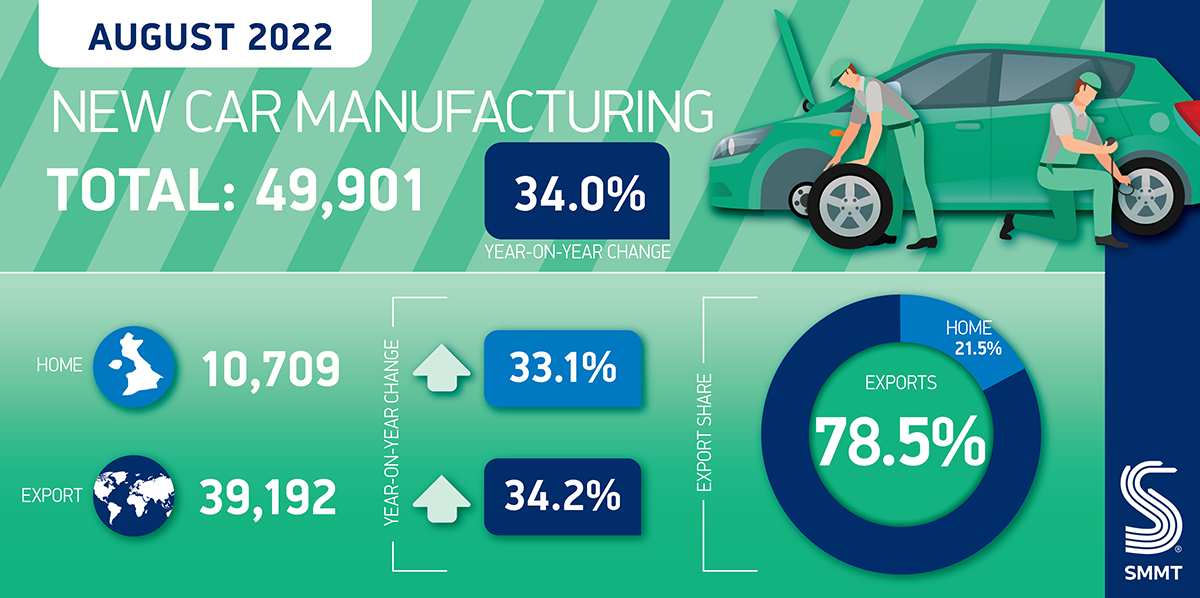

UK car manufacturing output rose for the fourth consecutive month in August, up 34.0% year on year to 49,901 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance was, however, -45.9% below August 2019’s pre-pandemic level of 92,158 units, underlining the scale of recovery still needed.1 The rise, though welcome, follows a very weak performance in August 2021 when production stoppages and extended summer shutdowns caused by the global chip shortage saw volumes plummet to historic lows.2

This year, output for the UK increased 33.1% in the month to 10,709 units, while the number of cars built for export rose 34.2% to 39,192 units. Production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles also grew. Almost a third (32.2%) of all cars made in Britain in August were one of these models, equivalent to 16,059 units, with most (70.5%) exported to global markets. Output of BEVs alone more than doubled, rising 115.9% to account for almost one in 10 cars produced.

Year-to-date, however, overall production remains -13.3% down on the first eight months of 2021 at 511,106 units. Overall, it means factories have turned out 78,501 fewer cars so far this year, with output more than half a million units behind average pre-Covid volumes.3 The sector is now on course to produce fewer than a million cars for the third consecutive year.4

The figures come as new analysis from SMMT highlights the staggering energy costs, already the highest in Europe, facing the UK’s automotive vehicle and component manufacturers. With their collective energy bill having risen by more than £100 million over the last 12 months to more than £300 million,5 the government’s significant intervention to cap prices for businesses over the winter period has temporarily limited further increases, providing timely and vital respite. With these costs expected to more than double again next year, however, and with some manufacturers anticipating even steeper increases, longer term solutions must be found to assure the viability of the sector beyond the end of the cap in six months’ time.

Energy is now the single biggest concern for UK automotive manufacturers, with almost seven in 10 (69%) SMMT members worried about the impact of onerous cost increases on their business operations. They also reported rising costs across the board, with average prices of raw materials up 38%, semiconductors up 95% and logistics up 43%.

While most companies have already implemented extensive energy saving measures and are absorbing increases where possible, the competitive and low margin nature of the industry has meant that almost nine in 10 (87%) are having to pass on costs, stoking inflation. The knock-on effect for many (41%) is that they have been forced to delay or cancel investments, with 13% reducing shifts and 9% resorting to cutting jobs.

There is also significant concern about the future, with 38% worried about business growth, 42% about their international competitiveness and 49% about their ability to recruit staff as companies strive to transition their workforces to zero emission technologies and processes.

Given this challenging backdrop, SMMT and its members are calling for action to restore stability and safeguard the industry’s competitiveness as it transitions towards net zero. Among the interventions members are seeking from government’s next fiscal event in November, in addition to energy price caps (called for by 84% of survey respondents), are the removal or reduction of VAT on energy (71%) and the same support for automotive as for Energy Intensive Industries (71%) thereby securing further price mitigation. Other measures that would deliver significant cost savings and unlock critical investment include business rates reduction (93%), grants for capital expenditure, improved R&D tax credits and investment in skills (90%).

Mike Hawes, SMMT Chief Executive, said,

While another month of rising UK car production is good news, and testament to sectoral efforts to overcome supply chain shortages, it overshadows what is an extremely tough and uncertain environment for manufacturers. Volumes are down dramatically and firms are having to take drastic steps to safeguard their businesses in the face of myriad challenges.

The government’s measures announced last week to alleviate crippling energy costs provide valuable respite, but long-term action is needed to restore stability and provide the sector with a globally competitive investment framework. Reform of business rates, enhanced capital allowances, an affordable and secure supply of low carbon energy, and investment in new skills can enable this critical sector to deliver the economic growth, productivity improvements, balance of trade benefits and job security the UK sorely needs.

Notes to editors

1. August 2019 – 92,158 units

2. August 2021 was the lowest volume August since 1956 (25,736 units)

3. Jan-Aug 5-year average output (2015-19) – 1,030,527 units

4. Latest production outlook (Auto Analysis, July 2022): 866,000 units in 2022; Output <1 million in 2021 (859,575); 2020 (920,928). Prior to that, 1986 was the last year recording output below 1m units

5. Based on analysis of BEIS energy prices, energy use reported in the SMMT Sustainability Report 2022, and survey of SMMT membership conducted 6-16 September 2022 using manufacturer respondent data