- The UK’s light commercial vehicle (LCV) market rises 10.8% in September, marking the first month of growth in 2022.

- Delivery of medium and large vans drives uplift, while battery electric vehicle (BEV) uptake continues to rise, up 70.0%, representing 4.4% of the market.

- Long-term measures that shore up operator confidence amid wider economic uncertainty are crucial to accelerating uptake of the latest, greenest vans.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

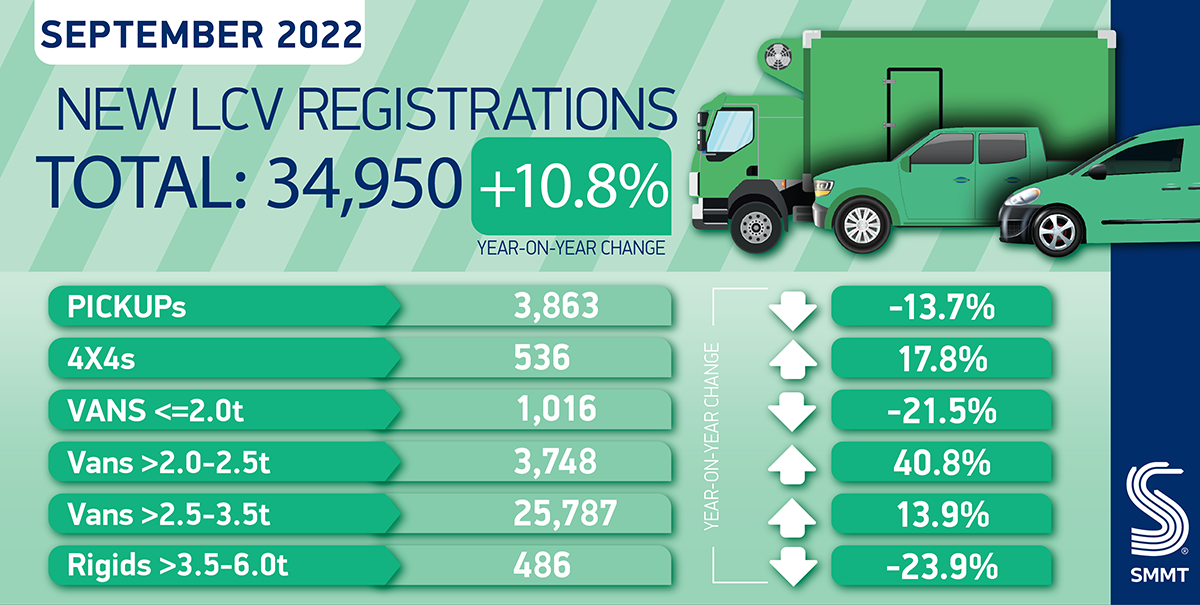

Britain’s light commercial vehicle (LCV) market grew by 10.8% to 34,950 units in September, one of the most popular months of the year for new van registrations due to the plate change. Despite strong order books throughout 2022, September is the first month of growth in registrations this year, as supply disruptions have restricted model availability. The performance is, however, artificially inflated in comparison with 2021, which saw the fewest registrations for the month since the 2009 recession,1 with this September still some -35.5% below the five-year pre-pandemic average.2

The year-on-year uptick was driven by the fulfilment of orders for vans weighing more than 2.5 tonnes, up 13.9% to represent 73.8% of the market, while registrations of vans weighing more than 2.0 tonnes to 2.5 tonnes rose by 40.8%. However, vans weighing less than or equal to 2.0 tonnes were down -21.5%.

Battery electric vehicle (BEV) deliveries, meanwhile, continued their upward trend, rising 70.0% to a market share of 4.4% – up from 2.9% in 2021. With a growing number of zero emission van models coming to market, more operators are benefitting from lower taxation, purchase incentives and zone charge exemptions. As a result, BEV volumes increased by 52.9% year on year from January to September.

Overall, however, UK van registrations during 2022 to date are down -20.1% year on year at 213,576 units, and some -24.8% below the pre-pandemic five-year average,3 despite strong order books for the latest LCV models. While there are signs that pandemic-related component shortages are starting to ease for some manufacturers, supply issues continue to stymie the market, while economic headwinds add further pressures on recovery. Measures that address the UK’s economic sluggishness and boost operator confidence will be crucial to stimulating the demand needed to help transition the van market to a zero emission future.

Mike Hawes, SMMT Chief Executive, said,

While the full recovery of Britain’s new van market remains some way off, September growth reflects van makers’ efforts to fulfil strong order books despite a paucity of supply. High energy costs and wider economic uncertainty, however, will undermine operator confidence, meaning that long-term measures to provide stability and growth are needed if the sector – so often a bellwether for business activity – is to return to its past success.

Notes to editors

1 LCV registrations in September 2021: 31,535 units.

2 LCV registrations average for September 2015-2019: 54,207 units.

3 January to September average 2015-2019: 283,883 units.