Acquisition Highlights:

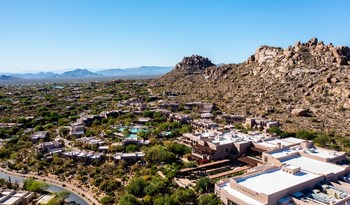

Luxury 210-key resort in North Scottsdale nestled in the foothills of the Sonoran Desert near Pinnacle Peak

The Company will purchase the asset using $267.8 million of cash on hand

Revenue per available room (RevPAR) of $407 forecasted for 2022 year-end

Numerous world-class amenities including spa treatments, a bi-level pool and authentic Southwest cuisine; offering breathtaking mountain views and ideally situated near two world-class golf courses

DALLAS, Nov. 1, 2022 /PRNewswire/ — Braemar Hotels & Resorts Inc. (NYSE: BHR) (“Braemar” or the “Company”) today announced it has entered into a definitive agreement to acquire the 210-room Four Seasons Resort Scottsdale at Troon North (the “Property”). The acquisition is expected to close in the fourth quarter, subject to certain customary closing conditions. Because the acquisition is subject to certain customary closing conditions, the Company can give no assurance that the transaction will be consummated by such date or at all.

Four Seasons Resort Scottsdale

Four Seasons Resort Scottsdale Pool

Four Seasons Resort Scottsdale Private Patio

Four Seasons Resort Scottsdale Bar and Lounge

“The acquisition of the Four Seasons Resort Scottsdale is an exciting opportunity for us to acquire a timeless, luxury resort ideally located in picturesque North Scottsdale,” said Richard J. Stockton, Braemar’s President and Chief Executive Officer. “This exquisite Property fits perfectly with our strategy of owning high RevPAR luxury hotels and resorts and further diversifies our portfolio.”

Located on East Crescent Moon Drive in Scottsdale, Arizona, the idyllic Property is set on 37 acres featuring adobe-inspired rooms situated among saguaro cacti, dramatic valleys, and views of the iconic Pinnacle Peak. Amenities include locally inspired spa treatments at the 9,000 sq. ft. spa, a bi-level pool and authentic Southwest cuisine. The Property also offers guests opportunities for outdoor adventure, including close shuttle access to two world-class golf courses, four pickleball and two tennis courts, as well as the opportunities to hike, bike or rock climb surrounding hills. In addition to the amenities of the self-contained Property, the resort benefits from its close proximity to the city of Scottsdale, known for its shopping boutiques, award winning restaurants, Old West history, Native American art, and being among the world’s finest golf destinations.

Four Seasons Resort Scottsdale at Troon North was opened in 1999 and has benefited from $20.7 million ($98,700 per key) of capital improvements since 2016. This included the renovation of all guest rooms, indoor meeting space, lobby, and food and beverage outlets. It has 210 luxurious and spacious guest rooms, including 22 suites that average 1,214 sq. ft. in size, all boasting private patios or balconies overlooking the colorful desert landscapes. Guests have multiple dining options including indulging at the 100-seat Talavera steakhouse, sampling American homestyle fare at 180-seat Proof cantina, enjoying desert and pool views at the 55-seat Saguaro Blossom poolside restaurant, or enjoying handcrafted cocktails at the 100-seat Onyx Bar and Lounge. The Property also boasts 35,900 square feet of total indoor and landscaped outdoor event space including three ballrooms and a variety of private meeting rooms including two dedicated boardrooms.

Four Seasons Resort Scottsdale at Troon North has been the recipient of the following awards:

AAA Five Diamond Winner 2022

Forbes Four Star Travel Award Winner 2022

World Travel Awards United States’ Leading Resort 2022

World Travel Awards Arizona’s Leading Resort 2022

The total consideration for the acquisition is $267.8 million ($1.28 million per key). The acquisition is expected to be funded with existing cash on hand. No common equity will be issued to fund the acquisition. Of the total consideration, $250 million is allocated to the existing resort and represents a capitalization rate of 5.7% on hotel net operating income of $14.2 million and a 15.2x hotel EBITDA multiple, based on unaudited operating financial data provided by the sellers and forecasted financial results for 2022. The Company expects to realize a stabilized yield of approximately 8.0% on its investment in the next three to five years. On a trailing 12-month basis as of August 30, 2022, the Property achieved RevPAR of $423.20, with 48.5% occupancy and an average daily rate (ADR) of $873.24, according to unaudited operating financial data provided by the seller.

Braemar Hotels & Resorts is a real estate investment trust (REIT) focused on investing in luxury hotels and resorts.

|

Braemar Hotels & Resorts Inc. |

||

|

Four Seasons Resort Scottsdale at Troon North |

||

|

Reconciliation of Hotel Net Income to Hotel EBITDA and Hotel Net Operating Income |

||

|

(Unaudited, in millions) |

||

|

12 Months Ending |

||

|

December 31, 2022 |

||

|

Net income (loss) |

$ 4.0 |

|

|

Interest expense |

4.3 |

|

|

Depreciation and amortization |

8.2 |

|

|

Hotel EBITDA |

$ 16.5 |

|

|

Capital reserve |

(2.3) |

|

|

Hotel Net Operating Income |

$ 14.2 |

|

|

__________ |

EBITDA is defined as net income (loss), computed in accordance with generally accepted accounting principles (“GAAP”), before interest, taxes, depreciation, and amortization. Hotel EBITDA multiple is defined as the purchase price divided by the trailing 12-month EBITDA. A capitalization rate is determined by dividing the property’s annual net operating income by the purchase price. Net operating income is the property’s hotel EBITDA minus a capital expense reserve of either 4% or 5% of gross revenues.

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release include, among others, statements about the Company’s strategy and future plans. These forward-looking statements are subject to risks and uncertainties. When we use the words “will likely result,” “may,” “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” or similar expressions, we intend to identify forward-looking statements. Such statements are subject to numerous assumptions and uncertainties, many of which are outside Braemar’s control.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated, including, without limitation: our ability to complete the proposed transaction on the terms or timeline currently contemplated or at all, the impact of COVID-19, and the rate of adoption and efficacy of vaccines to prevent COVID-19, on our business and investment strategy; our ability to repay, refinance or restructure our debt and the debt of certain of our subsidiaries; anticipated or expected purchases or sales of assets; our projected operating results; completion of any pending transactions; risks associated with our ability to effectuate our dividend policy, including factors such as operating results and the economic outlook influencing our board’s decision whether to pay further dividends at levels previously disclosed or to use available cash to pay dividends; our understanding of our competition; market trends; projected capital expenditures; the impact of technology on our operations and business; general volatility of the capital markets and the market price of our common stock and preferred stock; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the markets in which we operate, interest rates or the general economy; and the degree and nature of our competition. These and other risk factors are more fully discussed in Braemar’s filings with the Securities and Exchange Commission.

The forward-looking statements included in this press release are only made as of the date of this press release. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. Investors should not place undue reliance on these forward-looking statements. The Company can give no assurance that these forward-looking statements will be attained or that any deviation will not occur. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations, or otherwise, except to the extent required by law.

SOURCE Braemar Hotels & Resorts Inc.