NEW YORK, Nov. 2, 2022 /PRNewswire/ — The interconnected challenges of global security partnerships, financial integration, supply chain resilience, and migration are no longer simmering in the background. They are now top of the agenda and will likely continue to stay there in the year ahead, according to a new S&P Global Market Intelligence report released today. The newly published report, 2023 Economics & Country Risk Outlook, is part of S&P Global Market Intelligence’s Big Picture 2023 Outlook Report Series.

The new report highlighted that entering 2022, the question on many minds was the pace of the pandemic recovery. Russia’s invasion of Ukraine earlier this year dashed hopes of a smooth recovery. Instead, the conflict in Ukraine hastened a confrontation with a host of geopolitical risks and transformed Europe’s near-term security and economic picture. Next year, central banks in major economies will remain focused on inflation, with the impact of interest rates adding further stress on consumers. Tightening financial conditions will lead to a further slowdown in global economic growth, putting expansions in vulnerable regions at risk and deepening anticipated recessions in Europe.

“Looking ahead to 2023, European energy security will remain a source of near-term risk, clouding the economic outlook,” said Dr. Lindsay Newman, Head of Geopolitical Thought Leadership at S&P Global Market Intelligence. “This dynamic reflects a broader trend we are watching of operational, political and security risks underpinning the economic landscape for 2023.”

Key highlights from the report include:

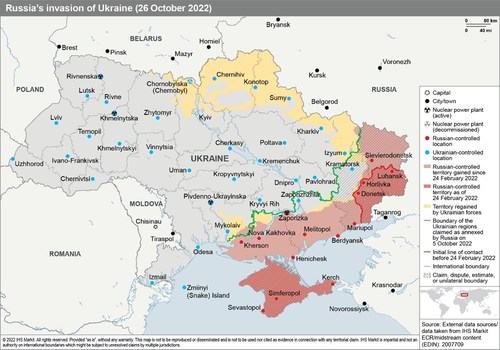

- With Ukraine’s fall counteroffensive and given its position to recover the territory Russia has annexed since 2014, the conflict looks set to continue deep into 2023, with few politically palatable off-ramps available for Russian President Vladimir Putin.

- Entering 2023, much depends on the severity of the European winter, on likely further sanctions, and on prospects for global measures being considered to cap the price of Russian oil. Economic and energy security concerns will drive short-term mitigation strategies in Europe, increasing fiscal, social, and political challenges for governments – especially those facing scheduled elections in 2023 (Poland, Finland, Estonia, Greece).

- Tightening financial conditions will lead to a further slowdown in global economic growth, putting expansions in vulnerable regions at risk and deepening anticipated recessions in Europe. The combination of subpar economic growth, rising unemployment, and improving supply chain conditions will eventually cause inflation to subside over the next two years.

To request a copy of the 2023 Economics & Country Risk Outlook, please contact [email protected].

S&P Global Market Intelligence’s opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world’s foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world’s leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781-301-9311

[email protected]

SOURCE S&P Global Market Intelligence