Strength across end-markets, thanks to continued expansion in manufacturing activities, bodes well for the Zacks Manufacturing – Electronics industry. Despite an increase, there is some slowdown in manufacturing activities, which can be linked to a softness in demand for electronics products. Persistent supply chain constraints and raw material cost inflation are added concerns for the industry. Manufacturing electronics companies have also been battling a perennial problem of labor shortages in the industry.

Despite these headwinds, pricing actions to tackle cost inflation should aid the performances of Eaton Corporation plc ETN, Emerson Electric Co. EMR and AZZ Inc. AZZ.

About the Industry

The Zacks Manufacturing-Electronics industry comprises companies that manufacture electronic products like battery chargers, battery accessories, outdoor cabinet enclosures, power transmission products, electrical motion controls and motive power devices. Some industry players also provide water-treatment products, engineered flow components, process equipment and turn-key systems. These companies also offer state-of-the-art customer support and after-market services to end users. These companies are increasing investments for developing innovative technologies, boosting customer and employee experience as well as supply-chain modernization programs. The manufacturing electronic companies sell products and services in various end markets, including robotics, semiconductor, defense, aerospace, medical equipment and satellite communications.

3 Trends Shaping the Future of the Manufacturing Electronics Industry

Supply Chain & Cost Woes: The industry is plagued by persistent supply chain constraints, primarily related to semiconductor shortages, which are weighing on volumes and delaying deliveries. Labor shortages have been a perennial problem for the industry participants. High raw material and freight costs are denting the margins of these companies. Pricing actions to tackle inflationary pressure have provided relief to some extent.

Softness in Demand: While manufacturing activity continues to expand, it is increasing at a slower pace, indicating some softness in demand for electronics products. In September, Institute for Supply Management’s (ISM) manufacturing PMI (Purchasing Managers’ Index) touched 50.9% (a figure above 50 implies an expansion in manufacturing), reflecting growth in manufacturing activities for the 28th consecutive month. However, the index dipped 1.9 percentage points from the figure recorded in August, with New Orders and New Export Orders indexes contracting. Amid growing uncertainty in the economy, the demand environment is expected to remain volatile.

Strength Across End-Markets: With continued expansion in manufacturing activities, strength across end-markets should drive growth of the industry. Well-diversified end-markets, including marine, mining, metal, energy, chemicals, power, renewable, life sciences, commercial, industrial, food, retail and other non-residential end markets, should help the industry players offset weakness in demand associated with a single market. Additionally, the digitalization of business operations is helping industry participants boost their competitiveness through enhanced operational productivity, product quality and better cost management.

Zacks Industry Rank Indicates Gloomy Prospects

The Zacks Manufacturing – Electronics industry, housed within the broader Zacks Industrial Products sector, currently carries a Zacks Industry Rank #183. This rank places it in the bottom 27% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate. The Zacks Consensus Estimate for the group’s 2022 earnings per share has decreased 12.5% over the past year.

Despite the industry’s drab near-term prospects, we will present a few stocks that you may hold in your portfolios. But before that, it’s worth taking a look at the industry’s stock market performance and current valuation.

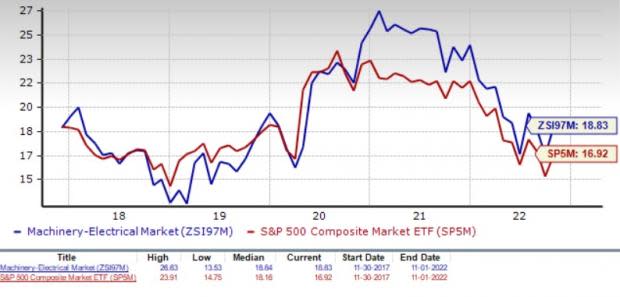

Industry Underperforms Sector & S&P 500

The Zacks Manufacturing – Electronics industry has underperformed the broader sector and the Zacks S&P 500 composite index in the past year.

Over this period, the industry has declined 19.8% compared with the sector and the S&P 500 Index’s decrease of 16.5% and 18.8%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of forward 12-month Price-to-Earnings (P/E), which is a commonly used multiple for valuing manufacturing stocks, the industry is currently trading at 18.83X compared with the S&P 500’s 16.92X. It is also above the sector’s P/E ratio of 15.12X.

Over the past five years, the industry has traded as high as 26.63X, as low as 13.53X and at the median of 18.84X as the chart below shows.

Price-to-Earnings Ratio

Price-to-Earnings Ratio

3 Manufacturing – Electronics Stocks to Keep a Tab On

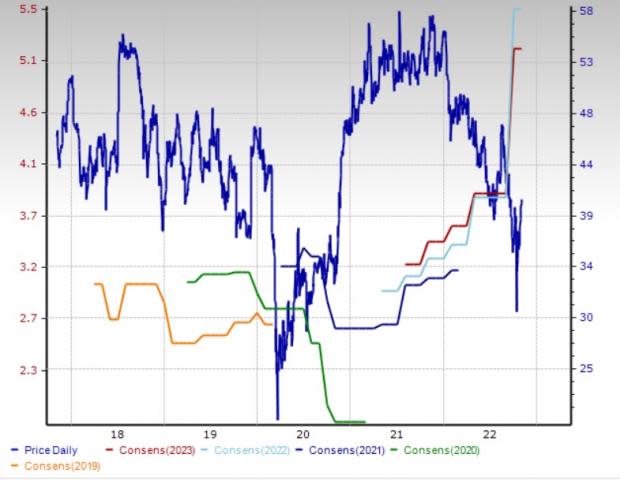

AZZ: Strategic transformation efforts, pricing actions and operational improvement initiatives are driving AZZ’s growth despite adversities such as high labor and raw material costs. Higher volumes for hot-dip galvanizing within the renewables, utility, OEM, and construction markets should continue to boost the company’s top line. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AZZ, provides metal coating services, welding solutions and specialty electrical equipment to a wide range of markets in North America. The Zacks Consensus Estimate for the company’s fiscal 2023 earnings has been revised upward by 44.1% in the past 90 days. Shares of the company have declined 12% in the past 60 days.

Price and Consensus: AZZ

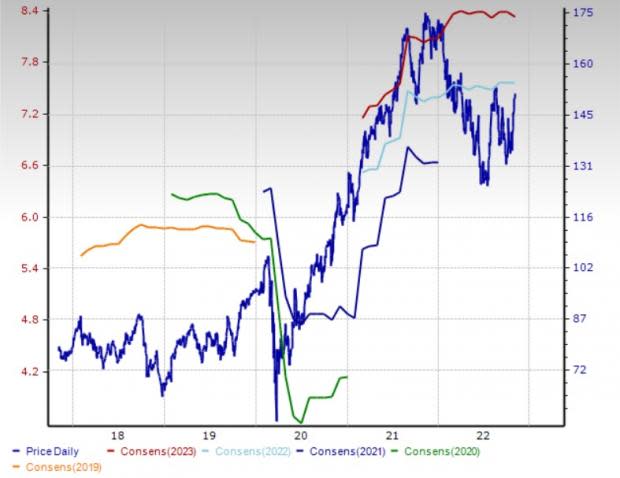

Eaton: Investments in research and development programs to introduce products, including power management solutions, augur well for Eaton’s growth prospects. The acquisition of Royal Power Solutions (January 2022), which helps ETN expand in multiple growth markets in the United States, should drive its top line. The company carries a Zacks Rank #3 (Hold).

Based in Dublin, Ireland, Eaton is a diversified power management company and a global technology leader in electrical components and systems. The Zacks Consensus Estimate for the company’s 2022 earnings has been revised northward by nearly 1% in the past 90 days. Shares of the company have gained 3.5% in the past six months.

Price and Consensus: ETN

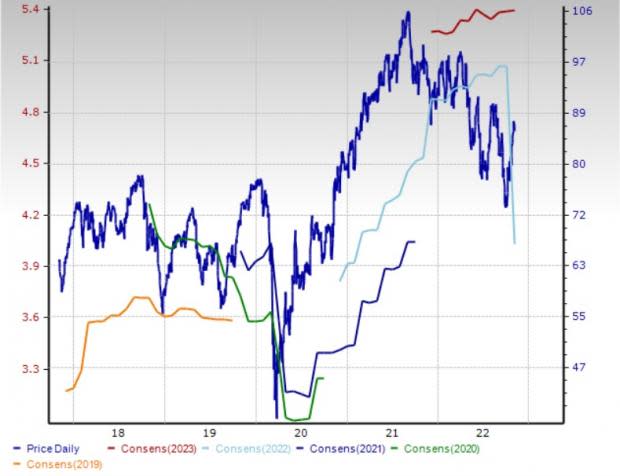

Emerson: Emerson is poised to benefit from strong demand for its technology, software and solutions. Strength in the energy, chemicals, power, renewable, life sciences and metals and mining end markets is likely to support top-line growth. Focus on operational efficiency and cost-control measures bode well for the company’s bottom-line growth. Portfolio restructuring actions should foster EMR’s growth. The company carries a Zacks Rank #3.

Headquartered in St. Louis, MO, Emerson is a diversified global engineering and technology company. The Zacks Consensus Estimate for the company’s 2022 earnings has been revised upward by approximately 1% in the past 90 days. Shares of the company have gained 5% in the past six months.

Price and Consensus: EMR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research