Goodyear Tire GT reported third-quarter 2022 adjusted earnings per share of 40 cents, missing the Zacks Consensus Estimate of 61 cents. Lower-than-anticipated revenues and operating income in the Americas and EMEA segments, and lesser-than-expected sales in the Asia Pacific segment weighed on the results. The bottom line decreased 44.4% from the year-ago figure of 72 cents.

The company generated net revenues of $5,311 million, rising 7.6% on a year-over-year basis, riding on pricing actions. The top line, nonetheless, fell short of the Zacks Consensus Estimate of $5,573 million.

In the reported quarter, tire volume was 46.7 million units, down 3% from the year-ago period. Replacement tire shipments declined 9%, reflecting a recovery in the number of imports into mature markets after supply chain disruptions affected the supply of those tires a year ago. Original equipment unit volume increased 25.6% year over year on the back of share gains from recent fitment wins and recovery in industry volumes.

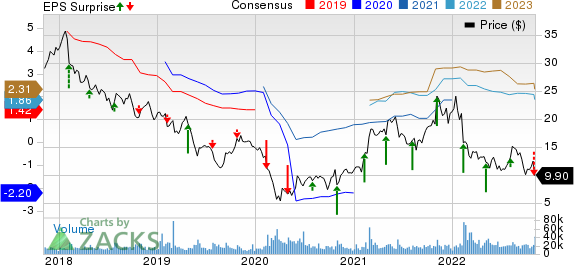

The Goodyear Tire & Rubber Company Price, Consensus and EPS Surprise

The Goodyear Tire & Rubber Company price-consensus-eps-surprise-chart | The Goodyear Tire & Rubber Company Quote

Segmental Performance

In the reported quarter, the Americas segment generated revenues of $3,304 million, around 11.4% higher than the prior-year period’s figure but missed the consensus metric of $3,370 million. The segment registered an operating income of $306 million, which increased 18.1%. Improvements in price/mix aided the upswing in operating margins. But the figure missed the consensus mark of $311 million.

Revenues in the Europe, Middle East and Africa (EMEA) segment were $1,358 million, shrinking 2.8% from the year-ago period and missing the consensus mark of $1,541 million. The segment’s operating profit came in at $30 million in the quarter, contracting 63% on raw material cost increases and lower volumes. The figure also trailed the consensus mark of $65 million.

Revenues in the Asia Pacific segment increased 13.9% year over year to $649 million but lagged the consensus mark of $662 million. The segment’s operating profit income was $37 million, up 15.6% from the year-ago figure, owing to the benefits of price mix. The figure also crossed the consensus metric of $22.84 million.

Financial Position

Selling, general & administrative expenses fell to $696 million from $727 million in the year-ago period.

Goodyear had cash and cash equivalents of $1,243 million as of Sep 30, 2022, up from $1,088 million on Dec 31, 2021. As of the third quarter of 2022, long-term debt and finance leases amounted to $7,839 million, up from $6,648 million on Dec 31, 2021. Capital expenditure in the quarter was $254 million, down from $281 million in the year-ago quarter.

Outlook

For the fourth quarter of 2022, the company anticipates continued volume growth in the Asia Pacific segment and volume softness in the EMEA unit. Raw material costs are expected to be up about $500 million in the fourth quarter. The company now expects to increase working capital within $300-$500 million, up from $300 million earlier. Capital expenditure is now expected to be in the range of $1-$1.1 billion, lower than $1.1-$1.2 billion estimated earlier.

Zacks Rank & Key Picks

GT currently has a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Cummins Inc. CMI, CarParts.com PRTS and Genuine Parts Company GPC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Cummins has an expected earnings growth rate of 18.4% for the current year. The Zacks Consensus Estimate for CMI’s current-year earnings has been revised 1% upward in the past 30 days.

CarParts has an expected earnings growth rate of 45% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant over the past 30 days.

Genuine Parts has an expected earnings growth rate of 18.1% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 1.6% downward over the past 7 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

CarParts.com, Inc. (PRTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research