Sales of passenger cars and SUVs managed to improve in October with growth of 11.7% and 65,966 units sold

Registrations of light commercial vehicles fell by 0.5% compared to the same month of the previous year, with 10,404 units

Sales of industrial vehicles, buses, coaches and microbuses increased by 8.4% in October with 2,788 units

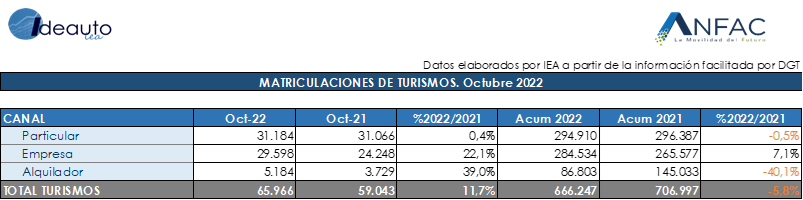

Madrid, November 2, 2022. The passenger car and SUV market achieved growth in sales for the third consecutive month, with an increase of 11.7% compared to the same month of October of the previous year, with a total of 65,966 units. However, despite this improvement, the month continues to be below pre-pandemic levels (October 2019), with a drop of 29.8%, a month in which 93,954 units were sold. The market continues to suffer the consequences of the microchip crisis and the manufacturing rhythm problems caused by the shortage of these components. Likewise, we must add the economic uncertainty that is conditioning the purchase decision, among other causes, being conclusive factors to reflect that the accumulated figure for the year remains negative, with a decrease of 5.8% and 666,247 units in total.

The average CO2 emissions of passenger cars sold in the month of October remain at 120.4 grams of CO2 per kilometer traveled, 0.3% higher than the average emissions of new passenger cars sold in October 2021. Until In the month of October, emissions have been reduced by 3.3% compared to the same accumulated period of the previous year.

As for the registrations by channels, they obtain increases in all of them. It is worth highlighting the notable increase in both the rental channel and companies. In the tenth month, sales directed at companies managed to grow by 22.1% to 29,598 units and, likewise, purchases in the rent-a-car channel accumulated 5,184 units sold, which represents an increase of 39%. For its part, sales to individuals achieved a slight increase of 0.4%, with 31,184 new units registered.

LIGHT COMMERCIAL VEHICLES

In October, registrations of light commercial vehicles accumulated a total of 10,404 units, which represents a decrease of 0.5% compared to last year. For the accumulated of the year, 97,163 registrations are reached, which registers a fall of 25.6% compared to the same period of the previous year. By channels, only registrations aimed at companies managed to grow, with an increase of 20.6%, while the self-employed channel and that of renters registered a drop of 13.3% and 51.5%, respectively.

INDUSTRIAL AND BUSES

Registrations of industrial vehicles, buses, coaches and microbuses in October maintained the upward trend of recent months, with an increase of 8.4% and a total of 2,788 units sold. In the accumulated of the year, there is a total of 20,957 units, which registers an increase of 11.5% in the first ten months. By type of vehicle, with the exception of medium industrial vehicles from 6 to 16 tons and microbuses, they managed to increase their sales in all types.

DECLARATIONS

Félix García, director of communication and marketing at ANFAC, explained that “the car and SUV market grew by more than 11% in October. It is the third consecutive month in which sales have risen in a declining market context and with a very unfavorable socioeconomic situation. The sector continues to suffer from the serious semiconductor crisis that penalizes production. Although demand persists, manufacturers continue to try to minimize manufacturing pacing problems caused by component shortages. As the war in Ukraine and geopolitical tensions in Asia continue, we do not expect the situation to improve until 2023, with which the market will close, in the best scenario, around 820,000 new passenger car registrations, more than 35,000 fewer cars than in 2021”.

Raúl Morales, communication director of FACONAUTO, indicated that “The positive data in October registrations is not representative, because we are still talking about a market with very low figures that we are also comparing with an already bad year such as 2021. The month was has been saved by the increase in the operations of companies and rental companies, while the individual channel, which is attended by dealers, once again shows us its most worrying face, remaining almost 40% below the sales it made before the pandemic.

The year will close, as we expected, with some 830,000 registered units, which confirms a worrying shrinkage of the automotive market in our country, that we do not know when the trend will change and that leaves us in a weak position in the decarbonisation process of the park in which we are immersed, which will culminate in 2035, when we can only market 0 emission vehicles”.

According to the communication director of GANVAM, Tania Puche, she highlighted “in October, the slight increase in enrollments in the individual channel stands out, which shows an increasingly weak demand as a result of an uncertain economic outlook, with loans increasingly more expensive. This circumstance, in a market in which 80% of vehicles are financed, stops families who want to embark on the purchase of a car. If we add to this situation that the chip crisis continues to take its toll on supply, everything indicates that we will close the year with around 820,000 units”.