Last week, many auto biggies released U.S. vehicle sales data for the month of October 2022. Among the automakers that revealed monthly sales numbers, Toyota, Mazda, Hyundai, Kia, Subaru and Volvo registered year-over-year gains, while Ford and Honda posted a decline in sales. Per Motor Intelligence, the seasonally adjusted annualized rate of sales reached 15.28 million in October, up from 13.39 recorded in the year-ago period.

Meanwhile, a host of auto players released third-quarter results last week. Leading engine maker Cummins CMI and tire giant Goodyear Tire GT missed earnings estimates. Meanwhile, automotive equipment supplier Lear LEA managed to pull off a comprehensive beat. Used car e-retailer Carvana CVNA incurred a wider-than-expected loss in the third quarter of 2022. Tenneco TEN— which is soon to be taken over by Apollo Global Management— also reported a loss against the consensus estimate of earnings per share.

Highlights of the Quarterly Releases

Goodyear Tire reported third-quarter 2022 adjusted earnings per share of 40 cents, missing the Zacks Consensus Estimate of 61 cents. The bottom line decreased 44.4% from the year-ago figure of 72 cents. The company generated net revenues of $5,311 million, rising 7.6% on a year-over-year basis, riding on pricing actions. The top line, nonetheless, fell short of the Zacks Consensus Estimate of $5,573 million.

For the fourth quarter of 2022, the company anticipates continued volume growth in the Asia Pacific segment and volume softness in the EMEA unit. Raw material costs are expected to be up about $500 million in the fourth quarter. The company now expects to increase working capital within $300-$500 million, up from $300 million earlier. Capital expenditure is now expected to be in the range of $1-$1.1 billion, lower than $1.1-$1.2 billion estimated earlier.

(Goodyear’s Q3 Earnings Lag Estimates, Revenues Up Y/Y)

Cummins reported third-quarter 2022 earnings of $3.21 per share, which declined from $3.69 in the prior-year quarter. The figure also missed the Zacks Consensus Estimate of $4.88. Cummins’ revenues totaled $7,333 million, up 22.8% from $5,968 million recorded in the year-ago quarter. The top line also beat Zacks Consensus Estimate of $6,958.2 million.

Cummins maintained its 2022 guidance for revenues. It continues to expect revenues to grow 8% year over year. EBITDA is now forecast at 15% of sales, down from 15.5% of sales guided earlier. Cummins continues to stick to its plans of returning nearly 50% of operating cash flow to shareholders in the form of dividends and share repurchases. Cummins currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

(Cummins Q3 Earnings Miss Estimates, Deteriorate Y/Y)

Lear reported third-quarter 2022 adjusted earnings of $2.33 per share, surging around 340% year over year from 53 cents. The bottom line also surpassed the Zacks Consensus Estimate of $2.14 per share. In the reported quarter, revenues increased 23% year over year to $5,241 million. The top line also beat the Zacks Consensus Estimate of $5,134 million.

Lear projects its full-year net sales in the band of $20.55-$21.05 billion. Core operating earnings are envisioned in the band of $815-$915 million. Operating cash flow is projected within $950-$1,075 million. Lear anticipates FCF in the band of $275-$375. The capital spending forecast is now within $675-$700 million. Adjusted EBITDA is envisioned within the range of $1,405-$1,505 million.

(Lear Q3 Earnings & Revenues Beat Estimates, Rise Y/Y)

Carvana incurred a loss of $2.67 per share in third-quarter 2022, wider than the Zacks Consensus Estimate of a loss of $2.02. The company had recorded a loss of 38 cents in the year-ago quarter. Third-quarter revenues of $3,386 million also lagged the Zacks Consensus Estimate of $3,645 million and fell 2.7% year over year.

Carvana had cash and cash equivalents of $316 million as of Sep 30, 2022, compared with $403 million on Dec 31, 2021. Long-term debt amounted to $6,616 million as of Sep 30, 2022, significantly increasing from $3,208 million recorded on Dec 31, 2021.For the fourth quarter, Carvana continues to expect a sequential reduction in retail units sold and total GPU on the back of reduced used vehicle industry demand, increasing benchmark interest rates and higher used vehicle depreciation rates.

(Carvana Q3 Loss Wider Than Expected, Sales Decline)

Tenneco incurred an adjusted loss of 14 cents per share in third-quarter 2022 as against the Zacks Consensus Estimate of earnings of 75 cents. The company’s EPS in the year-ago period was 17 cents. High costs resulted in dismal results in the quarter under discussion. Total costs and expenses flared up 14% year over year to $4,821 million. Revenues of $4,931 million topped the consensus estimate of $4,841 million and increased 14% year over year.

Tenneco had cash and cash equivalents of $415 million as of Sep 30, 2022, down from $859 million as of Dec 31, 2021. Long-term debt totaled $3,603 million, down from $5,018 million as of Dec 31, 2021. During the reported quarter, the company’s net cash provided by operating activities was $55 million. Tenneco has not provided any guidance on account of its pending takeover by Apollo Global Management, which was announced in February 2022. The transaction is expected to close by mid-November.

(Tenneco Q3 Earnings Miss, Sales Surpass Estimates)

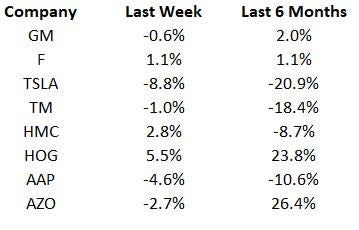

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will track China vehicle sales data for October 2022, which is likely to be released by the China Association of Automobile Manufacturers this week. Also, stay tuned for the quarterly results of Japan’s auto magnates, including Honda and Nissan, and various electric vehicle players like Rivian Automotive, Lordstown Motors and Lucid Group among others are slated to report this week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cummins Inc. (CMI) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Tenneco Inc. (TEN) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research