Nov 15 (Reuters) – Collapsed crypto exchange FTX outlined a “severe liquidity crisis” in official bankruptcy filings released on Tuesday, as regulators opened probes and called for the faster implementation of rules for the hamstrung industry.

FTX’s filing to a U.S. bankruptcy court said it was in contact with financial regulators and had appointed five new independent directors at each of its main companies, including Alameda research.

FTX founder and former chief executive Sam Bankman-Fried said he expanded his business too fast and failed to notice signs of trouble at the exchange, whose downfall sent shock waves through the crypto industry, the New York Times reported late on Monday.

“FTX faced a severe liquidity crisis that necessitated the filing of these cases on an emergency basis last Friday,” the court filing stated.

“Questions arose about Mr. Bankman-Fried’s leadership and the handling of FTX’s complex array of assets and businesses under his direction.”

FTX also confirmed that it had responded to a cyber attack on Nov. 11, after saying on Saturday it had seen “unauthorized transactions” on its platform.

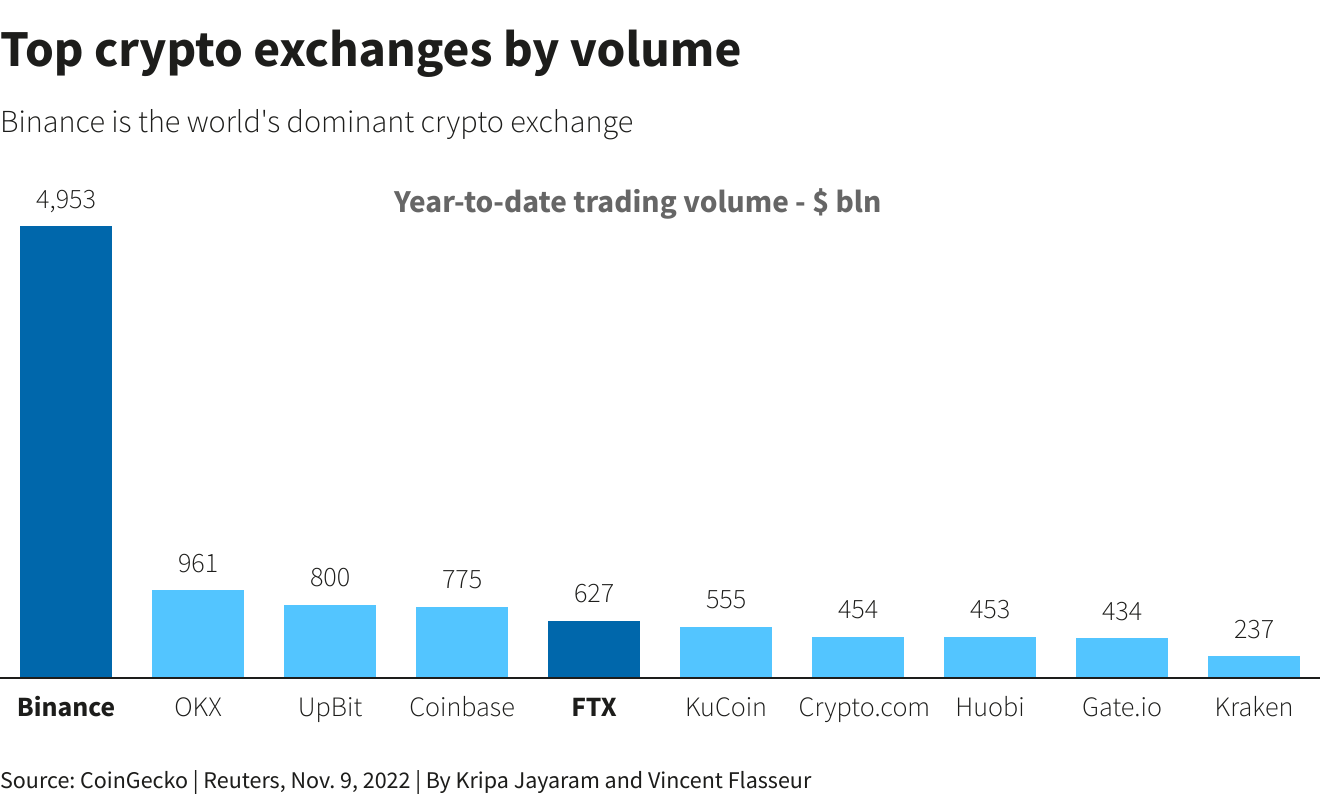

It filed for bankruptcy protection on Friday in one of the highest-profile crypto blowups after frenzied traders withdrew $6 billion from the platform in just 72 hours and rival exchange Binance abandoned a rescue deal.

The implosion of FTX, once a darling of the crypto industry with a $32 billion valuation as of January, has spurred investigations by the U.S. Justice Department, the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), a source with knowledge of the investigations told Reuters.

Crypto industry peers and partners have been quick to distance themselves from FTX or proclaim sound financials, while bitcoin with losses of 19% this month and other tokens have suffered.

The fallout has so far been limited to crypto exchanges and traders, but is featuring in mainstream policy discussions too.

French central bank Governor Francois Villeroy de Galhau in a speech in Tokyo called for a global regulatory response to financial uncertainty caused by the crypto market.

“Let me stress that this uncertainty is why we need to regulate strongly and quickly crypto assets internationally,” he said. “The last episodes show us that we cannot allow for a second ‘crypto winter’ to still add to uncertainty and financial instability.”

On Monday, officials from the U.S. Federal Reserve and legislature called for crypto finance to come under greater regulatory scrutiny.

THE FILING

The Delaware bankruptcy court ruled that the relief requested by FTX was in the best interests of the debtors, creditors and all parties.

FTX’s filing stated the “Debtors’ Chapter l1 Cases are complex, consisting of over one hundred debtor entities and involving non-traditional assets.”

FTX has engaged Alvarez & Marsal as financial advisor.

The firm said it has been in contact with the U.S. Attorney’s Office, SEC, CFTC, and dozens of federal, state and international regulatory agencies over the past 72 hours.

FTX has appointed five independent directors at its various units to ensure proper corporate governance during its bankruptcy, lawyers for the company said in the filing. Former U.S. District Court Judge Joseph Farnan and Matthew Doheny will oversee FTX Trading.

Mitchell Sonkin was appointed as a director at West Realm Shires, Matthew Rosenberg at Alameda Research and Rishi Jain at Clifton Bay Investments, according to the filing.

Writing by Vidya Ranganathan; Editing by Sam Holmes

Our Standards: The Thomson Reuters Trust Principles.