CHICAGO, Nov. 29, 2022 /PRNewswire/ — New product development initiatives for tractors of various engine power ratings and models will intensify the competition in the market during the forecast period. Several vendors in the market have a dedicated distribution network for different regions.

The government identifies regions according to their current production of export foods and their potential to increase production with the help of new institutional reforms. The emphasis on export-centric production and revenue incentives by exporting large, high-quality products will boost the sale of new tractors and agricultural equipment.

Spain & Poland Tractor Market Report Scope

|

Report Attributes |

Details |

|

Spain Tractor Market Size (2028) |

14.4 thousand Units |

|

Spain Tractor Market CAGR (2021-2028) |

4.13 % |

|

Poland Tractor Market Size (2028) |

39 thousand Units |

|

Poland Tractor Market CAGR (2021-2028) |

4.24 % |

|

Base Year |

2021 |

|

Forecast Year |

2022-2028 |

|

Key Leading Vendors in Spain |

John Deere, CNH Industrial, AGCO, Kubota, SDF, JCB, Iseki Farm Implement Trading Co., and Arbos Group |

|

Key Leading Vendors in Poland |

John Deere, CNH Industries, AGCO, Claas, TAFE, SDF, ACE, ISEKI, DEUTZ-FAHR, Mahindra & Mahindra, Yanmar, Escorts, and Kubota |

Autonomous Tractors Creating Huge Market Demand in Spain

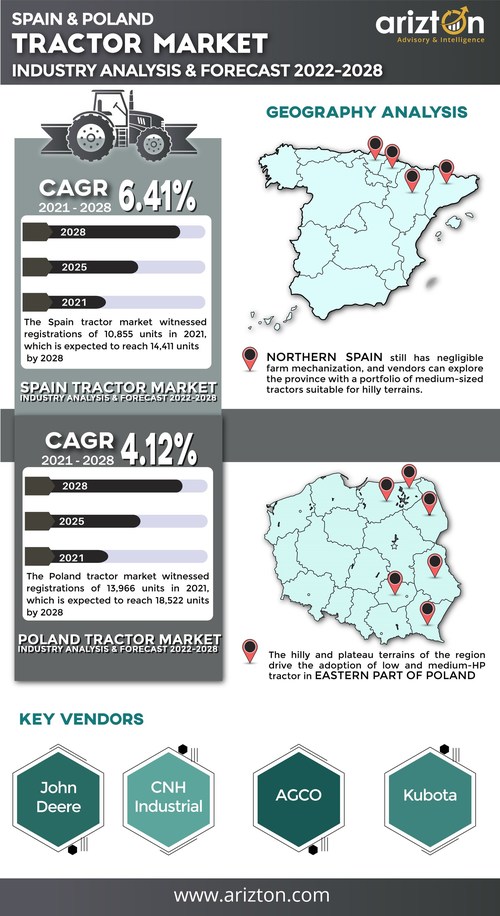

The Spain tractor market is to reach 14.4 thousand units by 2028, growing at a CAGR of 4.13% during the forecast period.

There is a rapid increase in innovation and extensive use of robotics and AI in Spain. The current method of farming is likely to be revolutionized entirely using autonomous tractors and agricultural robots, which will perform time-consuming tasks in a much more efficient and effective way within the next ten years. Self-driving or autonomous tractors can help farmers reduce their working hours. There is also a huge potential for data monitoring. The price of an autonomous tractor is estimated to be 40%−50% higher than the price of a conventional tractor. Thus, affordability will be a major challenge for farmers. However, autonomous tractors will provide better returns to Spain farmers.

Spain has over 46.8 million food consumers and is the fourth-largest food market in Western Europe. It has more than 50% of its area under agricultural land, covering more than 2 million hectares despite its high population density. The country witnessed a massive increase in farm mechanization, both terms of agricultural and industrial productivity, driven by a technological revival in the last decade. The Spain tractor market plays a key role in farming as it eases the work and increases productivity. Globally, the demand for organic products is rising because of the associated health benefits such as fewer or no chemicals and fertilizers, non-GMO yield, and ethical farming. Spain is the leader in organic farming in the EU.

In Spain, tractors play a major role in farming, as they ease the work and increase productivity. Globally, the demand for organic products is rising because of the associated health benefits, such as less or no chemicals and fertilizers, non-GMO yield, and ethical farming. Many consumers and countries across Europe are switching to organic agricultural produce. Spain is the leader in organic farming in the EU. In 2021, the land area devoted to organic farming grew 2.5% compared to 2020, reaching around 1 million hectares.

Key Highlights

- The Spain tractor market grew by 9.3% in 2021 from 2020. The increase in crop production and machinery sales was due to a favorable climate and government support to farmers through incentives in 2021.

- In 2020, Spain imported USD 1.5 billion worth of tractors, of which 22.0% was from Germany, 20.9% from France, and 13.8% from the Netherlands.

- More than 2.3 million hectares of Spain are used for agriculture. Spain’s Agricultural sector generated USD 54.65 billion in revenue, accounting for 12% of the total income of the European Union.

- Spain’s government plans to double the quantity and revenues from agricultural products exported by 2025, with the share of farming exports growing relatively slowly. The government identifies regions according to their current production of export foods and their potential to increase production with the help of new institutional reforms.

- In 2020, Spain exported USD 1.4 billion worth of tractors. Around 34.4% were exported to Italy, 15.1% to Germany, and 10.5% to France.

Key Vendors

- John Deere

- CNH Industrial

- AGCO

- Kubota

Other Prominent Vendors

- SDF

- JCB

- Iseki Farm Implement Trading Co.

- Arbos Group

Market Segmentation

Horsepower

- Less than 50 HP

- 50–100 HP

- 101–150 HP

- 151–200 HP

- 201–300 HP

- Above 300 HP

Drive Type

- 2-Wheel-Drive

- 4-Wheel-Drive

Regions

- Spain

- Northern

- Eastern

- Central

- Southern

Request for Free Spain Tractor Market Sample Now: https://www.arizton.com/request-sample/3571

Shortage of Agricultural Laborers Procuring High Demand for Tractors in Poland

The Poland tractor market is expected to reach 18 thousand units by 2028 growing at a CAGR of 4.12% during 2022-2028. Poland has over 37.8 million food consumers and is the fifth-largest tractor market in Europe. The country witnessed a massive increase in agricultural and industrial productivity and farm mechanization. In 2020, Poland exported USD 820 million worth of tractors. The major export markets of Polish farm tractors include Germany, Russia, the UK, Ukraine, and Turkey.

For several reasons, a shortage of laborers is witnessed in Poland’s agricultural sector. The main reasons are the lack of incentives, migration to other countries for employment, and extreme working conditions. Poland’s rural youth is no longer interested in agriculture and is migrating to cities to explore new opportunities. The aging workforce also contributes significantly to the shortage of laborers.

Moreover, Income and growth opportunities in the non-agricultural sector, low wages in the agricultural industry, and extreme work conditions reduce the percentage of the total workforce engaged in agriculture. The drastic shortage of farm laborers is expected to increase the demand for farm machinery, such as tractors.

Key Insights:

- In 2020, Poland imported USD 1.8 billion worth of tractors, of which 24.7% was from the Netherlands, 21.0% from Germany, and 10.7% from France.

- The Poland tractor market grew by 40.8% in 2021 from 2020. The increase in crop production and tractor sales was due to a favorable climate in 2021.

- The Polish government plans schemes and initiatives to facilitate credit and improve agriculture-related operations, which will contribute to the growth of the overall value chain of the market.

- The technology needs of Polish farmers are diverse. The country’s agricultural economy is progressing towards larger-scale commercial production and greater productivity, shifting away from subsistence agriculture and labor-intensive farming practices.

- The Western region industry witnessed the highest growth rate of CAGR of 4.85% during the forecast period. Technological improvements such as IoT-based sensor networks, weather forecasting, etc., in Western region agricultural production can create awareness of new tractors and improved implements, which will help increase farm yields.

Key Vendors

- John Deere

- CNH Industrial

- AGCO

- Kubota

Other Prominent Vendors

- Deutz-Fahr

- Zetor Poland Sp. o.o.

- Escorts

- JCB

- Yanmar

- MTW Holdings

Market Segmentation

Horsepower

- Less than 50 HP

- 50–100 HP

- 101–180 HP

- Above 180 HP

Drive Type

- 2-Wheel-Drive

- 4-Wheel-Drive

Regions

- Poland

- Northern

- Eastern

- Western

- Southern

Request for Free Poland Tractor Market Sample Now: https://www.arizton.com/request-sample/3584

Check Some of the Top-Selling Related Reports:

Germany Tractor Market – The Germany Tractor market is expected to grow at a CAGR of 5.10%, from 32k units in 2021 to 45k units by 2028. In 2021, the 50-100HP segment accounted for the largest share due to increasing landholding structures in Germany.

Italy Tractor Market – The Italy tractor market was valued at 24k units in 2021 and is expected to reach 31k units by 2027, growing at a CAGR of 3.74% from 2022 to 2028. The increased use of tractors in the power range of 50-100 HP is due to their ability to effectively carry out all tasks in the field, including soil preparation, irrigation, weeding, harvesting, and haulage. These farm tractors have the power to perform the required farming tasks and are also used in several other ways, such as operating generators for irrigation and running both companies and domestically made harvesters and threshers. The labor shortage and reduced agriculture production costs have triggered the demand for this segment in the Italian market.

Turkey Tractors Market – The Turkey tractors market is expected to grow at a CAGR of over 5% from 2022 to 2028 and is projected to reach 94 thousand units by 2028. New Holland and Tumosan dominated the Turkey tractors market with a collective market share of over 52%. The threat of rivalry is high in the Turkey tractor market since more than 50% of the claim belongs to the top three key players. These players are thriving on innovation in the tractor market. They are increasingly investing in developing advanced agriculture tractor technology for precision farming and machine automation.

France Tractor Market – France tractor market size was valued at 29k units in 2021 and is expected to reach 39k units by 2028 growing at a CAGR of 4.24%. Tractors are the largest segment of France agriculture equipment market, accounting for less than 38% of the share. Tractors can be rightfully called the backbone of the France agriculture industry. Agriculture tractors accounted for 98% of France’s overall tractors market in 2021. The German and France tractor market are the two biggest industries in the European region, and France is the 2nd largest market.

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Call: +1-312-235-2040

+1 302 469 0707

Mail: enquiry@arizton.com

Photo: https://mma.prnewswire.com/media/1957603/Spain_Poland_Tractor_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

SOURCE Arizton Advisory & Intelligence