Last week, China-based electric vehicle (EV) stars NIO Inc. NIO, Li Auto LI and XPeng Inc. XPEV announced their delivery updates for November. While NIO and Li Auto hit monthly-record deliveries, XPeng witnessed a sharp fall in deliveries on a yearly basis. XPeng also released its third-quarter results, with losses wider than the year-ago period. The forecast for the fourth quarter was also weak. ChargePoint Holdings, Inc. CHPT also reported results for the third quarter of fiscal 2023. Meanwhile, Blink Charging BLNK also made it to the top stories with the installation of 50 EV charging stations.

While XPeng carries a Zacks Rank #2 (Buy), NIO, Li Auto, Blink Charging and ChargePoint carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inside the Headlines

XPeng reported 5,811 monthly deliveries of Smart EVs in November, down roughly 63% year over year. The company delivered 1,546 flagship G9 SUVs last month, mass deliveries of which commenced at the end of October. For the first 11 months of the year, XPeng’s total deliveries were 109,465 units, representing a 33% increase year over year.

Last week, XPeng also announced its third-quarter results. The company incurred a loss per American Depositary Share (ADS) of 39 cents in the third quarter of 2022, wider than the year-ago loss of 29 cents amid higher manufacturing expenses due to supply chain snafus. Revenues of $959.2 million were up 19.3% year over year on improved deliveries. For the fourth quarter, XPeng expects deliveries in the band of 20,000-21,000 vehicles, signaling a year-over-year decrease of 49.7-52.1%. Revenues are envisioned between RMB 4.8 billion and RMB 5.1 billion, indicating a year-over-year decline of 40.4-43.9%.

Li Auto saw deliveries of 15,034 vehicles in November 2022. The deliveries marked record-high monthly delivery, up 11.5% year over year. Its cumulative deliveries totaled 236,101 as of the end of November. Notably, the Li L9 model, a six-seater, full-size flagship SUV for families, has been gaining immense popularity and has become the most preferred choice of a 6-seater SUV in China.

Story continues

LI also stated that it was getting a good response for its Li L8 model, a large premium smart SUV for families, deliveries of which commenced in early November. The Li L8 model is available in two variants, namely a six-seater and a VIP five-seater, to cater to diverse family groups. As of Nov 30, 2022, Li’s retail stores totaled 276 in 119 cities, its servicing centers were 317 and Li Auto-authorized body and paint shops were operating in 226 cities.

NIO delivered 14,178 vehicles in November, up 30.3% year over year, setting a new high for monthly deliveries. The deliveries include 8,003 premium smart electric SUVs and 6,175 premium smart electric sedans. From the beginning of the year till November end, NIO delivered 106,671 vehicles, up 31.8% year over year. Cumulative deliveries of NIO vehicles reached 273,741 as of Nov 30, 2022.

Meanwhile, NIO and Tencent Holdings inked an agreement to deepen their partnership in the autonomous driving domain. The companies will collaborate on related cloud services, intelligent driving maps and digital ecosystem.

ChargePoint incurred an adjusted quarterly loss of 17 cents per share, narrower than the Zacks Consensus Estimate of a loss of 19 cents. The bottom line, however, deteriorated from a loss of 14 cents per share recorded in the year-ago quarter. Revenues of $125.34 million for the quarter ended October 2022 missed the Zacks Consensus Estimate by 4.58%. This compares to year-ago revenues of $65.03 million.

Cash and cash equivalents as of Oct 31, 2022 were $188.3 million. For the fourth quarter of fiscal 2023, CHPT envisions revenues of $160-$170 million, marking a 108% year-over-year increase from the midpoint of the guided range. It expects the adjusted gross margin in the fourth quarter to witness sequential improvement. For fiscal 2023, ChargePoint expects revenues to be between $475 million and $485 million.

Blink Charging announced the installation of 50 EV charging stations at the Granite Properties development, Midtown Union in Atlanta. The charging stations are split between Midtown Union’s north and south parking decks. It will offer services to the office customers and residents of the Mira at Midtown Union. The charging infrastructure is set to make EV ownership more accessible in Atlanta. President of Blink Charging commented, “With the installation of the L2 EV charging stations at Midtown Union, Granite Properties is making electric vehicle ownership even more achievable for residents and visitors. We are thrilled to join the new Midtown Union development and look forward to supporting more Granite Properties projects in the future.”

The new Series 6 L2 charging stations installed at the Midtown Union sport a modern aluminum casing and interactive LED lights. Using the SemaConnect Cloud, the property team can gain access, customize pricing, and download usage and sustainability reports. The SemaConnect app will enable residents and customers to access private stations, view station status, and control personal accounts.

Price Performance

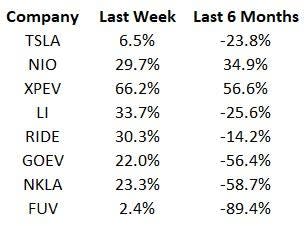

The following table shows the price movement of some of the major EV players over the last week and six-month period.

Zacks Investment Research

Image Source: Zacks Investment Research

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry. Also, investors are awaiting third-quarter results of Li Auto, scheduled to be unveiled this week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blink Charging Co. (BLNK) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

ChargePoint Holdings, Inc. (CHPT) : Free Stock Analysis Report