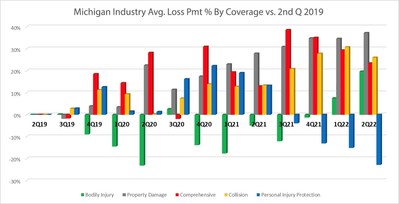

DETROIT , Dec. 16, 2022 /PRNewswire/ — CURE auto insurance reveals industry data showing the dramatic impact Michigan’s 2019 “no-fault” insurance reforms are having on the car insurance landscape. Industry average costs per medical claim went down an average of 28% within the past 12 months since the new law went into effect. CURE CEO, Eric S. Poe, points to this data as irrefutable proof that rebuts any critics who have made assertions that the reform act was not having a real impact. “Our industry is suffering from one of worst years on record as a result of the COVID 19 supply chain shortages, which are driving costs of repairs and replacements sky high. If it were not for the no-fault line of coverage and Governor Whitmer’s courageous commitment to enact the reforms, Michigan car insurers would be taking an even greater beating,” Poe said. In fact, the industry data shows that the Michigan no-fault option is not only the best performing line of coverage but the only profitable one for the car insurance market this past year.

Eric S. Poe, Esq., CPA, CEO, CURE Auto Insurance

CURE’s expansion into Michigan cannot go unnoticed as 40% of its drivers were currently unable to afford car insurance and went uninsured. Further, 94% of the 200,000 drivers who have sought quotes since July 2021 are choosing to look at options only available under the new law. “With an average savings of $812 per policy, we think this is simply a reflection of what the law has allowed us to provide – namely an affordable solution for the over 50,000 vehicles we insure and 70% of CURE insured drivers living in the Metro Detroit area.”

When asked what this means to Michigan drivers, Poe responded, “In the simplest terms, the reforms show that car insurance rates in Michigan have a bright future. Not only have drivers seen over $3 billion in cash refunds from the MCCA ordered by Governor Whitmer in the past year, we believe rates will decrease as the new law continues to prevent the medical billing abuse that plagued the market for decades.”

Headquartered in Princeton, N.J., CURE auto insurance was heralded as the “cure” for the auto insurance no-fault crisis in New Jersey when it was founded in 1990. Specializing in no-fault insurance markets, CURE auto insurance insures over 100,000 vehicles and is licensed to do business New Jersey, Pennsylvania and Michigan.

More information can be found at cure.com or by calling 800-535-CURE.

SOURCE CURE Auto Insurance