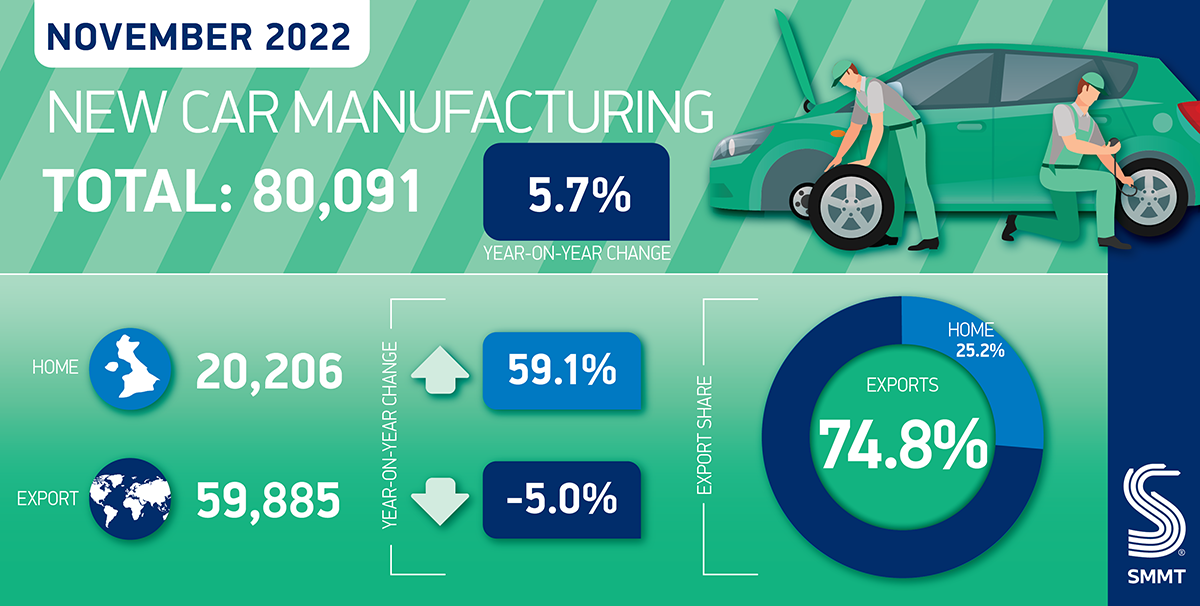

- November UK car production grows 5.7% with 80,091 cars manufactured.

- Electrified vehicle output rises 18.3% to 29,318 units and more than a third of total production.

- Volumes for home market up 59.1% while exports decline -5.0% in the month.

UK car production grew for the second consecutive month in November, up 5.7% to 80,091 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The rise means UK car manufacturing output has grown in six of the past seven months demonstrating how, even amid global chip shortages and supply chain constraints, factories are doing their best to meet demand for new cars at home and overseas.

Despite the overall rise in output, November’s performance was still down against historic levels, -44.1% off the pre-pandemic five-year average for the month and -25.7% off 2019’s total of 107,744 units. The reasons for this trend are many, including the impact of Covid lockdowns overseas, recently in China, structural and product changes, the long-running squeeze on semiconductor supply and wider turmoil resulting from war in Ukraine.

Production for the home market was up 59.1% to 20,206 units, a rise of 7,505 cars, while export volumes fell -5.0% to 59,885, a loss of 3,170. Exports accounted for 74.8% of all cars made in the month with the majority of shipments (57.3%) heading into the European Union, followed by the US (21.9%) and China (5.9%).

Continuing the recent upward trend, UK production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles rose once again, with combined volumes up 18.3% to 29,318 units and representing more than a third (36.6%) of total production in November. Since January, UK manufacturers have turned out 209,930 of these vehicles combined, up 2.9% on the same period in 2021.

Mike Hawes, SMMT Chief Executive, said,

These figures bring some Christmas cheer to UK car makers in what has been another incredibly tough year. Supply chain shortages, overseas lockdowns and some structural and product changes have combined to throttle output for much of 2022 but there is renewed hope these issues will begin to ease in 2023. This could bring a much-needed boost to the economy, however, to attract the investment needed for long term growth, we still need stability and more competitive conditions – not least to alleviate crippling long term energy costs.