Aptiv PLC APTV shares have had an impressive run on the bourses in the past three months. The stock has gained 20% compared with the 2.6% decline of the industry it belongs to and the 4.7% rally of the Zacks S&P 500 composite.

Reasons for the Upside

Aptiv remains exposed to the lucrative connected cars market. With safety becoming a key selling point for connected cars, automakers are increasingly seeking related technologies. Aptiv is well-positioned to leverage on growing electrification, connectivity and autonomy trends in the automotive sector.

The recent acquisition of Wind River Studio will enable APTV to give a quicker and cost-effective access to full-vehicle software architecture to its clients, expand to multiple industries, and transform into an edge-enabled, software-defined future.

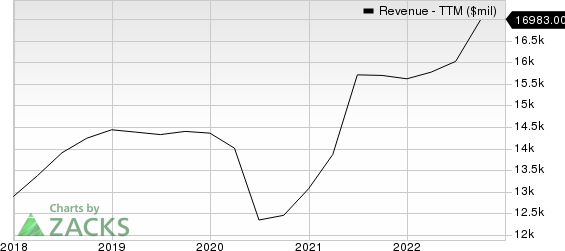

Aptiv PLC Revenue (TTM)

Aptiv PLC revenue-ttm | Aptiv PLC Quote

Aptiv has a sound liquidity position. Its current ratio (a measure of liquidity) was at 2.66 at the end of third-quarter 2022, higher than the 2.63 recorded at the end of the second quarter and the prior-year quarter’s 2.11. A current ratio, which is greater than 1.5, is usually considered good for a company. This may imply that the risk of default is less.

Favorable Estimate Revisions

The direction of estimate revisions serves as an important pointer, when it comes to the price of a stock. One estimate for 2023 has moved north over the past 30 days versus one southward revision. Over the same period, the Zacks Consensus Estimate for 2023 earnings has increased 0.4%.

Zacks Rank and Stocks to Consider

Aptiv currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Booz Allen Hamilton Holding Corporation BAH and CRA International, Inc. CRAI.

Booz Allen has a long-term earnings growth expectation of 8.9%. Presently, BAH carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Booz Allen delivered a trailing four-quarter earnings surprise of 8.8%, on average.

CRA International carries a Zacks Rank of 2 at present. CRAI has a long-term earnings growth expectation of 14.3%.

CRA International delivered a trailing four-quarter earnings surprise of 25.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report