Sales of passenger cars and SUVs closed with 73,927 units in December, 14.1% less due to bottlenecks in the transport of vehicles to points of sale.

Registrations of light commercial vehicles achieved a rise of 12.4% more in the month, with 12,184 sales, but closing the year with a drop of 21.3%

Sales of industrial vehicles, buses, coaches and minibuses increased by 33.1% in December with 2,705 units with an annual growth of 13.8%

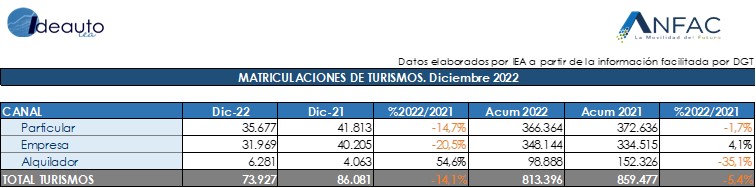

Madrid, January 2, 2023. The passenger car and SUV market reaches a total of 813,396 units sold during 2022, with a drop of 5.4%. This figure is below the forecasts for the sector, which stood at around 830,000 units in the best of scenarios, due, in part, to the pronounced decline that occurred in December with a drop in sales of 14 .1% and 73,927 new registrations. The difficulties in transporting vehicles to dealerships have caused thousands of cars to remain stopped in ports and fields, delaying their delivery to buyers. In any case, 2022 has been a difficult year for car sales marked by factors such as the war in Ukraine, the increase in energy and fuel costs or the increase in inflation and interest rates that have conditioned the decision to user purchase.

The average CO2 emissions of passenger cars sold in December remain at 119 grams of CO2 per kilometer traveled, 2.3% lower than the average emissions of new passenger cars sold in the same month of 2021. At the end of the year in 2022, emissions have been reduced by 3.1% compared to the previous year, with an average of 120.4 grams of CO2 per kilometer travelled.

Regarding registrations by channels, they reflect the framework of the general market, where economic conditions have weighed down sales to individuals with a slight fall of 1.7% for the total year, with 366,364 units sold. For its part, the business channel, despite the drop recorded in December, managed to close the year with an increase of 4.1% and 348,144 registrations. As for the rental channel, it is the one that has been most affected with a decrease of 35.1% and 98,888 registrations.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles add up to a total of 119,506 units in 2022, which represents a notable decrease of 21.3% compared to last year. Despite this general calculation, the last month has managed to improve the figures with an increase of 12.4% in sales, reaching 12,184 sales. As for sales by channels, all of them suffered a sharp drop with declines of 31% and 38.6% in sales to self-employed workers and renters, respectively.

INDUSTRIAL AND BUSES

During 2022, the registrations of industrial vehicles, buses, coaches and minibuses achieved an increase of 13.8%, with a total of 25,911 units, being the only automobile market that achieved an annual increase. During the last month, there was once again an improvement over the previous year, with growth of 33.1% and 2,249 registrations. By type of vehicle, all increased their sales, highlighting heavy industrial vehicles >16 tons that reached 20,357 units, with an improvement of 13.6%, or buses, coaches and microbuses with 2,457 sales and an increase of 25.4%.

STATEMENTS

Félix García, director of communication and marketing at ANFAC, explained that “2022 has been a year in which the market has once again fallen short of forecasts. The semiconductor crisis was deeply aggravated by exogenous factors such as the war in Ukraine or China’s Covid Zero policy lockdowns. In addition to the economic crisis with rising energy prices, inflation and interest rates, the perfect storm has come to an end with these bottlenecks in maritime and road transport. All of this means that 2022 is once again below forecasts and leaves us with an unfavorable scenario for 2023 where, being cautious, we should tackle the assault on the border of 900,000 units. Everything will depend on whether the conflict in Ukraine ends and the logistics chain is normalized so that more new vehicles can be delivered. It will also help to add new registrations if the Government accelerates the measures to promote fast charging points and direct aid for electrified vehicles. With a market below one million units there is a real risk of loss of investment and employment.”

Raúl Morales, communication director of FACONAUTO, indicated that “Last year, the market has not been able to change its negative trend, mainly due to the persistent bottlenecks in the supply of vehicles, which has greatly conditioned the activity of dealers . In addition, the rise in the price of fuel and of the vehicles themselves have been circumstances that have had a negative influence. And in the background, a context in which inflation, the increase in interest rates and the uncertainty of households have eroded the capacity to consume. Dealers have seen this situation worsen in the last stretch of the year, when the market has reflected a clear drop in demand. The uncertainty with which we closed 2022 prevents us from envisioning a change for this 2023. We handle two scenarios: a bare growth of 5%, that is, 870,000 units, to which an additional 10% would have to be added if the bottlenecks in production, with which we would go to 960,000 units. Neither of the two forecasts is good news, because we are very far from the figures we saw before the pandemic.

According to GANVAM’s communication director, Tania Puche, highlighted that “the year has been more complicated in terms of registrations than the previous one and we practically have to go back to 2011 to see similar volumes. In this third negative year in a row, in which some 400,000 fewer units have been registered than before the pandemic, the lack of supply has made a dent in the market and everything points to the fact that, although with less intensity, it will continue to do so in 2023 , with the risk it entails for employment and the competitiveness of the sector. In addition, in a context in which the rate of electrification has not yet reached cruising speed, refocusing decarbonisation strategies to stop the aging of the park in its tracks becomes a priority objective for this course that we have just launched”.