BorgWarner Inc. (NYSE:BWA) shareholders will doubtless be very grateful to see the share price up 30% in the last quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 21% in that half decade.

The recent uptick of 5.3% could be a positive sign of things to come, so let’s take a look at historical fundamentals.

View our latest analysis for BorgWarner

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

While the share price declined over five years, BorgWarner actually managed to increase EPS by an average of 20% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It’s strange to see such muted share price performance despite sustained growth. Perhaps a clue lies in other metrics.

The modest 1.5% dividend yield is unlikely to be guiding the market view of the stock. In contrast to the share price, revenue has actually increased by 9.9% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

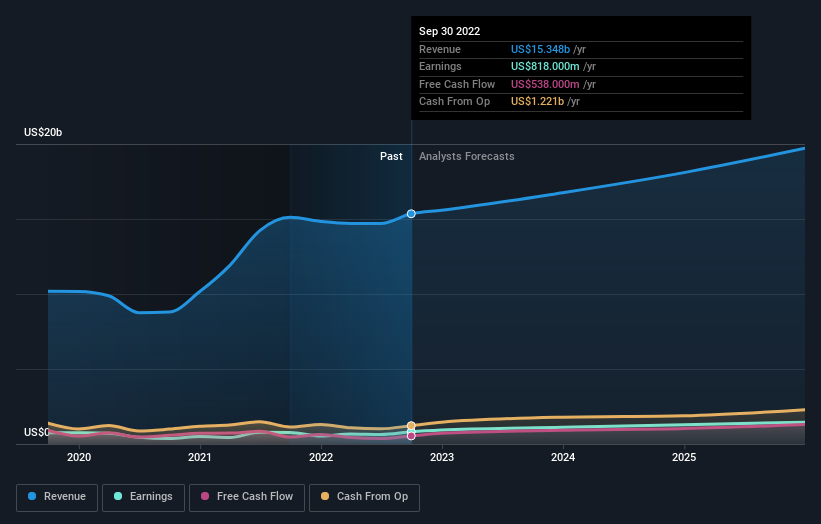

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

BorgWarner is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think BorgWarner will earn in the future (free analyst consensus estimates)

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of BorgWarner, it has a TSR of -14% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While it’s certainly disappointing to see that BorgWarner shares lost 9.1% throughout the year, that wasn’t as bad as the market loss of 15%. Unfortunately, last year’s performance may indicate unresolved challenges, given that it’s worse than the annualised loss of 3% over the last half decade. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don’t forget that Buffett said that ‘turnarounds seldom turn’. It’s always interesting to track share price performance over the longer term. But to understand BorgWarner better, we need to consider many other factors. For instance, we’ve identified 3 warning signs for BorgWarner that you should be aware of.

But note: BorgWarner may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here