Jan 17 (Reuters) – Bitcoin is on the charge in 2023, dragging the crypto market off the floor and electrifying bonk, a new meme coin.

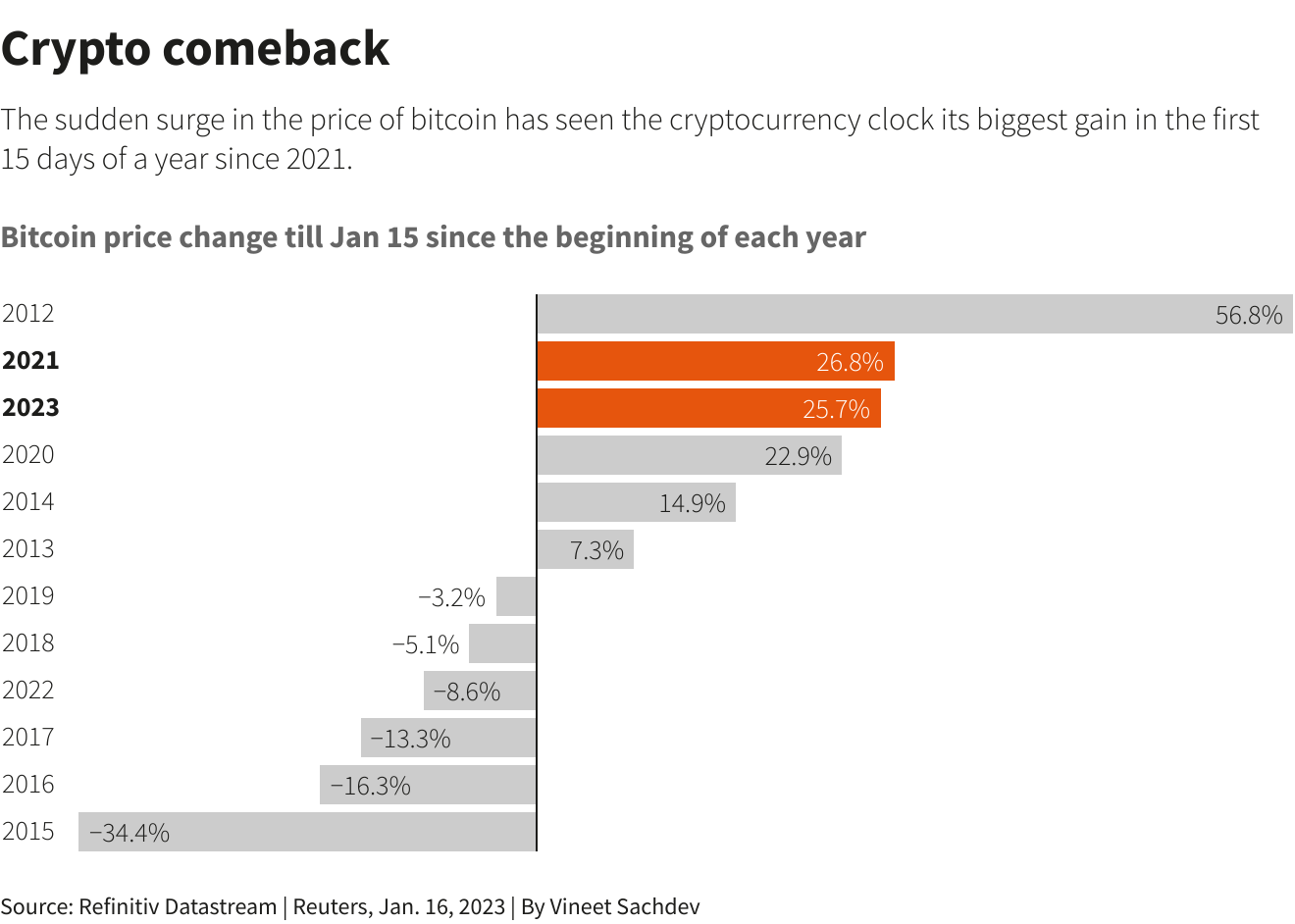

The No.1 cryptocurrency has clocked a 26% gain in January, leaping 22% in the past week alone, breaking back above the $20,000 level and putting in on course for its best month since October 2021 – just before the Big Crypto Crash.

Ether has also risen, by 29% this year, helping drive the value of the overall global cryptocurrency market above $1 trillion, according to CoinGecko.

“After a rough year last year for cryptos, we are seeing a form of mean reversion,” said Jake Gordon, analyst at Bespoke Investment Group, referring to the theory of asset prices returning to long-term averages.

Researchers said investor bets on a rosier macroeconomic picture were driving a jump in riskier assets across the board.

Few crypto tokens have benefited more than bonk, which was launched at the end of December on the Solana blockchain and had rocketed 5,000% by early January. It has since fallen back, though remains up 910% since the start of the year.

It is the latest entrant to the hyper-volatile world of meme coins, cryptocurrencies inspired by online memes and jokes, and is modeled after the same grinning Shiba Inu dog as dogecoin – which itself was catapulted to fame by Elon Musk tweets.

Bonk’s a puppy, though.

Even at its peak it was worth just $0.000004873759 with a market capitalization of about $205 million.

Other meme tokens are also up, with dogecoin and Shiba Inu up 19% and 27% respectively in 2023.

But buyers beware.

“Investors need to be especially cautious when it comes to coins like doge, Shiba Inu and bonk,” said Les Borsai, co-founder of digital assets services firm Wave Financial.

“They fall just as hard as they surge.”

Nonetheless, some market players pointed to the relative cheapness of these tokens – doge is worth about eight cents – as a reason why speculators were willing to place bets on them.

“Meme coins belong to crypto, it’s part of the culture,” said Martin Leinweber, digital assets product specialist at MarketVector Indexes. “It just takes a few lines of codes to create a meme token and if you have a community for it, people love that.”

RUMORS OF SOL’S DEATH EXAGGERATED

Bonk is a meme coin with a mission. It was created, in part, to support the Solana blockchain, which has seen an exodus of funds and users since crypto exchange FTX filed for bankruptcy in November, and its native Solana token drop over 37%.

The Solana token has now indeed jumped as bonk has gained traction: it’s up 131% in 2023, the biggest gainer among major cryptocurrencies.

“Rumors of Solana’s death seem to have been greatly exaggerated,” said Tom Dunleavy, senior research analyst at data firm Messari. “Despite the recent price appreciation seemingly being driven by speculation, the underlying ecosystem remains quite strong.”

TOO EARLY TO CALL A CRYPTO REVERSAL

Some researchers chalked the crypto gains up to optimism that inflation had peaked, reducing the need for tighter central bank policy.

“Bitcoin and crypto tend to front-run everything, which is why we’ve seen notable relative strength in this asset class of late,” said Wave Financial’s Borsai.

There’s certainly been an increase in activity.

The dollar value of bitcoin trading volumes on major exchanges over a 7-day period jumped to $151 million, the highest in nearly two months, according to data from Blockchain.com.

Total bitcoin flows – representing all uses including trading and payments – have increased by 13,130 bitcoin on average in the last 7 days, the largest rise in 64 days, Chainalysis data showed.

However, market watchers warned against celebrating too soon, noting trading volumes remained low and the macroeconomic environment uncertain.

“It’s too early to declare a definitive reversal for the crypto market despite the recent strength we’ve seen of late,” said Aaron Kaplan, co-founder of Prometheum, a digital asset securities trading platform.

“If interest rate increases are below what the market expects, then risk assets will benefit and crypto prices will likely continue the uptrend, but there’s just too much uncertainty right now.”

Reporting by Medha Singh and Lisa Mattackal in Bengaluru; Editing by Pravin Char

Our Standards: The Thomson Reuters Trust Principles.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.