Last week, the European Automobile Manufacturers Association released data for commercial car registrations for December and full-year 2022. The European Union (EU) commercial vehicle market inched down 5.1% last month, representing the 18th straight month of decline as parts shortages continued to weigh on vehicle availability. While registrations in Germany and Spain rose 8.4% and 15.2%, respectively, France and Italy recorded a 14.2% and 8.3% fall in sales. For full-year 2022, commercial vehicle registrations in the EU declined 14.6% to 1.6 million units. Registrations in all the major EU markets witnessed double-digit percentage declines. Sales in France, Spain, Germany and Italy fell 17.7%, 16.7%, 11% and 10.5%, respectively, year over year.

Meanwhile, fourth-quarter 2022 earnings for the auto sector kicked off last week and results have been pretty decent despite industry challenges. Electric vehicle behemoth Tesla TSLA delivered yet another blockbuster show, with fourth-quarter earnings and revenues not just topping estimates but increasing year over year. Trucking giant PACCAR PCAR also delivered a comprehensive beat in the fourth quarter of 2022. Results also witnessed noticeable improvement from the year-ago period. Auto retailer Group 1 Automotive GPI managed to maintain its earnings beat streak courtesy of higher-than-expected profits from its New-vehicle retail and Parts/Service segments. Automotive equipment providers Autoliv Inc. ALV and Gentex Corp. GNTX delivered an earnings beat and miss, respectively. Fourth-quarter revenues of both firms fell shy of estimates.

PACCAR currently carries a Zacks Rank #2 (Buy). While ALV carries a Zacks Rank #3 (Hold), GPI, GNTX and TSLA are #5 (Strong Sell) Ranked.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inside the Headlines

Tesla reported fourth-quarter 2022 earnings of $1.19 a share, up from the year-ago figure of 85 cents and surpassing the Zacks Consensus Estimate of $1.09. This marked an earnings beat for the electric vehicle (EV) behemoth for the eighth time in a row. Higher-than-expected revenues from Energy Generation/Storage and Services/Other segments resulted in this outperformance. Our estimate for the bottom line was 83 cents a share.

Total revenues came in at $24,318 million, witnessing year-over-year growth of 37.2%. The top line also crossed the consensus mark of $23,729 million. Our estimate for revenues was $22,404 million. Tesla reported an overall gross margin of 23.8% for the reported quarter. The operating margin came in at 16%. Tesla had cash and cash equivalents of $22,185 million as of Dec 31, 2022.Long-term debt and finance leases, net of current portion, totaled $1,597 million, down from $5,245 million on Dec 31, 2021. (Tesla Q4 Earnings Beat for the 8th Straight Quarter)

PACCAR posted earnings of $2.64 per share for fourth-quarter 2022, which beat the Zacks Consensus Estimate of $2.23 and rocketed 80% from the year-ago figure. Higher-than-expected pretax income from Trucks, Parts and Financial Services segments resulted in the outperformance. Consolidated revenues (including trucks and financial services) came in at $8,129.5 billion, up from $6,686.1 million recorded in the corresponding quarter of 2021. Sales from Trucks, Parts and Others were $7,734.7 million, which surpassed the consensus mark of $7,036.8 million.

PACCAR’s cash and marketable debt securities amounted to $6,158.9 million as of Dec 31, 2022, compared with $4,813 million on Dec 31, 2021. Capex and R&D expenses for 2023 are envisioned in the band of $525-$575 million and $360-$410 million, respectively. The company declared cash dividends of $4.19 per share in 2022. This included $2.80/share extra cash dividend, which was paid on Jan 5, 2023. PACCAR announced a 50% stock dividend in December and will issue the new shares on Feb 7. (PACCAR Ends 2022 on Strong Note With Q4 Earnings Beat)

Group 1 reported fourth-quarter 2022 adjusted earnings per share of $10.86, beating the Zacks Consensus Estimate of $10.51. The outperformance can be attributed to higher-than-anticipated gross profit from the company’s New-vehicle retail and Parts/Service segments. The bottom line increased 15.1% from the prior-year quarter’s $9.43 per share. The company registered net sales of $4,069 million, beating the Zacks Consensus Estimate of $3,872 million. Also, the top line rose 16.6% from the year-ago quarter’s $3,489.6 million.

Selling, general and administrative expenses were up 7.8% year over year to $453.8 million. Group 1 had cash and cash equivalents of $47.9 million as of Dec 31, 2022, up from $14.9 million as of 2021-end. Total debt was $2,082.5 million as of Dec 31, 2022, up from $2,035.7 million recorded on Dec 31, 2021. During the quarter under review, GPI repurchased 973,365 shares at an average price of $166.14 per common share for a total of $161.7 million. As of Dec 31, 2022, the company had 14.3 million common shares outstanding. (Group 1 Q4 Earnings Surpass Estimates, Rise 15% Y/Y)

Autoliv reported fourth-quarter 2022 adjusted earnings of $1.83 per share, beating the Zacks Consensus Estimate of $1.54. Higher-than-expected revenues from the Airbags and Associated Products segment led to the outperformance. Smart pricing strategies to offset commodity cost woes aided profits. The bottom line also shot up 40% on a year-over-year basis. The company reported net sales of $2,335 million in the quarter, which missed the Zacks Consensus Estimate of $2,403 million. The top line, however, rose 10% year over year.

Autoliv had cash and cash equivalents of $594 million as of Dec 31, 2022, down 39% year over year. Long-term debt totaled $1,054 million, decreasing from $1,662 million as of Dec 31, 2021. During the quarter under review, Autoliv hiked its dividend by 2.7% to 66 cents per share and repurchased 0.65 million shares at an average price of $84.67 per share. The company forecasts full-year 2023 organic sales growth of around 15%. Adjusted operating margin is anticipated within the 8.5-9% range. Operating cash flow is expected at $900 million for 2023. (Autoliv Q4 Earnings Beat on Pricing, Dividend Up)

Gentex reported fourth-quarter 2022 earnings of 37 cents per share, marginally missing the Zacks Consensus Estimate of 38 cents but up 5.7% from 35 cents recorded in the year-ago quarter. This Zeeland-based automotive products supplier reported net sales of $493.6 million, falling short of the Zacks Consensus Estimate of $496 million but increasing 18% from the year-ago period. The company recorded a gross margin of 31.2%, lower than the year-ago quarter’s 34.3%.

Gentex had cash and cash equivalents of nearly $215 million as of Dec 31, 2022, down from $262.3 million as of Dec 31, 2021. For the first half of 2023, Gentex remains concerned about continued margin pressure. It expects impeding effects from supply and labor constraints to potentially hinder global light vehicle production growth rates. Gentex’s 2023 net sales are estimated to be $2.2 billion. The gross margin is projected in the band of 32%-33%. Capital expenditure is anticipated within $200-$225 million. Operating expenses are estimated in the band of $260-$270 million. (Gentex Misses Q4 Earnings Estimates by a Whisker)

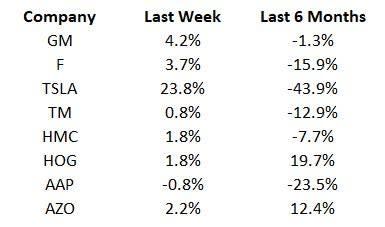

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on U.S. vehicle sales data for January. Investors are also awaiting the quarterly releases of a host of auto biggies which are reporting this week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report