The soaring popularity of green vehicles is proving to be a major boon for the Zacks Automotive – Foreign industry. Sales of electric vehicles (EVs) are witnessing a massive jump in most countries amid heightening climate concerns. Despite economic worries, vehicle sales in major car markets, including China, Europe and India, are expected to grow year over year in 2023. Commodity inflation and escalating operating expenses remain a concern for the automakers, but the overall prospects of the industry look upbeat. Encouragingly, the valuation of the industry is also supportive, trading at a discount to both S&P 500 and the broader auto sector. Industry participants like BYD Co. BYDDY, Volkswagen AG VWAGY and BMW AG BAMXF are worth betting on.

Industry Overview

Companies in the Zacks Automotive – Foreign industry are involved in designing, manufacturing and selling vehicles, components as well as production systems. The foreign automotive industry is highly dependent on business cycles and economic conditions. China, Japan, Germany and India are some of the key foreign automotive manufacturing countries. The widespread usage of technology is resulting in a fundamental restructuring of the market. Stricter emission and fuel-economy targets and ramp-up of charging infrastructure as well as supportive government policies are boosting sales of green vehicles. With almost all firms intensifying their electrification game, competition is getting tougher with each passing day. Foreign automakers are now actively engaged in the R&D of electric and autonomous vehicles, fuel efficiency along with low-emission technologies.

Key Themes Shaping the Industry’s Fate

EVs Serving as a Major Catalyst: Various cities and nations are pushing toward green energy amid heightening climate concerns. The European Commission is set to phase out new petrol and diesel cars by 2035. China intends to ban fossil fuel cars and sell only new energy vehicles by 2035. Japan will scrap the sale of gasoline-powered cars by the mid-2030s. California will ban the sale of new ICE cars effective 2035 and ensure that 100% of new car and truck sales are electric by 2035 and 2045, respectively. The acceleration of EV targets is offering opportunities to automakers. With consumers’ confidence in EVs rising fast, automakers are prioritizing their resources toward the sale of new energy vehicles, and sales of green vehicles are rocketing. Last year, global sales of EVs jumped roughly 70% year over year to 7.8 million vehicles, accounting for 10% of all new cars sold in 2022. Per S&P Global Mobility forecasts, around 10 million EV units will be sold in 2023, accounting for 14% of the total new vehicle sales.

China Vehicle Market Fending off Challenges: Vehicle sales in China, the world’s largest car market, witnessed the second straight year of growth in 2022. Auto sales managed to maintain momentum last year even in the face of COVID resurgences, commodity inflation, chip crunch and supply chain snarls. According to the China Association of Automobile Manufacturers, a total of 26.86 million vehicles were sold in the country last year, marking a 2.1% increase from the 2021 level. Importantly, sales of EVs almost doubled last year, hitting a record high. Despite the COVID-19 resurgence in the country and economic concerns, Cui Dongshu — Secretary-General of China Passenger Car Association — believes that China could see around 1% in annual growth in its car market in 2023, with fewer sales in the earlier months before they pick up speed toward the end of the year. Sales of new energy vehicles in China are expected to grow 30% year over year.

European Market on the Recovery Track: Per the European Automobile Manufacturers Association (“ACEA”), the European Union passenger vehicle market rose 12.8% last month to 896,967 units, marking the fifth straight month of growth. However, for full-year 2022, new car registrations contracted 4.6% to 9,255,930 units, owing to supply chain snarls and chip concerns, largely in the first half of the year. Encouragingly, ACEA envisions sales of new cars in Europe to recover in 2023 notwithstanding the broader economic uncertainty. Sales are expected to rise roughly 5% year over year to reach 9.8 million vehicles in 2023.

India Outstrips Japan as the 3rd Largest Market: India’s auto industry posted its highest-ever vehicle sales last year, overtaking Japan to become the third-largest vehicle market in 2022. Per the Society of Indian Automobile Manufacturers, more than 3.79 million units of passenger vehicles were sold in India in 2022, up roughly 23% year over year. India is hopeful that the growth momentum will sustain this year. In terms of output, India retains its fourth spot. For the first time, it manufactured more than 5 million vehicles in 2022. Per S&P Global Mobility, India’s light vehicle production is expected to grow 5-8% on a yearly basis in 2023.

Cost Headwinds Prevail: The Russia-Ukraine war has triggered a second round of global microchip shortage and supply chain disruptions. Although supply chain snarls are gradually abating, they are far from over. Industry participants are battling high commodity, freight, fuel and logistics costs. Moreover, aggressive EV spending might put near-term operating margins and cash flow under pressure. While the ramp-up of EV targets will offer opportunities to automakers, it will also escalate capex and R&D expenses as they transition from gas-powered models.

Zacks Industry Rank Indicates Solid Prospects

The Zacks Automotive – Foreign industry is a 27-stock group within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #60, which places it in the top 24% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates decent near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential.

Before we present a few stocks that investors can buy given their solid potential, let’s look at the industry’s recent stock market performance and current valuation.

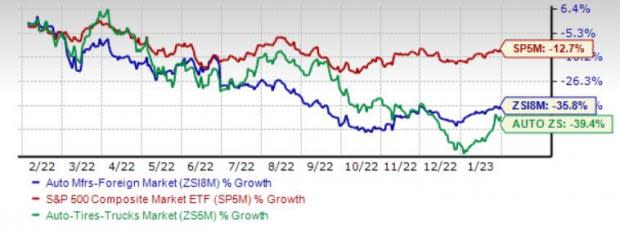

Industry Lags S&P 500, Tops Sector

The Zacks Automotive – Foreign industry has outperformed the Auto, Tires and Truck sector but underperformed the Zacks S&P 500 composite over the past year. The industry has lost 35.8% compared with the S&P 500 and the sector’s decline of 12.7% and 39.4%, respectively.

One-Year Price Performance

Industry’s Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

Based on trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 9.66X compared with the S&P 500’s 12.33X and the sector’s 12.9X.

Over the past five years, the industry has traded as high as 10.91X, as low as 5.61X and at a median of 7.82X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

3 Stocks to Ride On

Volkswagen: Germany-based Volkswagen delivered on its NEW AUTO Strategy in 2021, enhancing the resilience of its business model in a tough macro-environment and laying the foundation for future growth. While the company’s overall deliveries in 2022 contracted 7% year over year, the company made a considerable progress in the electrification domain. It delivered 572,100 all-electric vehicles last year, up 26% from 2021. The company remains the BEV leader in Europe. Volkswagen has set aside 89 billion euros (a little more than $100 billion) for the development of EVs and future technologies by 2026. By 2026, the company expects green cars to account for 25% of total vehicle sales. Volkswagen expects half of the global vehicle sales to consist of battery-powered EVs by 2030, setting ambitious goals in an era of green transportation.

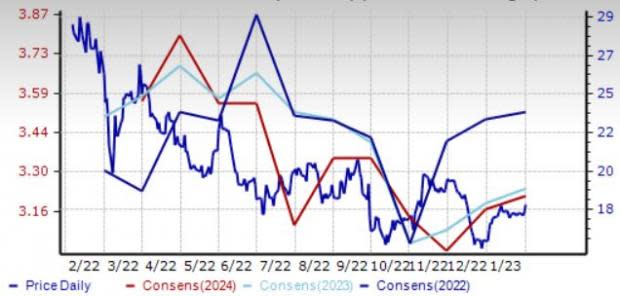

VWAGY currently sports a Zacks Rank #1 (Strong Buy). The consensus mark for 2023 sales implies year-over-year growth of 2%. The Zacks Consensus Estimate for 2023 earnings has been upwardly revised by 5 cents over the past seven days to $3.24 per share.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price & Consensus: VWAGY

BMW AG: Germany-based BMW AG is one of the leading multi-brand automobile manufacturers that focuses on the premium segments of the worldwide automobile and motorcycle markets. BMW AG is taking great strides in electrification and expects EVs to account for 50% of its global sales by 2030. By 2025, the carmaker expects to sell more than two million all-electric vehicles. Sales of BMW AG’s fully-electric vehicles more than doubled to 215,755 units in 2022. The auto biggie has pledged to invest around €30 billion toward e-mobility by 2025 end. It intends to build five gigafactories for electric car batteries through partnerships, strategically positioned globally at places where the auto biggie manufactures its EVs.

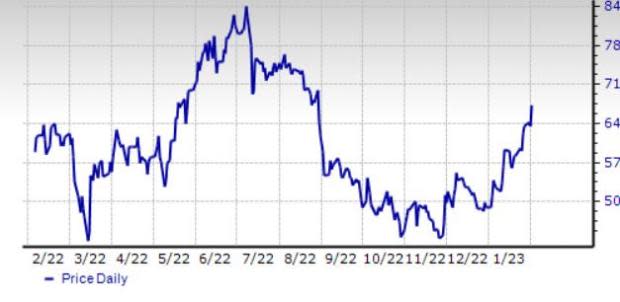

BMW AG currently sports a Zacks Rank #1. The Zacks Consensus Estimate for 2023 earnings has been upwardly revised by 43 cents over the past seven days to $14.96 per share. The consensus mark for 2023 sales implies year-over-year growth of 2.3%.

Price & Consensus: BAMXF

BYD: China-based BYD is principally engaged in the research, manufacture, and distribution of automobiles, secondary rechargeable batteries as well as mobile phone components. The company stands to benefit from the robust demand for green vehicles and batteries in China. The firm’s rechargeable battery business provides lithium-ion and nickel batteries that are essential for the development of green vehicles. The rising deliveries of Han and Tang models are driving BYD’s top line. Solid execution capabilities and expansion efforts will further fuel the stock. In 2022, the company sold 1.86 million EVs, up a whopping 209% year over year. BYD estimates 2022 net income to jump more than 450% to 17 billion yuan or $2.5 billion.

BYD currently carries a Zacks Rank #2 (Buy). The consensus mark for 2023 earnings and sales implies year-over-year growth of 42% and 32%, respectively. The Zacks Consensus Estimate for 2023 earnings has been upwardly revised by 4 cents over the past seven days to $1.97 per share.

Price & Consensus: BYDDY

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Bayerische Motoren Werke AG (BAMXF) : Free Stock Analysis Report

Volkswagen AG Unsponsored ADR (VWAGY) : Free Stock Analysis Report