CRA International, Inc., which conducts business as Charles River Associates CRAI, reported lower-than-expected fourth-quarter fiscal 2022 results. The company also revealed a below par revenue guidance for 2023.

The below par results and the tepid guidance naturally disappointed investors. Consequently, the stock plummeted 11.4% since the earnings release on Mar 2.

What did the Q4 Earnings Report Unveil

Non-GAAP EPS came in at $1.19, missing the Zacks Consensus Estimate by 15%. However, the quarterly earnings increased 4.4% from the year-ago fiscal quarter’s reported number. Revenues of $145 million also missed the Zacks Consensus Estimate by 2.4% but increased 7.6% from the year-ago fiscal quarter’s reported figure.

Charles River delivered 74% utilization, while headcount was up by 9.1% from the year-earlier fiscal quarter’s reported number. Non-GAAP EBITDA decreased 4% from the prior-year fiscal quarter’s reading to $14.6 million. Non-GAAP EBITDA margin plunged 120 basis points from the year-ago fiscal quarter’s reported number to 10.1%.

CRAI exited the quarter with $31.4 million cash compared with $24.1 million witnessed at the end of the prior fiscal quarter. Charles River used cash worth $60.14 million in operating activities, while capex was $8.1 billion. In the quarter, CRAI paid out $2.72 million of dividends.

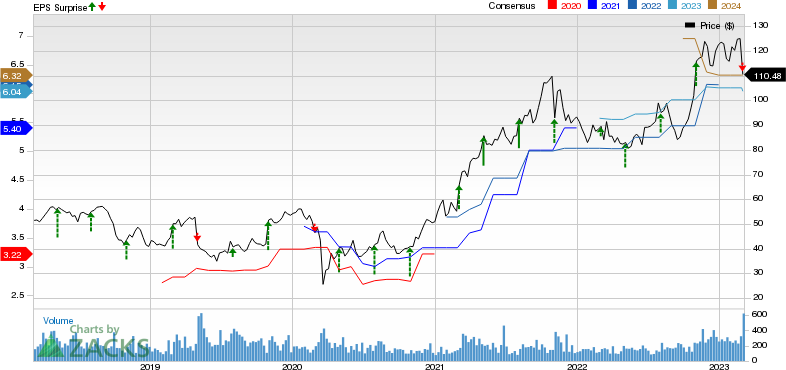

Charles River Associates Price, Consensus and EPS Surprise

Charles River Associates price-consensus-eps-surprise-chart | Charles River Associates Quote

Moreover, CRAI’s board of directors expanded the company’s existing share repurchase program, under which $22.9 million currently remains, by $20 million.

2023 Guidance

For 2023, on a constant currency basis relative to fiscal 2022, Charles River expects its revenues between $615 million and $640 million. The midpoint of the guided range ($627.5 million) is however pegged below the Zacks Consensus Estimate of $630.29 million.

CRAI expects non-GAAP EBITDA margin to be in the range of 10.8-11.5%. Currently, Charles River carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

The following stocks from the Business Service sector reported better-than-expected fourth-quarter results.

Gartner, Inc. IT, currently carrying a Zacks Rank #3 (Hold), reported better-than-expected fourth-quarter 2022 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings (excluding 49 cents from non-recurring items) per share of $3.70 beat the Zacks Consensus Estimate by 44% and increased 23.8% year over year. IT’s revenues of $1.5 billion beat the Zacks Consensus Estimate by 2.6% and improved 15.2% year over year on a reported basis and 20% on a foreign-currency-neutral basis.

Aptiv PLC APTV, currently carrying a Zacks Rank of 3, reported better-than-expected fourth-quarter 2022 results. Adjusted earnings (excluding 41 cents from non-recurring items) of $1.27 per share beat the Zacks Consensus Estimate by 6.7% and increased more than 100% on a year-over-year basis. APTV’s revenues surpassed the Zacks Consensus Estimate by 6% and increased 12.2% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report