China Association of Automobile Manufacturers (CAAM) released vehicle sales data for February. Vehicle sales in China rose 13.5% year over year to 1.97 million units last month. Meanwhile, sales for the first two months of 2023 contracted 15.2% year on year. Sales of new energy vehicles (NEVs) soared around 56% year over year to 525,000 units in February. Sales of NEVs for the first two months of 2023 totaled 933,000 units, up 21% on a year-over-year basis.

On the news front, recreational vehicle maker Thor Industries THO released its quarterly results. It delivered dismal results, snapping its beat streak. The earnings and revenues not just fell short of estimates but also declined from the year-ago levels. Auto equipment provider Magna International MGA launched senior notes offerings, the proceeds of which would be used for partially funding the Veoneer buyout and also for general corporate purposes. Meanwhile, U.S. legacy automaker General Motors GM has offered a voluntary buyout to the majority of its U.S. employees to slash structural costs over the next two years. Close peer Ford F plans to cut 1,100 jobs at its plant in Valencia, Spain, amid changes in the production lineup in Europe.

GM and MGA carry a Zacks Rank #3 (Hold). While F is a #4 Ranked (Sell) stock, Thor carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Last Week’s Top Stories

Thor posted second-quarter 2023 adjusted earnings of 50 cents per share, which lagged the Zacks Consensus Estimate of $1.10 per share. This underperformance can be largely attributed to lower-than-anticipated revenues from the North American Towable RVs and North American Motorized RVs segments. The bottom line declined a massive 89.5% from the year-ago profit of $4.79 per share. The company registered revenues of $2,347 million for the quarter under review, missing the Zacks Consensus Estimate of $2,531 million. The top line also declined 39.4% year over year.

As of Jan 31, 2023, Thor had cash and cash equivalents of $281.6 million and long-term debt of $1,758.5 million. Thor now projects its full-year consolidated net sales in the range of $10.5-$11.5 billion, down from the prior guided range of $11.5-$12.5 billion. The consolidated gross profit margin is now expected to be in the range of 13.4-14.2%, down from the previous forecast of 14.2-14.9%. Earnings per share are now expected to be in the range of $5.50-$6.50, down from the previously projected range of $7.40-$8.70. (Thor’s Q2 Earnings Miss Estimates, Revenues Shrink Y/Y)

Magna announced plans to offer two series of U.S. dollar-denominated senior notes and one series of euro-denominated senior notes. The company will raise $300 million through Series 1 U.S. dollar senior notes, $500 million through Series 2 U.S. dollar senior notes and €550 million through euro senior notes. It will utilize the proceeds from the U.S. dollar senior notes to fund a portion of its impending Veoneer Active Safety Business Acquisition, pay related expenses and for general corporate purposes, including the repayment of existing indebtedness. The proceeds from the euro senior notes will be utilized for general corporate purposes, including repayment of its existing indebtedness.

The offerings of U.S. dollar senior notes and euro senior notes are expected to end on Mar 21, 2023 and Mar 17, 2023, respectively. In case the Veoneer Acquisition is not completed on or prior to Dec 19, 2023, or the equity purchase agreement gets terminated, Magna must redeem all the outstanding notes at a redemption price of 101% of the principal amount of the notes, along with accrued and unpaid interest. (Magna Announces U.S. Dollar & Euro Senior Notes Offerings)

General Motors will offer Voluntary Separation Program to the majority of its 58,000 U.S. employees who have spent five or more years in the company as of Jun 30, 2023. Outside the United States, the buyouts will be offered to executives who have spent at least two years in the company. According to the letter sent to employees from GM CEO Mary Barra on Thursday, the aim of the program is to slash $2 billion in structural costs by the end of 2024.

GM also stated, “By permanently bringing down structured costs, we can improve vehicle profitability and remain nimble in an increasingly competitive market.” According to a public filing, the legacy automaker expects a pretax charge of $1.5 billion related to the separation program. The major chunk of charges is expected to be all-cash and will take place during the first half of the year. (General Motors Offers Voluntary Buyout to Reduce Costs)

Ford announced plans to slash 1,100 jobs in Valencia, Spain. The company plans to discontinue the production of the S-Max and Galaxy in its plant at Valencia in April to shift its focus toward the profitable SUV and van segments. This shift in the production lineup is cited as a reason for job cuts by the company’s spokesperson.Ford currently builds the Kuga compact SUV and Transit Connect compact van in Valencia, after winding up the production of the Mondeo midsize car in Valencia last year.

Ford plans to unveil a full-electric vehicle for Europe later this month. The production of the model will start in Ford’s factory in Cologne, Germany. The production of EV will replace the production of Fiesta cars in Cologne. Ford is also planning to discontinue the production of the Focus compact car in 2025 in its factory at Saarlouis, Germany and is looking for a factory buyer. Last year, the company discussed its plan to build next-generation EVs in Valencia and said it will start the production of the vehicles later this decade. (Ford Announces Layoff of 1,100 Employees From Spain)

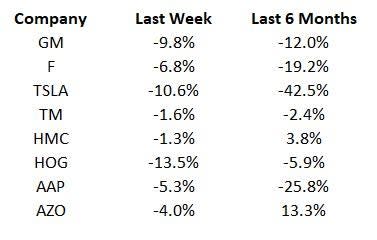

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will keep a tab on February 2023 passenger vehicle registrations to be released by the European Automobile Manufacturers Association soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Thor Industries, Inc. (THO) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report