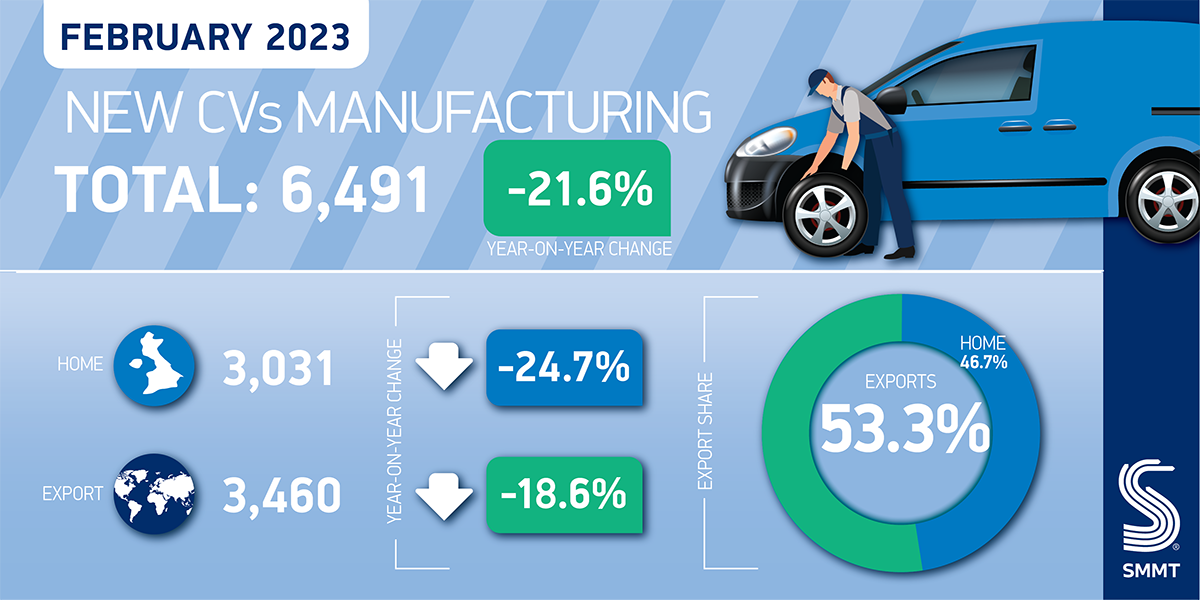

- British CV production falls -21.6% to 6,491 units after 11 months of consecutive growth in 2022, excluding December, and strong January performance.

- Export volumes drop by -18.6%, while output for the UK declines by -24.7% as supply chain constraints affect output.

- Production output rises 4.3% in year to date thanks to best January performance since 2012, with further growth recorded in both export and domestic markets.

UK commercial vehicle (CV) production fell by -21.6% in the second month of the year, with 6,491 vans, trucks, taxis, buses and coaches leaving factory lines, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT). The decline follows a large rise in February last year and, last month, the best January performance in a decade, but supply chain constraints restricted production in February.

February saw the number of CVs produced for overseas markets decrease by -18.6% to 3,460 units – with some 90.3% destined for the EU.1 Output for the domestic market fell more steeply, down -24.7% to 3,031 units. The decline is expected to be temporary as volumes are set to increase significantly over the full year, notably so once a major new electric van plant comes on stream.

In the year to date, 15,790 units have been built, up 4.3% on the first two months of 2022, thanks to a high performing January. The export and domestic markets also benefitted from the strong result, increasing 7.2% and a more marginal 0.9% respectively this year.

Mike Hawes, SMMT Chief Executive, said,

Following last year’s strong growth and a bumper start to 2023, February’s decline in commercial vehicle output is disappointing. The fall should, however, be temporary as additional production begins later in the year. UK automotive manufacturers continue to show resilience against persistent supply chain and economic challenges and will push to deliver the latest and cleanest CVs to customers at home and abroad. But success isn’t yet guaranteed, so we look now to government to provide a framework of measures that boost the industry’s long-term competitiveness and encourage inward investment to drive electrification for this vital sector.

Notes to editors

1 UK exports to the EU: 3,123 units.