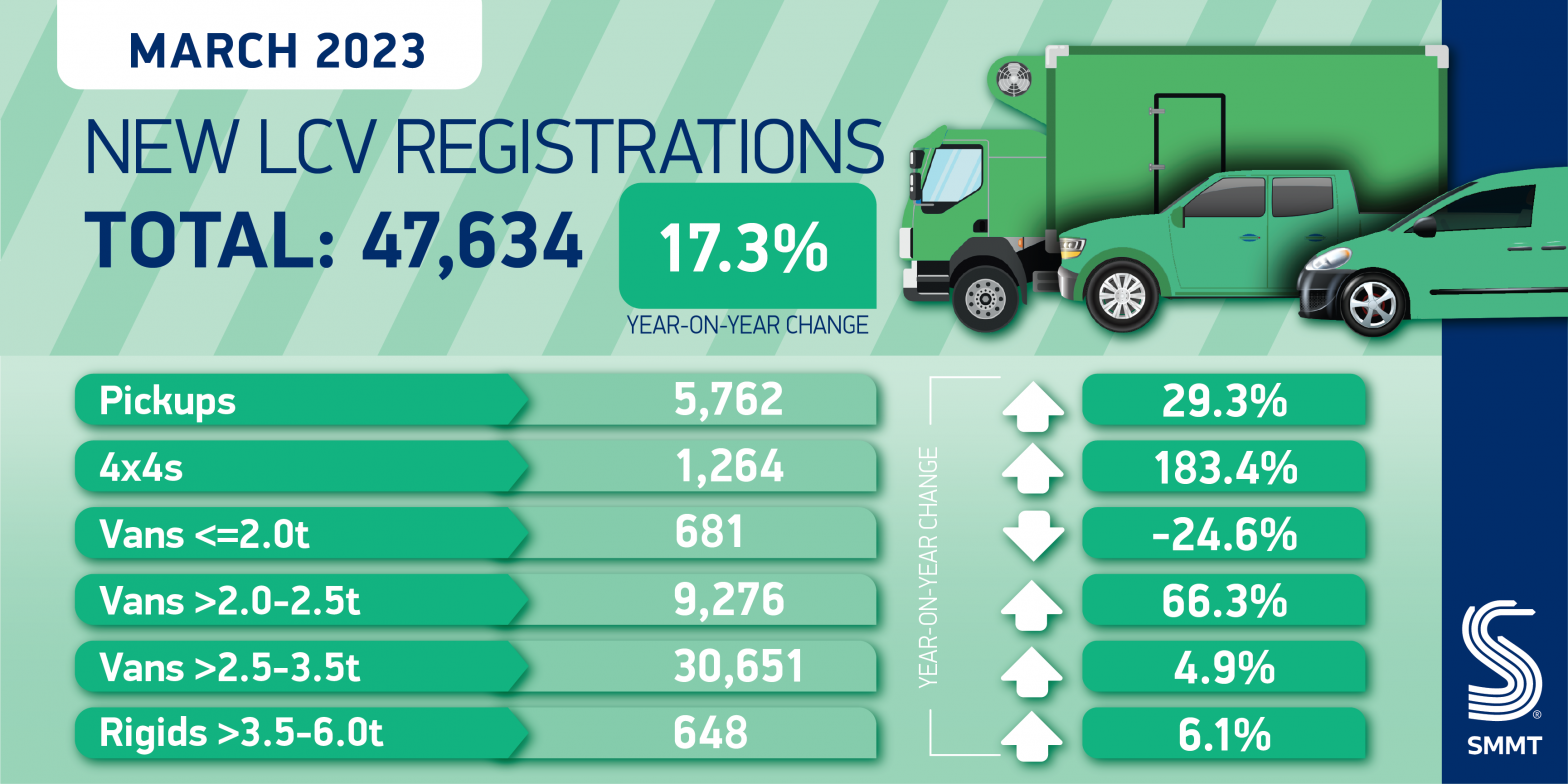

- Light commercial vehicle (LCV) registrations rise by 17.3% to 47,634 units in third month of successive growth.

- Registrations increase across majority of segments, primarily driven by mid-size vans and 4x4s, up 66.3% and 183.4% respectively.

- YTD market grows 17.4% to 87,272 units but remains -15.1% below pre-pandemic 2019 Q1 as erratic supply chain issues continue.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new light commercial vehicle (LCV) market grew for the third consecutive month in March, rising by 17.3% to 47,634 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Traditionally a large volume month due to the new number plate, the growth was amplified by comparison with a weak March last year, when chronic supply chain shortages drove the market down by -27.6%.1

Demand was up across all segments, apart from vans weighing up to and including 2.0 tonnes, down -24.6%, reflecting broader trends which favour larger units. The second most popular weight class, vans weighing greater than 2.0 to 2.5 tonnes, rose by two thirds to 66.3%. Registrations of vans weighing greater than 2.5 to 3.5 tonnes increased marginally by 4.9%, as market share declined to 64.3%. Double digit growth did, however, continue in the smaller volume pickup and 4×4 utility segments, however, rising by 29.3% and some 183.4% respectively.

As a result, 87,272 light commercial vehicles have been registered in the first quarter of 2023, up 17.4% against Q1 last year, in the best start to the year since 2021’s 97,356 units.2 However, despite the rise in demand, the quarter remains -15.1% off pre-pandemic 2019.3

Deliveries of battery electric vans continued to grow, up by 32.7% as an increasing choice of models makes switching to zero emission vehicles more compelling. Infrastructure remains the biggest barrier to uptake, however, with a paucity of charging points that are both suitable in size and location for van use. The publication last week of a Zero Emission Vehicle Mandate will compel a rapid increase in the sale of zero emission vans and is due to come into force in less than nine months. Infrastructure providers must therefore use the certainty this provides and catch up with the commitments made by vehicle manufacturers by investing now in infrastructure that gives more operators the confidence to transition.

Mike Hawes, SMMT Chief Executive, said,

A solid first quarter of growth for the van market is a positive outcome, given the importance of vans in keeping Britain’s businesses on the move. These working vehicles are also essential in helping Britain decarbonise, so all barriers to uptake must be removed to accelerate fleet renewal. The most important requirement now is the urgent development of widespread and dependable van-suitable charging infrastructure to bolster operator confidence to make the switch.

Notes to editors

1 UK LCV registrations, March 2022: 40,613 units, compared with 56,122 in March 2021

2 UK LCV Q1 registrations 2022: 74,344 units

3 UK LCV Q1 registrations 2019: 102,743 units