When we’re researching a company, it’s sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. A business that’s potentially in decline often shows two trends, a return on capital employed (ROCE) that’s declining, and a base of capital employed that’s also declining. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. In light of that, from a first glance at Adient (NYSE:ADNT), we’ve spotted some signs that it could be struggling, so let’s investigate.

Understanding Return On Capital Employed (ROCE)

If you haven’t worked with ROCE before, it measures the ‘return’ (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Adient:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

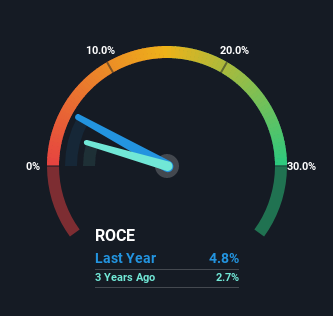

0.048 = US$281m ÷ (US$9.3b – US$3.4b) (Based on the trailing twelve months to December 2022).

Thus, Adient has an ROCE of 4.8%. In absolute terms, that’s a low return and it also under-performs the Auto Components industry average of 12%.

See our latest analysis for Adient

In the above chart we have measured Adient’s prior ROCE against its prior performance, but the future is arguably more important. If you’d like to see what analysts are forecasting going forward, you should check out our free report for Adient.

The Trend Of ROCE

The trend of ROCE at Adient is showing some signs of weakness. The company used to generate 8.1% on its capital five years ago but it has since fallen noticeably. In addition to that, Adient is now employing 32% less capital than it was five years ago. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. If these underlying trends continue, we wouldn’t be too optimistic going forward.

What We Can Learn From Adient’s ROCE

In short, lower returns and decreasing amounts capital employed in the business doesn’t fill us with confidence. Investors haven’t taken kindly to these developments, since the stock has declined 37% from where it was five years ago. With underlying trends that aren’t great in these areas, we’d consider looking elsewhere.

If you’re still interested in Adient it’s worth checking out our FREE intrinsic value approximation to see if it’s trading at an attractive price in other respects.

While Adient may not currently earn the highest returns, we’ve compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here