BorgWarner Inc. BWA reported adjusted earnings of $1.09 per share for first-quarter 2023, up from $1.05 recorded in the prior-year quarter. But the bottom line fell short of the Zacks Consensus Estimate of $1.13 per share on weaker-than-expected sales. The automotive equipment supplier reported net sales of $4,180 million, which missed the Zacks Consensus Estimate of $4,214 million. The top line, however, increased 7.9% year over year.

BorgWarner currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

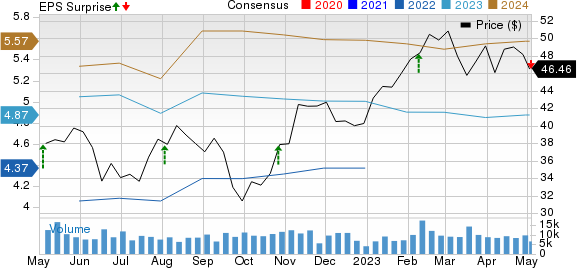

BorgWarner Inc. Price, Consensus and EPS Surprise

BorgWarner Inc. price-consensus-eps-surprise-chart | BorgWarner Inc. Quote

Segmental Performance

Air Management: Net sales totaled $1,979 million in the reported quarter compared with $1,738 million in the year-ago period. The sales figure surpassed the Zacks Consensus Estimate of $1,939 million. Adjusted operating income of $285 million rose from $251 million recorded in the year-ago quarter and topped the consensus metric of $273 million.

Drivetrain & Battery Systems: Net sales totaled $955 million in the reported quarter compared with $895 million in the year-ago period. Adjusted operating income of $110 million inched down from $113 million recorded in the year-ago quarter.

e-Propulsion: Sales from the segment were $487 million, up from $440 million a year ago. The segment incurred an adjusted operating loss of $34 million, wider than $17 million in the corresponding period of 2022.

Fuel Systems: Sales from the segment totaled $568 million, down from $591 million generated in the year-ago quarter. The metric also fell short of the consensus estimate of $626 million. The segment generated an adjusted operating income of $48 million, down from $66 million recorded in the corresponding period of 2022 and lagging the consensus mark of $69 million.

Aftermarket: Sales from the segment totaled $330 million, up from $307 million in the year-ago quarter. The figure, however, lagged the Zacks Consensus Estimate of $344 million. The segment generated an adjusted operating income of $45 million, up from $39 million and ahead of the consensus mark of $39.5 million.

Financial Position

In the January-March quarter, BorgWarner had $950 million in cash/cash equivalents/restricted cash compared with $1,338 million as of Dec 31, 2022. In the March quarter, long-term debt was $4,175 million, up from $4,166 million recorded on Dec 31, 2022.

Net cash used in operating activities was $12 million in the quarter under review. Capital expenditures and FCF totaled $278 million and negative $290 million, respectively.

2023 Projections

For full-year 2023, the company anticipates net sales within $17.1-$17.9 billion, indicating year-over-year growth of 7.5-12.5%. Importantly, BorgWarner envisions electric vehicle revenues of around $1.5 billion-$1.8 billion for 2023, up from $870 million in 2022.

Adjusted operating margin is expected in the band of 10-10.4%. Adjusted net earnings are estimated to be within $4.60-$5.15 per share. Free cash flow is projected in the band of $550-$650 million.

Key Releases From the Auto Space

Tesla TSLA reported first-quarter 2023 earnings of 85 cents per share, down from the year-ago figure of $1.07 but outpaced the Zacks Consensus Estimate of 83 cents. This marked the ninth straight quarter of earnings beat for the electric vehicle behemoth. Higher-than-expected revenues from its Energy Generation/Storage and Services/Other segments resulted in this outperformance.

Total revenues came in at $23,329 million, recording year-over-year growth of 24%. However, the top line missed the consensus mark of $23,472 million. Tesla reported an overall gross margin of 19.3% for the reported quarter. The operating margin came in at 11.4%. Management stuck to its target of around 50% growth in deliveries in the foreseeable future. For 2023, it expects deliveries to reach 1.8 million units.

General Motors GM reported first-quarter 2023 adjusted earnings of $2.21 per share, surpassing the Zacks Consensus Estimate of $1.64. Higher-than-expected operating profits from GMNA, GMI and Financial segments led to the outperformance. The bottom line also rose from the year-ago quarter’s earnings of $2.09 per share.

Revenues of $39,985 million beat the Zacks Consensus Estimate of $38,677.9 million and increased from $35,979 million recorded in the year-ago period. However, the company recorded an adjusted EBIT of $3,803 million, lower than $4,044 million in the prior-year quarter. The automaker’s share in the GM market was 8.6% in the reported quarter, down from the year-ago quarter’s 9%.

PACCAR’s PCAR earnings of $2.25 per share for first-quarter 2023 beat the Zacks Consensus Estimate of $1.82 and rocketed 95.6% from the year-ago figure. Higher-than-expected pretax income from Trucks, Parts and Financial Services segments resulted in the outperformance. Consolidated revenues (including trucks and financial services) came in at $8,473.3 million, up from $6,472.6 million recorded in the corresponding quarter of 2022.

PACCAR’s cash and marketable debt securities amounted to $5,922.2 million as of Mar 31, 2023, compared with $6,158.9 million on Dec 31, 2022. The company paid cash dividends of 25 cents per share during the reported quarter. Capex and R&D expenses for 2023 are envisioned in the band of $600-$650 million and $380-$420 million, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report