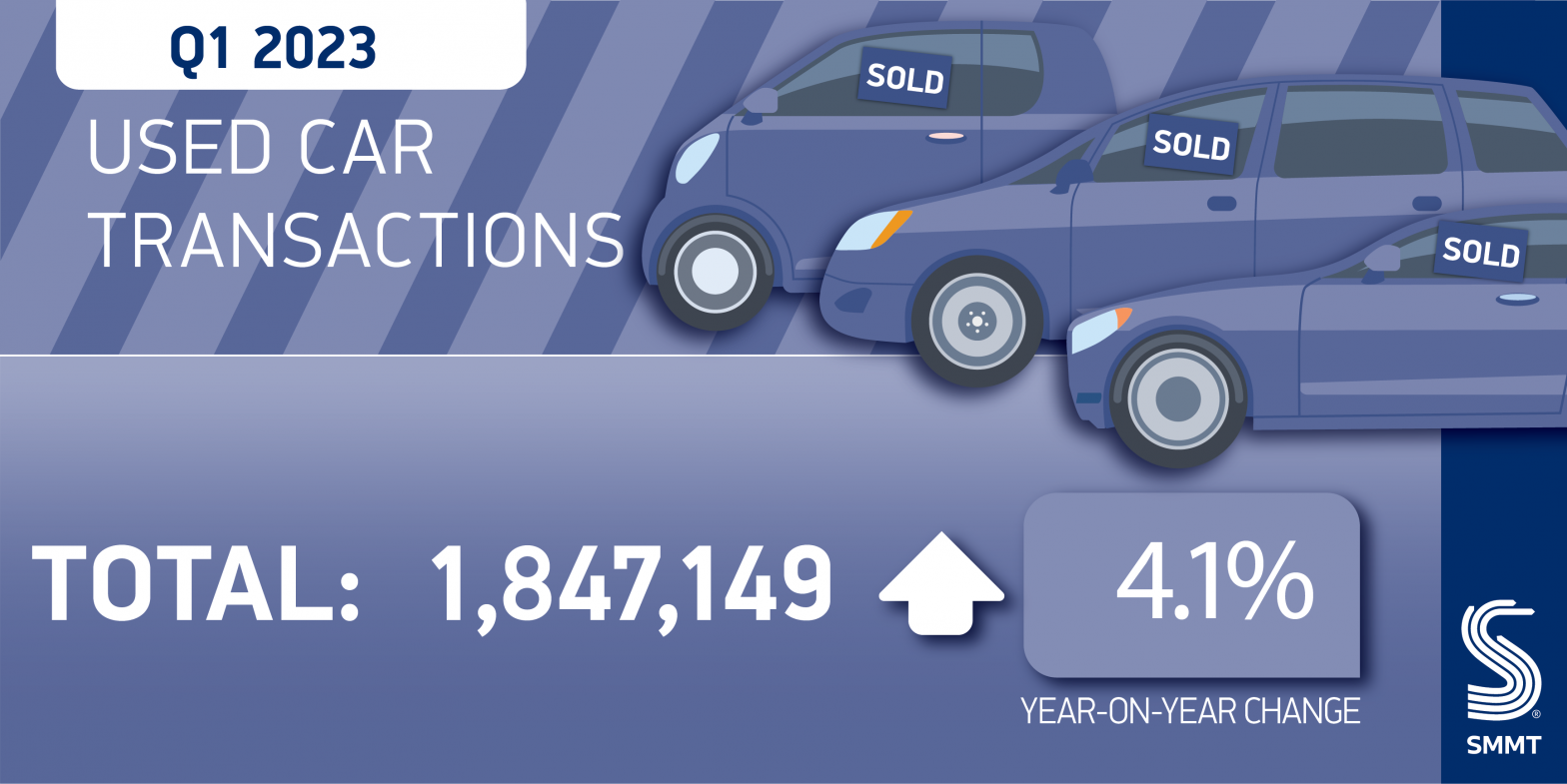

- UK used car market grows 4.1% in Q1 2023 after three successive quarters of decline.

- Best start to a year since 2020, but market remains below pre-pandemic levels.

- BEV sales up 56.5% as 26,257 change hands, representing 1.4% of the market in Q1.

Download the used car sales report for Q1 2023

The UK’s used car market grew 4.1% in the first quarter of 2023 following three successive quarters of decline, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 1,847,149 transactions took place, with 72,798 additional cars changing hands compared with the same period in 2022, as growth in the new car market improved availability.

In the best start to a year since 2020, used car sales posted robust growth in each month as demand continued to recover post-pandemic, with rises of 3.6% in January, 4.4% in February and 4.3% in March. However, Q1 transactions remain -8.6% below pre-pandemic levels, reflecting the ongoing impact of supply challenges and consumer sentiment in light of the economic backdrop.

Battery electric vehicles (BEVs) were the fastest growing powertrain, with transactions rising 56.5% to 26,257 units, representing 1.4% of the market – up from 0.9% last year. Plug-in hybrids (PHEVs) also changed hands in greater volumes, rising 13.9% to 16,006 units. As a result, plug-ins comprised 2.3% of sales, up from 1.7% last year as increasing numbers of zero emission vehicles entered the second-hand market. Hybrids (HEVs) also grew, by 38.2% to 49,182 units.

While demand for used electrified vehicles continues to grow, conventional powertrains remain dominant, with petrol transactions rising 4.5% to 1,048,015 units and diesel sales up marginally by 0.2% to 706,282 units. Combined, ICE cars accounted for 95.0% (1,754,297 units) of the market, a fall of 1.2 percentage points on last year.

Superminis remained the most popular vehicle type at almost 600,000 transactions. However, despite posting volume growth of 3.3%, market share slipped to 32.3%.1 Rounding off the top three vehicle types were lower medium, at 26.5% of the market, and dual purpose, with a 15.5% share – after recording the largest volume growth, at 15.1%. The three segments accounted for almost three quarters of all cars sold (74.3%). At the other end of the scale, luxury saloons recorded the steepest fall, at -7.3%.

Black was once again the most popular used car colour, equating to more than a fifth (21.4%) of sales. Grey, last year’s most popular colour for new cars, took second place, knocking blue back into third. Silver/aluminium – once top of the podium – as well as green and beige were the only colours to decline in the top 10 ranking fourth, seventh and 10th and falling by -1.8%, -2.3% and -0.7% respectively.

Mike Hawes, SMMT Chief Executive, said,

Easing supply chain challenges have reenergised new car registrations, unlocking availability in the used market and, importantly, delivering more zero emission capable vehicles to second and third owners. Sustaining that growth is vital for our environmental goals, which means bolstering the new car market to drive supply to the used sector. Infrastructure rollout must also improve – and at speed – with affordable and reliable charging essential if more used buyers are to switch to the latest and cleanest available vehicles.

Notes to editors:

1 Market share Q1 2022: 32.6%