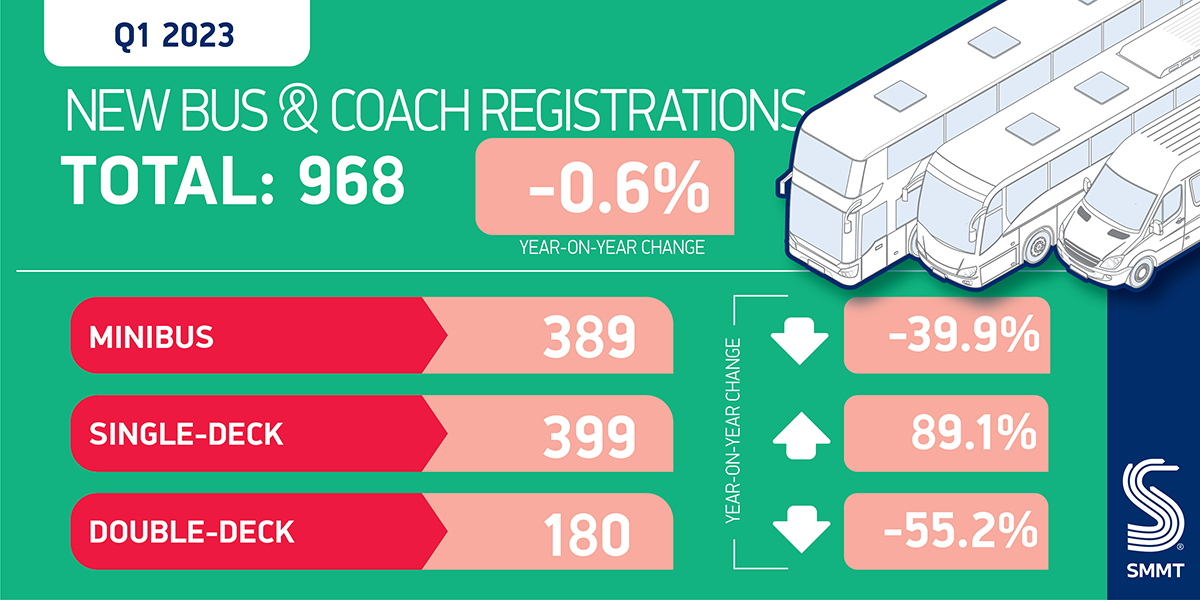

- UK demand for new buses and coaches declines slightly -0.6% in Q1 2023, some -39.7% below the pre-pandemic five-year average.

- Single and double deck bus and coach sectors rally, up 89.1% and 55.2% respectively, but falling minibus registrations and ongoing supply chain shortages stymie growth.

- Industry awaits government response to consultation on Category B licence derogations as sector continues to decarbonise amid historically low ridership levels.

SEE BUS & COACH REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK’s new bus and coach market fell by -0.6% in the first quarter of 2023, with 968 vehicles joining Britain’s transport network, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). With passenger numbers still low since the sharp decline in ridership caused by the pandemic, the overall market remains tough, albeit stable since the first quarter of last year. Registrations remain -39.7% below the pre-pandemic five-year average,1 highlighting the scale of the challenge to get the sector on the road to recovery.

The slight decline was driven by minibus registrations, which fell by -39.9% to just 389 units, representing 40.2% of the market compared with 66.4% during the same period in 2022 amid turbulent supply shortages and naturally volatile fleet renewal. In contrast, demand for single and double decker buses and coaches reached the highest Q1 total since pre-pandemic 2019,2 with single deckers rising by 89.1% on last year to 399 units and double deckers by 55.2% to 180 units.

While Britain’s latest bus ridership statistics show that the number of local passenger journeys in England grew by 79.6% to 2.8 billion during the 12 months ending in March 2022,3 the total is significantly below the same period up to 2020, at 4.1 billion journeys. Measures such as the Bus Fare Cap Grant to boost passenger numbers are welcome in the short term, but a plan to deliver long-term growth is required.

The industry has a key role to play in the decarbonisation of road transport so providing affordable, accessible zero emission transport requires higher levels of fleet renewal over the coming years. Operators need greater confidence to make the switch amid a challenging business environment, with the smoother, faster roll out of Zero Emission Bus Regional Area (ZEBRA) funding across all UK regions needed to help stimulate further investment.

At the same time, minibus operators await the outcome of a consultation on Category B licence derogations which would allow existing minibus drivers to operate alternatively fuelled vehicles weighing up to 4.25 tonnes on their current licence. Given the limitations on the current number of qualified minibus drivers, the measure would enable more operators to invest in the latest electrified models – improving access to zero emission mobility for everyone in society while ensuring long-term decarbonisation.

Mike Hawes, SMMT Chief Executive, said,

While building back Britain’s bus and coach sector remains a challenge, with supply disruptions still affecting minibus deliveries, the market is showing signs of recovery – particularly with the boost in single and double decker vehicle uptake. The sector has a vital role in decarbonising road transport, and potential minibus licence allowances have the potential to enable more operators to renew their fleets with the latest zero emission vehicles – driving long-term market growth and improving access to green mobility for all.

Notes to Editors

1 Q1 average, 2015-2019: 1,606 units.

2 Q1 bus and coach registrations, 2019: 1,205 units.

3 UK government bus statistics, April 2023.