- Q1 2023 Revenue grew 130% year-over-year to $525 million[1]

- Q1 2023 Loss for the period improved by 43% year-over-year to $250 million

- Q1 2023 Adjusted EBITDA improved by 77% year-over-year to $(66) million, with Deliveries Segment Adjusted EBITDA margins at an all time high

SINGAPORE, May 18, 2023 – Grab Holdings Limited (NASDAQ: GRAB) today announced unaudited financial results for the first quarter ended March 31, 2023.

“This quarter, we reported another solid set of results which reflects our disciplined focus to drive sustainable growth and profitability. Our revenues for the quarter more than doubled year-over-year (“YoY”)[1], while we reduced our Adjusted EBITDA losses by 77% YoY,” said Anthony Tan, Group Chief Executive Officer and Co-Founder of Grab. “With five sequential quarters of Adjusted EBITDA improvements, we remain on track on our path to profitability, and to achieve Group Adjusted EBITDA breakeven in the fourth quarter of this year. We are confident that we can drive growth for Mobility and Deliveries, and create more income opportunities for our partners to meet the growing demand from both travelers and domestic consumers.”

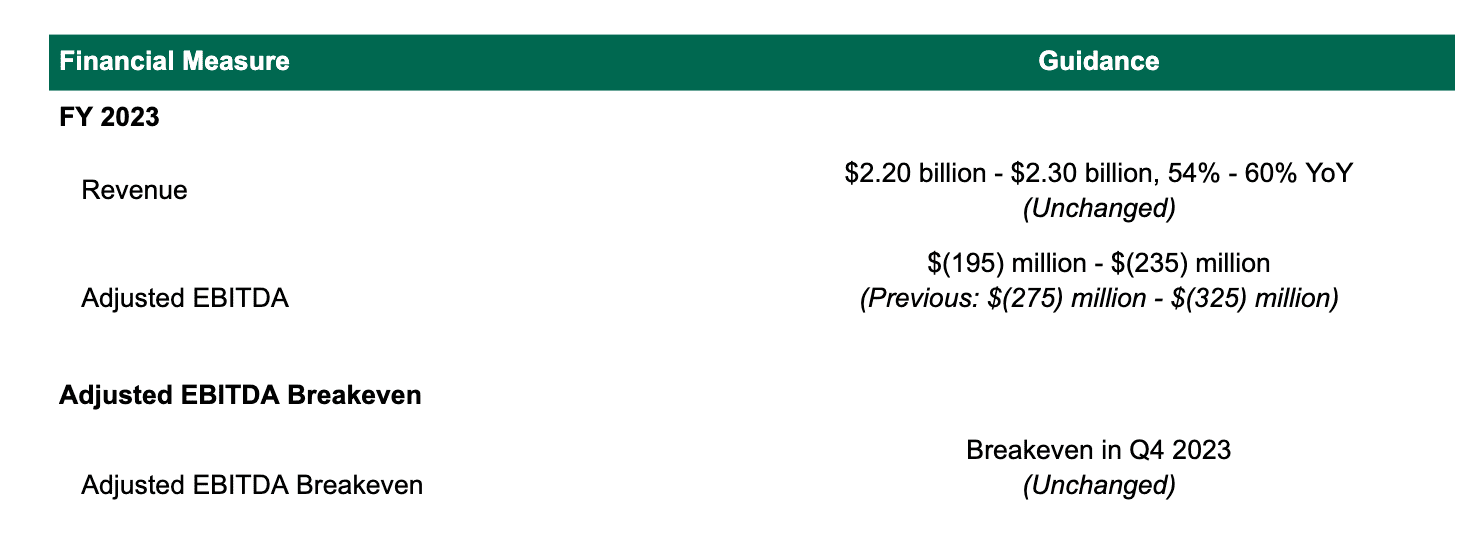

“We are pleased with our first quarter results, with strong revenue growth and profitability improvements across all of our segments, supported by a strong balance sheet. On the back of the solid first quarter performance, we are revising-up our Adjusted EBITDA guidance range by $80 million to $90 million, to $(195) million to $(235) million for the full year 2023,” said Peter Oey, Chief Financial Officer of Grab. “We remain focused on driving cost efficiencies across our organization and improving operating leverage.”

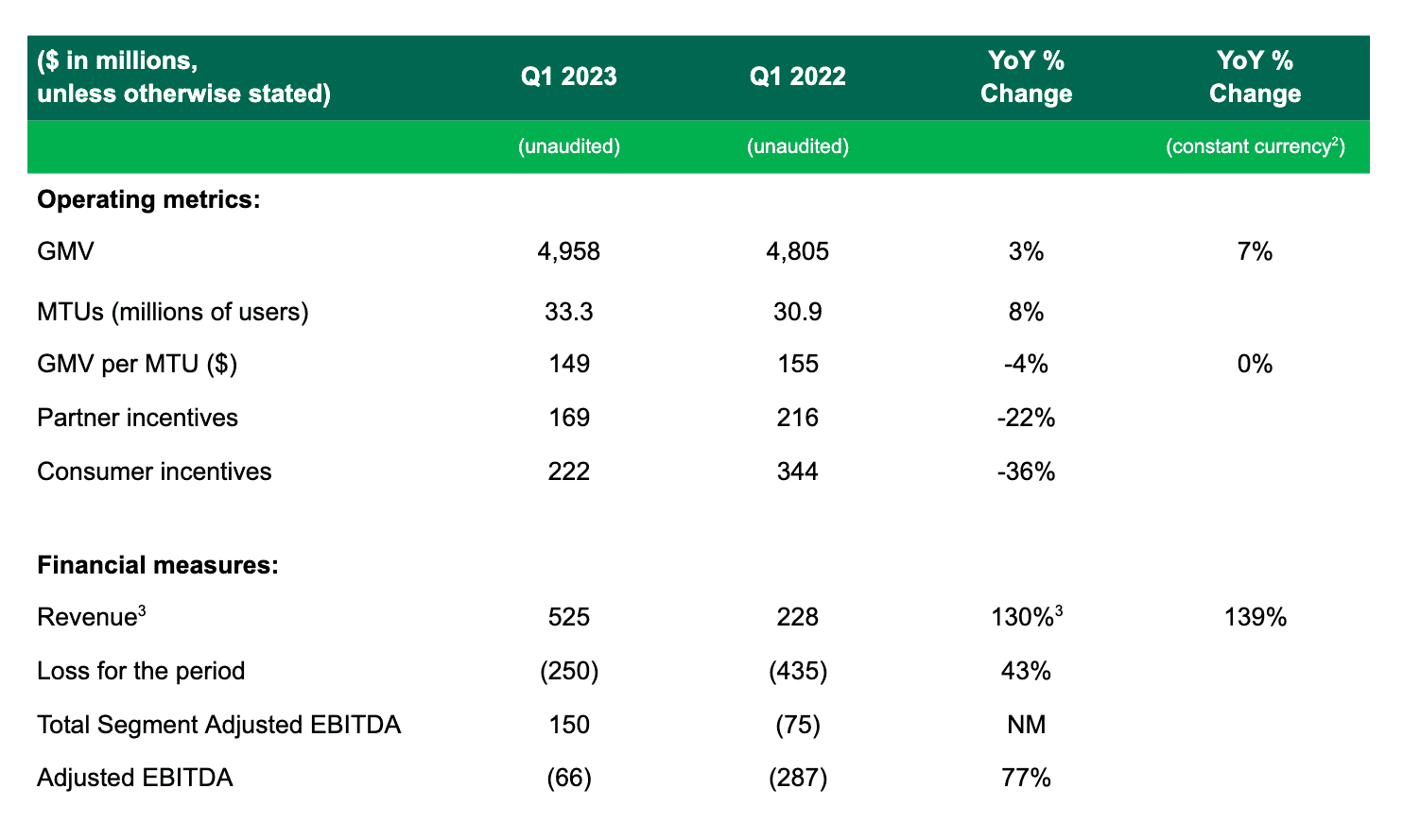

Group First Quarter 2023 Key Operational and Financial Highlights

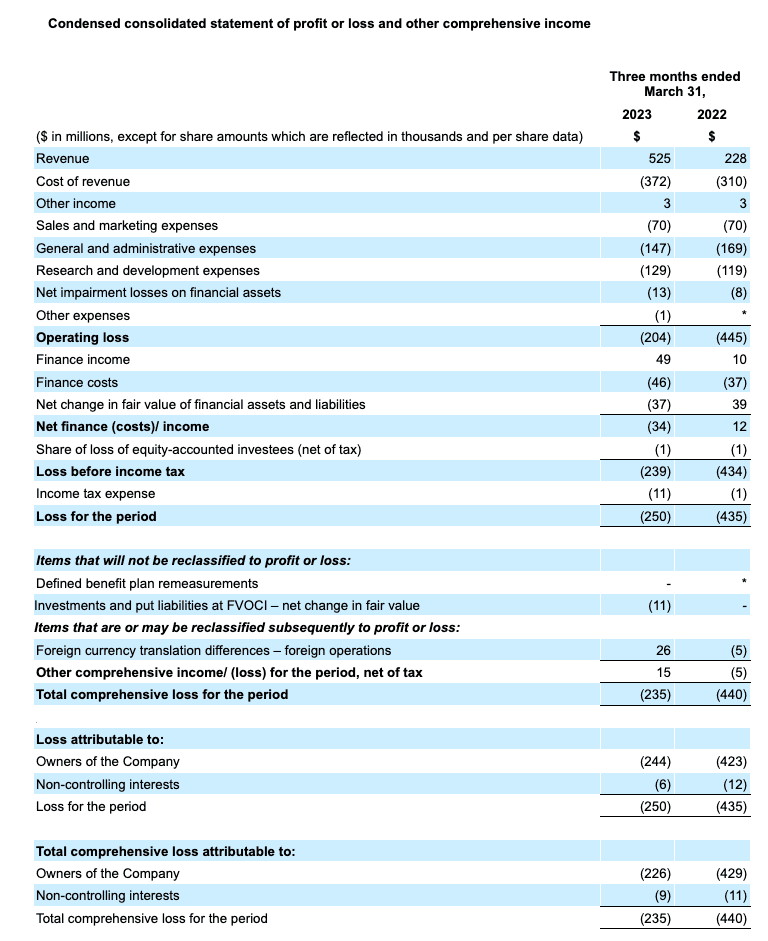

- Revenue grew 130% YoY to $525 million in the first quarter of 2023, or 139% on a constant currency basis[2], attributed to growth across all our segments, a reduction in incentives and a change in business model for certain delivery offerings in one of our markets[3].

- Total GMV grew 3% YoY, or 7% YoY on a constant currency basis, primarily due to the continued growth in Mobility, which offset softer Deliveries demand as a result of Chinese New Year and Ramadan during the first quarter. For our Deliveries segment, GMV declined YoY against a first quarter 2022 comparison base where Deliveries demand was supported by COVID restrictions on dine-in and social gatherings in Southeast Asia. Additionally, fasting during the Ramadan period commenced during the first quarter of this year, which was earlier as compared to the prior year where it commenced in the second quarter.

- Total incentives further reduced to 7.9% of GMV in the first quarter, compared to 11.6% in the same period in 2022 and 8.2% in the previous quarter, demonstrating our continued focus on optimizing our incentive spend and the health of our marketplace.

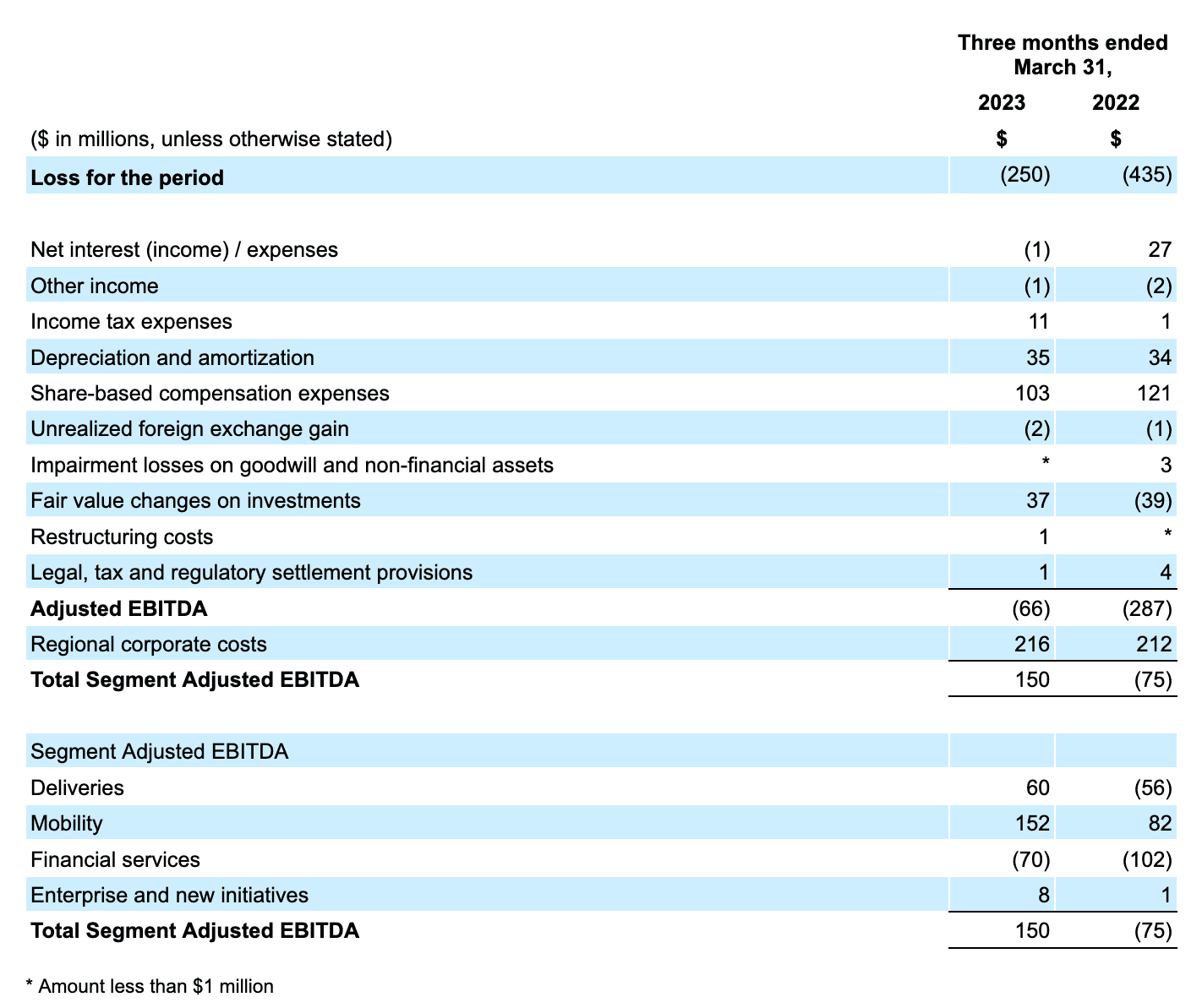

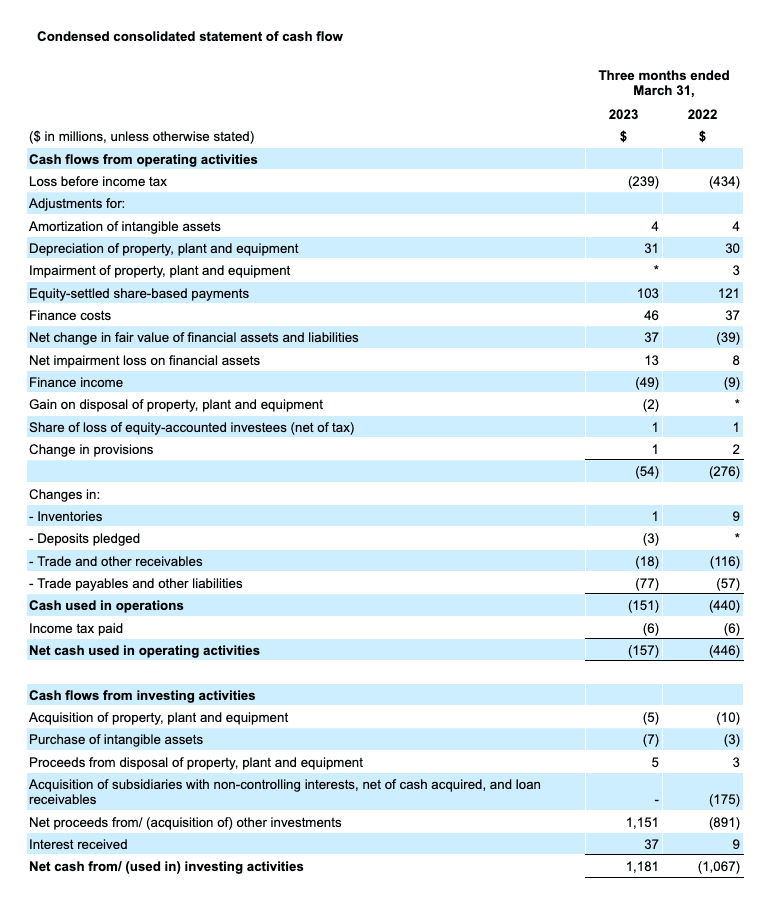

- Loss for the quarter was $250 million, a 43% improvement YoY, primarily due to the improvement in Group Adjusted EBITDA and a reduction in net interest expenses. Our loss for the quarter included a $37 million non-cash loss from fair value changes on investments, and $103 million in non-cash stock-based compensation expenses.

- Group Adjusted EBITDA was negative $66 million for the quarter, an improvement of 77% compared to negative $287 million for the same period in 2022 as we continued to grow GMV and revenue while improving profitability on a Segment Adjusted EBITDA basis. We have recorded sequential improvements in Group Adjusted EBITDA on a quarter-over-quarter (QoQ) basis for five consecutive quarters.

- Group Adjusted EBITDA margin was (1.3)% for the quarter, an improvement from (6.0)% in the first quarter of 2022 and (2.2)% in the fourth quarter of 2022.

- Regional corporate costs[4] for the quarter were $216 million, compared to $212 million in the same period in 2022 and $223 million in the prior quarter. Overall headcount across our core segments and corporate functions has fallen sequentially over the past two quarters. Management remains focused on driving cost efficiencies across our organization in order to further reduce regional corporate costs.

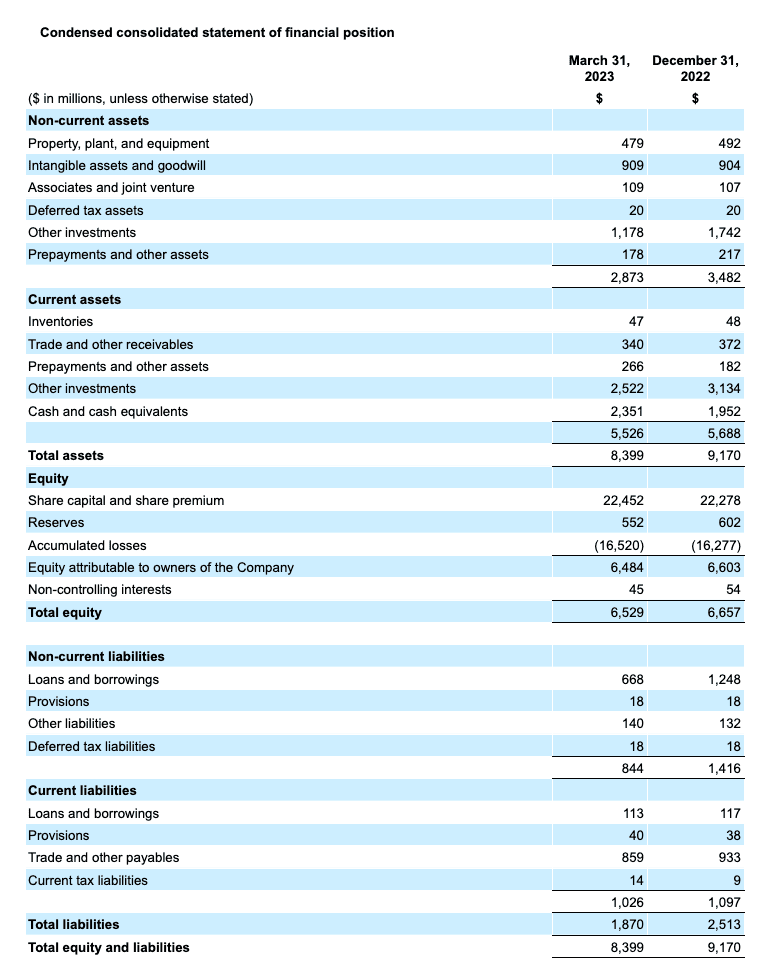

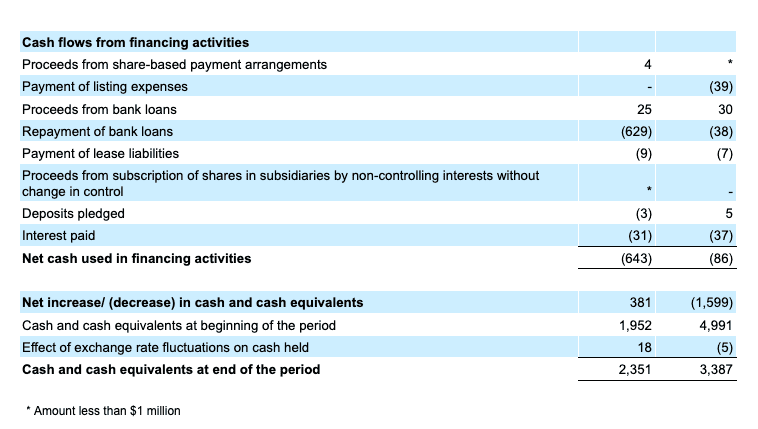

- Cash liquidity[5] totaled $5.8 billion at the end of the first quarter, compared to $6.5 billion at the end of the prior quarter, with a substantial part of the cash outflow attributed to the prepayment of our Term Loan B in the aggregate principal amount of $600 million completed in February 2023. Our net cash liquidity[6] was $5.0 billion at the end of the first quarter, compared to $5.1 billion at the end of the prior quarter.

Business Outlook

The guidance represents our expectations as of the date of this press release, and may be subject to change.

Segment Financial and Operational Highlights

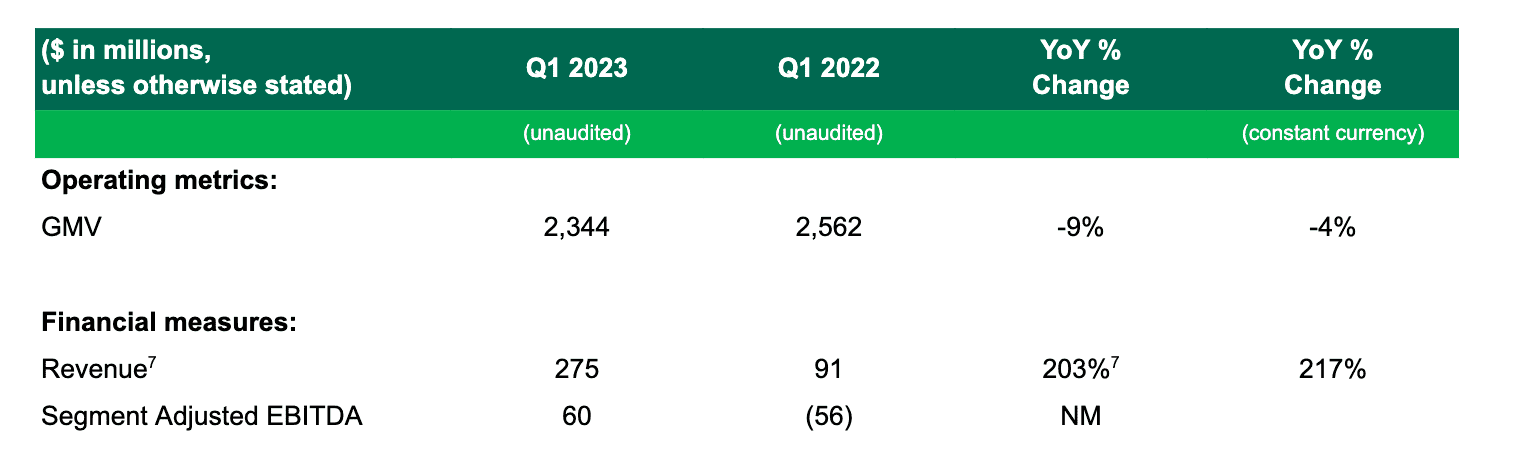

Deliveries

- Deliveries revenue grew 203% YoY, or 217% YoY on a constant currency basis, to $275 million in the first quarter from $91 million in the same period in 2022. The strong growth was primarily attributed to contributions from Jaya Grocer, a reduction in incentives, and a change in business model of certain Deliveries offerings in one of our markets.

- Deliveries GMV declined 9% YoY, or 4% YoY on a constant currency basis, against a first quarter 2022 comparison base where Deliveries demand was supported by COVID restrictions on dine-in and social gatherings in Southeast Asia. Additionally, fasting during the Ramadan period commenced during the first quarter of this year, which was earlier as compared to the prior year where it commenced in the second quarter. Notably, we have seen a rebound in Deliveries transactions following Chinese New Year and the Ramadan fasting period.

- Deliveries segment adjusted EBITDA as a percentage of GMV expanded to an all time high of 2.6% in the first quarter of 2023 from 2.0% in the fourth quarter of 2022 and negative 2.2% in the first quarter of 2022, amid greater optimization of our incentive spend. In the first quarter of 2023, several countries across our six core markets reported Deliveries segment adjusted EBITDA as a percentage of GMV that exceeded our steady-state target of 3%.

- GrabUnlimited, our subscription program, enables us to deepen user engagement on our platform. In the first quarter 2023, GrabUnlimited users accounted for over a quarter of Deliveries GMV and on average, GrabUnlimited subscribers spend 3.7x more in Food Deliveries relative to non-subscribers.

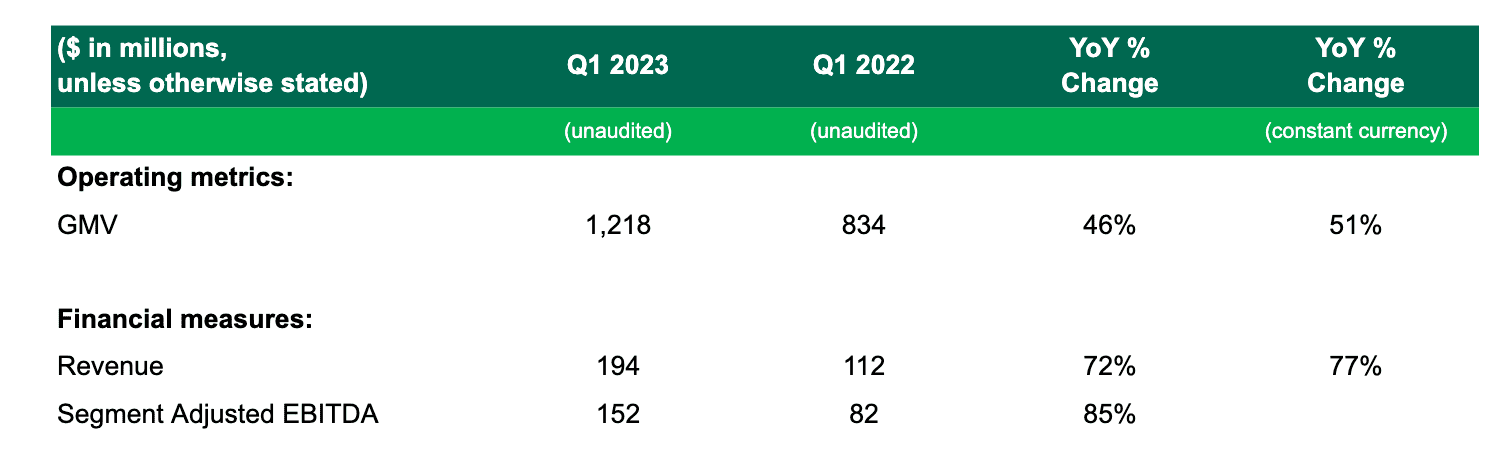

Mobility

- Mobility revenues continued to grow strongly, rising 72% YoY, or 77% YoY on a constant currency basis, in the first quarter 2023. The increase can be attributed to our efforts to improve supply across the region, which enabled us to capture the recovery in tourism ride-hailing demand, and the growth in domestic demand.

- Mobility GMV increased 46% YoY, or 51% YoY on a constant currency basis.

- Mobility segment adjusted EBITDA as a percentage of GMV was 12.4% in the first quarter of 2023, increasing from 9.8% in the same period last year, and in line with our steady-state target of 12%.

- During the quarter, we remained focused on increasing active driver supply whilst optimizing our existing driver supply to meet the strong demand growth. In the first quarter of 2023, monthly active driver supply increased by 10% YoY and 2% QoQ, while total active driver online hours increased by 14% YoY and 3% QoQ.

- Our efforts to improve driver supply resulted in a QoQ reduction in average passenger wait times and the proportion of surged Mobility rides. Underpinned by strong demand levels, Mobility fulfillment rates also improved QoQ and average driver earnings per transit hour increased by 14% YoY and 4% QoQ.

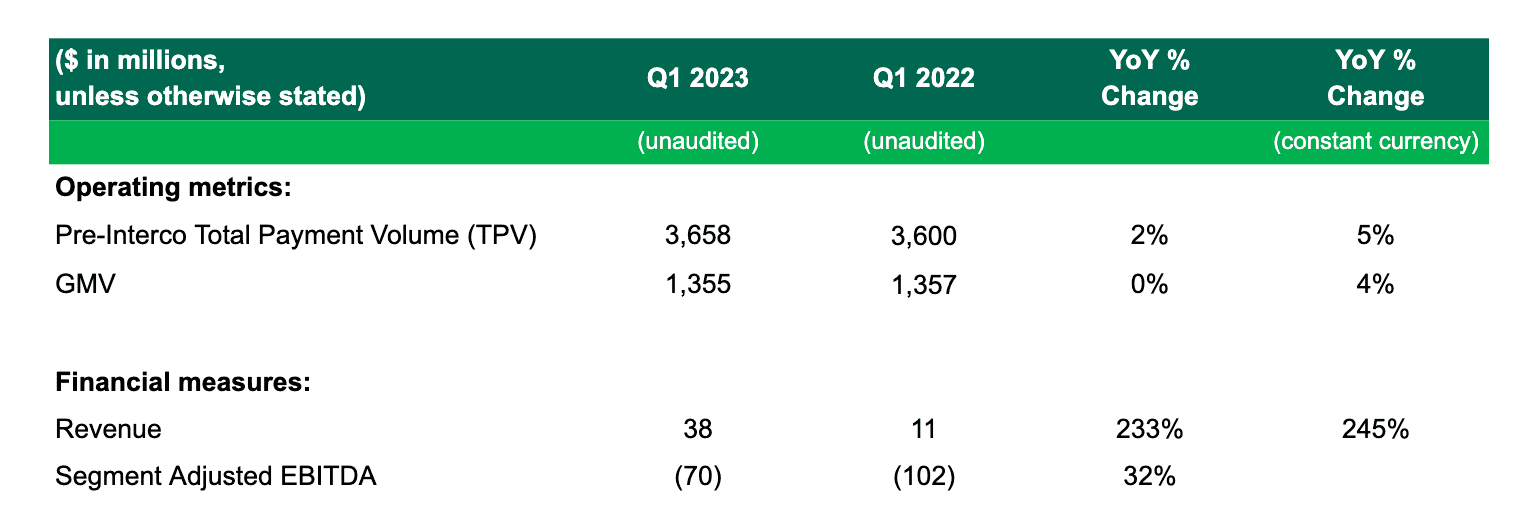

Financial Services

- Revenue for Financial Services grew 233% YoY, or 245% YoY on a constant currency basis, to $38 million in the first quarter of 2023. The YoY growth was primarily driven by lowered consumer incentives and higher contributions from lending.

- GMV for Financial Services remained stable YoY, or grew 4% YoY on a constant currency basis, with the slower growth consistent with our efforts to focus on ecosystem transactions.

- Segment adjusted EBITDA for the quarter improved by 32% YoY to negative $70 million, attributable to lowered consumer incentives and a reduction in overhead expenses. We continued to streamline our cost base across GrabFin’s businesses, and operating expenses improved by 19% YoY and 10% QoQ.

- We continued to focus on lending to our ecosystem partners, with GrabFin’s loan disbursements during the quarter growing by 45% YoY. In April, our digital bank in Singapore (GxS Bank) announced the launch of the GxS FlexiLoan, the bank’s first lending product.

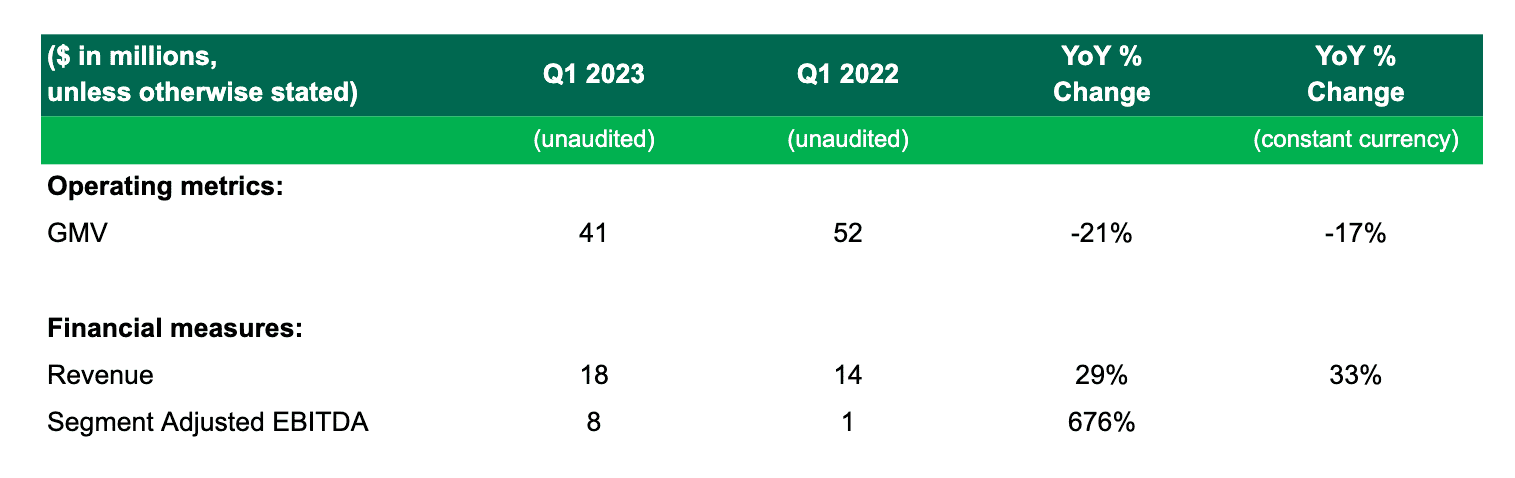

Enterprise and New Initiatives

- Revenue from Enterprise and New Initiatives rose 29% YoY, or 33% YoY on a constant currency basis for the first quarter of 2023, mainly driven by lowered incentives.

- GMV for the first quarter declined 21% YoY, or 17% YoY on a constant currency basis, as we focused on driving profitable transactions.

- Segment adjusted EBITDA grew 676% YoY in the quarter compared to the same period in 2022, primarily attributed to lowered incentives and a reduction in operating expenses as we focused on profitability.

About Grab

Grab is a leading superapp in Southeast Asia, operating across the deliveries, mobility and digital financial services sectors. According to research done by Euromonitor for Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam, Grab remained the category leader in 2022 by GMV in online food deliveries and ride-hailing in Southeast Asia. Serving over 500 cities in eight Southeast Asian countries, Grab enables millions of people to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending and insurance, all through a single app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone, and strives to serve a triple bottom line: to simultaneously deliver financial performance for its shareholders and have a positive social and environmental impact in Southeast Asia.

Forward-Looking Statements

This document and the announced investor webcast contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this document and the webcast, including but not limited to, statements about Grab’s goals, targets, projections, outlooks, beliefs, expectations, strategy, plans, objectives of management for future operations of Grab, and growth opportunities, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. Forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of Grab, which involve inherent risks and uncertainties, and therefore should not be relied upon as being necessarily indicative of future results. A number of factors, including macro-economic, industry, business, regulatory and other risks, could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to: Grab’s ability to grow at the desired rate or scale and its ability to manage its growth; its ability to further develop its business, including new products and services; its ability to attract and retain partners and consumers; its ability to compete effectively in the intensely competitive and constantly changing market; its ability to continue to raise sufficient capital; its ability to reduce net losses and the use of partner and consumer incentives, and to achieve profitability; potential impact of the complex legal and regulatory environment on its business; its ability to protect and maintain its brand and reputation; general economic conditions, in particular as a result of COVID-19, currency exchange fluctuations and inflation; expected growth of markets in which Grab operates or may operate; and its ability to defend any legal or governmental proceedings instituted against it. In addition to the foregoing factors, you should also carefully consider the other risks and uncertainties described under “Item 3. Key Information – D. Risk Factors” and in other sections of Grab’s annual report on Form 20-F for the year ended December 31, 2022, as well as in other documents filed by Grab from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

Forward-looking statements speak only as of the date they are made. Grab does not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required under applicable law.

Unaudited Financial Information

Grab’s unaudited selected financial data for the three months ended March 31, 2023 and 2022 included in this document and the investor webcast is based on financial data derived from the Grab’s management accounts that have not been reviewed or audited.

Non-IFRS Financial Measures

This document and the investor webcast include references to non-IFRS financial measures, which include: Adjusted EBITDA, Segment Adjusted EBITDA, Total Segment Adjusted EBITDA and Adjusted EBITDA margin. Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab’s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab’s management uses: Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab’s business segments, as it does not include regional corporate costs. However, there are a number of limitations related to the use of non-IFRS financial measures, and as such, the presentation of these non-IFRS financial measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies. See below for additional explanations about the non-IFRS financial measures, including their definitions and a reconciliation of these measures to the most directly comparable IFRS financial measures. With regard to forward-looking non-IFRS guidance and targets provided in this document and the investor webcast, Grab is unable to provide a reconciliation of these forward-looking non-IFRS measures to the most directly comparable IFRS measures without unreasonable efforts because the information needed to reconcile these measures is dependent on future events, many of which Grab is unable to control or predict.

Explanation of non-IFRS financial measures:

- Adjusted EBITDA is a non-IFRS financial measure calculated as net loss adjusted to exclude: (i) interest income (expenses), (ii) other income (expenses), (iii) income tax expenses (credit), (iv) depreciation and amortization, (v) share-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and (xii) share listing and associated expenses.

- Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of each of our four business segments, excluding, in each case, regional corporate costs.

- Total Segment Adjusted EBITDA is a non-IFRS financial measure, representing the sum of Adjusted EBITDA of our four business segments.

- Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value.

This document and the investor webcast also includes “Pre-InterCo” data that does not reflect elimination of intragroup transactions, which means such data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions.

We compare the percent change in our current period results from the corresponding prior period using constant currency. We present constant currency growth rate information to provide a framework for assessing how our underlying GMV and revenue performed excluding the effect of foreign currency rate fluctuations. We calculate constant currency by translating our current period financial results using the corresponding prior period’s monthly exchange rates for our transacted currencies other than the U.S. dollar.

Operating Metrics

Gross Merchandise Value (GMV) is an operating metric representing the sum of the total dollar value of transactions from Grab’s products and services, including any applicable taxes, tips, tolls, surcharges and fees, over the period of measurement. GMV includes sales made through offline stores. GMV is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business. GMV provides useful information to investors as it represents the amount of a consumer’s spend that is being directed through Grab’s platform. This metric enables Grab and investors to understand, evaluate and compare the total amount of customer spending that is being directed through its platform over a period of time. Grab presents GMV as a metric to understand and compare, and to enable investors to understand and compare, Grab’s aggregate operating results, which captures significant trends in its business over time.

Total Payments Volume (TPV) means total payments volume received from consumers, which is an operating metric defined as the value of payments, net of payment reversals, successfully completed through our platform.

Monthly Transacting User (MTUs) is defined as the monthly number of unique users who transact via Grab’s apps (including OVO), where transact means to have successfully paid for any of Grab’s products or services. MTUs over a quarterly or annual period are calculated based on the average of the MTUs for each month in the relevant period. Starting in 2023, MTUs additionally include the monthly number of unique users who transact with Grab offline while recording their loyalty points on Grab’s apps. MTUs is a metric by which Grab understands, evaluates and manages its business, and Grab’s management believes is necessary for investors to understand and evaluate its business.

Partner incentives is an operating metric representing the dollar value of incentives granted to driver- and merchant-partners, the effect of which is to reduce revenue. The incentives granted to driver- and merchant-partners include base incentives and excess incentives, with base incentives being the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by us from those driver- and merchant-partners, and excess incentives being the amount of payments made to driver- and merchant-partners that exceed the amount of commissions and fees earned by us from those driver- and merchant-partners. For certain delivery offerings where Grab is contractually responsible for delivery services provided to end-users, incentives granted to driver-partners are recognized in cost of revenue.

Consumer incentives is an operating metric representing the dollar value of discounts and promotions offered to consumers, the effect of which is to reduce revenue. Partner incentives and consumer incentives are metrics by which we understand, evaluate and manage our business, and we believe are necessary for investors to understand and evaluate our business. We believe these metrics capture significant trends in our business over time.

Industry and Market Data

This document also contains information, estimates and other statistical data derived from third party sources (including Euromonitor), including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations and due to the nature of the techniques and methodologies used in market research, and as such neither Grab nor the third-party sources (including Euromonitor) can guarantee the accuracy of such information. You are cautioned not to give undue weight on such estimates. Grab has not independently verified such third-party information, and makes no representation as to the accuracy of such third-party information.

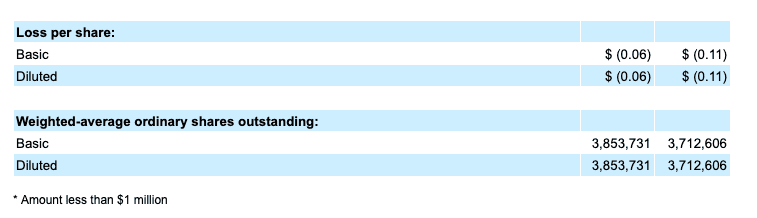

Unaudited Summary of Financial Results

As we incurred net loss for the period ended March 31, 2023, basic loss per share was the same as diluted loss per share.

The number of outstanding Class A and Class B ordinary shares was 3,784 million and 103 million for the period ended March 31, 2023. 397 million potentially dilutive outstanding securities were excluded from the computation of diluted loss per ordinary share because their effects would have been antidilutive for the period ended March 31, 2023, or issuance of such shares is contingent upon the satisfaction of certain conditions which were not satisfied by the end of the period.

[1] Deliveries Revenues benefited in Q1 2023 due to a business model change implemented in Q4 2022 for certain delivery offerings in one of our markets from being an agent arranging for delivery services provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users. Assuming the change in business model had occurred in Q1 2022, Q1 2023 Group revenue growth would have been 58% YoY.

[2] We calculate constant currency by translating our current period financial results using the corresponding prior period’s monthly exchange rates for our transacted currencies other than the U.S. dollar.

[3] Deliveries Revenues benefited in Q1 2023 due to a business model change implemented in Q4 2022 for certain delivery offerings in one of our markets from being an agent arranging for delivery services provided by our driver-partners to end-users, to being a principal whereby Grab is the delivery service provider contractually responsible for the delivery services provided to end-users. Assuming the change in business model had occurred in Q1 2022, Q1 2023 Group revenue growth would have been 58% YoY.

[4] Regional corporate costs are costs that are not attributed to any of the business segments, including certain cost of revenue, research and development expenses, general and administrative expenses and marketing expenses. These regional cost of revenue include cloud computing costs. These regional research and development expenses also include mapping and payment technologies and support and development of the internal technology infrastructure. These general and administrative expenses also include certain shared costs such as finance, accounting, tax, human resources, technology and legal costs. Regional corporate costs exclude share-based compensation expenses and capitalized software costs.

[5] Cash liquidity includes cash on hand, time deposits and marketable securities.

[6] Net cash liquidity includes cash liquidity less loans and borrowings.