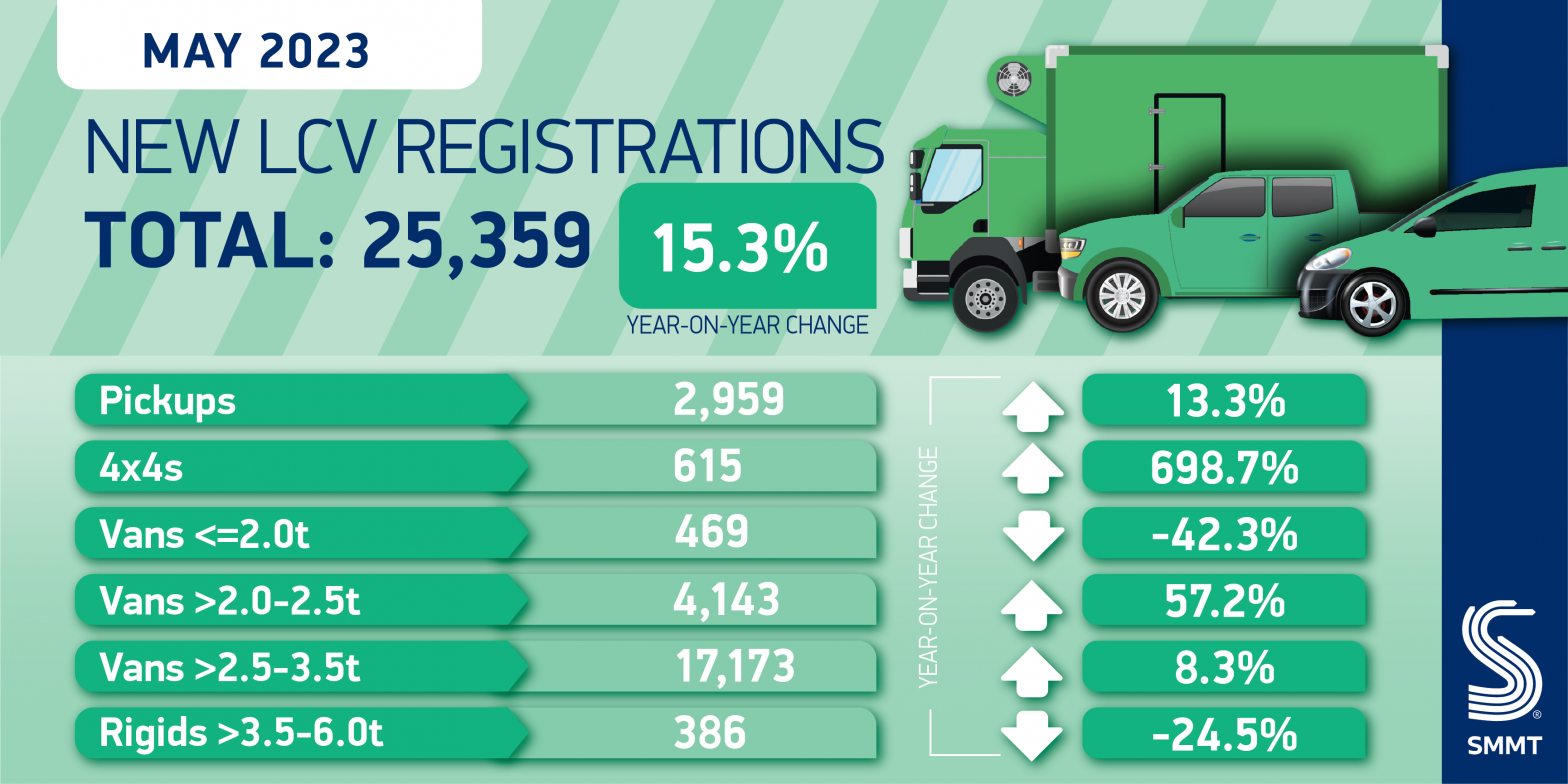

- New light commercial vehicle registrations reach 25,359 units in May, up 15.3% on last year in the fifth consecutive month of rising demand.

- Deliveries of new battery electric vans grow by a fifth (19.8%) to 1,041 units, as more businesses enjoy the benefits of the latest green tech.

- 135,296 vans now registered in 2023 thanks to easing supply chain disruptions and sustained demand for larger vehicles.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The number of UK light commercial vehicles (LCVs) registered in the UK grew by 15.3% in May compared with last year, reaching 25,359 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). It represents the fifth consecutive month of rising deliveries as the market rebounds from a tough 2022 as supply chain challenges continue to ease, although registrations remain -13.0% below the pre-pandemic 2019 level.1

Registrations of the largest LCVs, weighing greater than 2.5 to 3.5 tonnes, rose by 8.3% to 17,173 units, representing nearly seven in 10 (67.7%) new vans, while deliveries of medium-sized vans weighing more than 2.0 to 2.5 tonnes reached 4,143 units, up 57.2%. As fleet operators continue to opt for models with larger payloads, demand for small vans at or below 2.0 tonnes fell by -42.3%, while the number of newly registered pickup vans increased by 13.3%. Meanwhile, deliveries of new 4x4s surged by 698.7% to 615 units last month, evidence of the diverse range of LCVs that keep Britain on the move.

More businesses switched to zero emission workhorses, too, with the battery electric vehicle (BEV) market up 19.7% to 1,041 units, representing around one in 24 new vans. Rising demand means that 7,028 all-electric vans have been registered so far in 2023, an increase of 15.5% on the same period last year. With more than 25 electric van models now available in the UK, operators have a wealth of choice in zero emission solutions. Despite the strong progress made by the sector, demand for electric vans remains some distance behind the new car market, where the BEV market share is three times greater.

Next year, the launch of the Zero Emission Vehicle (ZEV) Mandate will set a minimum quota for new ZEV registrations for every manufacturer, however, the greatest barrier to increased BEVs on UK roads is charging anxiety – the fear of being unable to find a suitable, available and working chargepoint wherever and whenever needed – a particularly acute concern for commercial vehicle operators.

As such, the UK must form a national plan to deliver the zero emission van transition and do so urgently. This can be achieved via a supportive fiscal framework, simplified planning processes, faster grid connections and the provision of a nationwide network of reliable, affordable chargepoints. In addition, regulated infrastructure targets that are commensurate with new vehicle registration mandates would help to reassure van operators that their specific business needs can be met with a battery electric van. Investment is undoubtedly coming for the car sector, but the van sector cannot be left behind.

Mike Hawes, SMMT Chief Executive, said,

A van market rebound is an opportunity to deliver an increasingly environmentally sustainable recovery and a boost to the economy. But every lever must be pulled to support the electric switch. With the forthcoming ZEV Mandate, we also need a national plan to deliver public charging infrastructure that encourages plug-in van uptake, to give the UK confidence over what can – and must – be a stable, successful transition for businesses up and down the country.

Notes to editors

1 May 2019: 29,142 units.