Eaton Corporation’s ETN wide market reach, accretive acquisitions, consistent investment in research and development (R&D) programs and product improvement are contributing to its strong performance.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projections

The Zacks Consensus Estimate for 2023 earnings per share and revenues is pegged at $8.45 and $22.68 billion, respectively, suggesting an increase of 11.6% and 9.3% from the year-ago reported figures.

The consensus mark for 2024 earnings and revenues is pegged at $9.25 per share and $23.97 billion, respectively. The top- and bottom-line estimates suggest a 9.4% and 5.7% year-over-year increase, respectively.

Surprise History, Dividend Yield and Earnings Growth

Eaton’s trailing four-quarter earnings surprise is 2.5%, on average.

Its dividend yield is currently pegged at 1.77%, higher than the Zacks S&P 500 Composite’s average of 1.68%.

The company’s long-term (three- to five-year) earnings growth is projected at 11%.

Regular Investments in R&D

Eaton has laid out a 10-year plan that includes a $3 billion investment in R&D programs, allowing the company to create sustainable products over this period. The products supplied by Eaton are deemed to be a critical part of the global infrastructure and essential in the current crisis situation.

In 2022, after spending $665 million in R&D, the company invested $179 million in R&D programs in first-quarter 2023, up 8.5% from the year-ago period. ETN is expected to continue to invest in R&D activities in the remaining portion of 2023 and develop new products.

Return on Equity (ROE)

ROE is a measure of a company’s financial performance and shows how it is utilizing its funds. Eaton’s ROE is currently pegged at 18.7%, better than the industry average of 11.17%, which indicates that the company is utilizing its funds more efficiently than its peers.

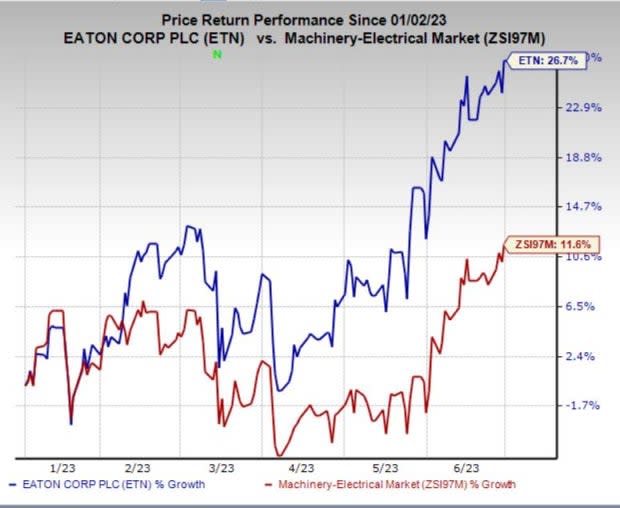

Price Performance

Over the past six months, the stock has gained 26.7% against the industry’s decline of 11.6%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same sector include A.O. Smith Corporation AOS, Zurn Elkay Water Solutions Co. ZWS and Emerson Electric Co. EMR, each currently holding a Zacks Rank #2 (Buy).

The current dividend yields of A.O. Smith, Zurn Elkay Water Solutions and Emerson Electric — which persistently distribute dividends to shareholders — are 1.66%, 1.08% and 2.33%, respectively.

The Zacks Consensus Estimate for 2023 earnings per share of A.O. Smith and Zurn Elkay Water Solutions has moved up 3.9% and 2.3%, respectively, in the past 90 days. In the same time frame, the fiscal 2023 earnings estimate for Emerson Electric has moved up 2.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Zurn Elkay Water Solutions Cor (ZWS) : Free Stock Analysis Report