July 13 (Reuters) – A threatened U.S. strike at United Parcel Service (UPS.N) could be “one of the costliest in at least a century,” topping $7 billion for a 10-day work stoppage, a think tank specializing in the economic impact of labor actions said on Thursday.

That estimate from Michigan-based Anderson Economic Group (AEG) includes UPS customer losses of $4 billion and lost direct wages of more than $1 billion. A 15-day UPS strike in 1997 disrupted the supply of goods, cost the world’s biggest parcel delivery firm $850 million and sent some customers to rivals like FedEx (FDX.N).

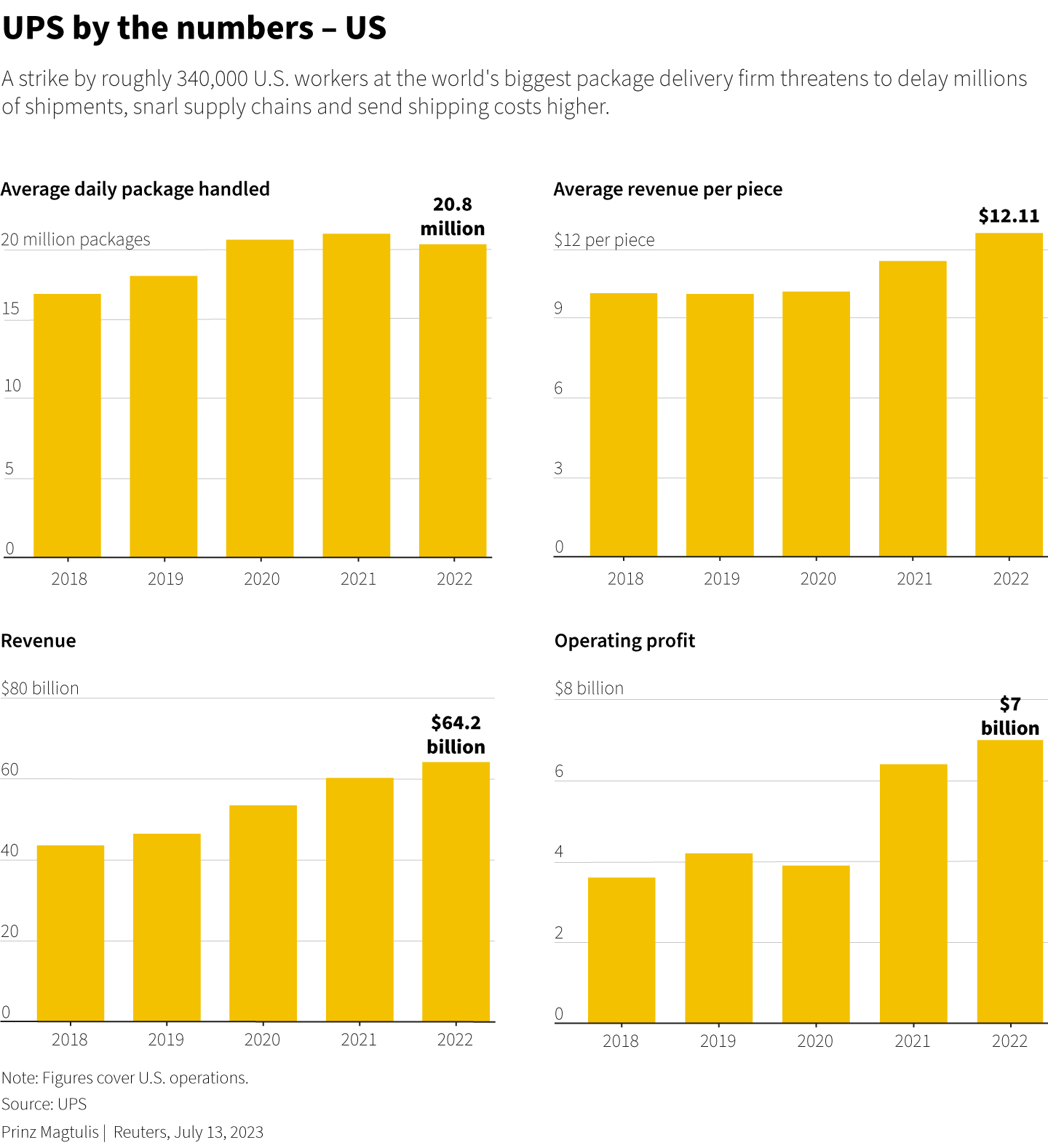

Roughly 340,000 union-represented UPS workers handle about a quarter of U.S. parcel deliveries and serve virtually every city and town in the nation. A strike could delay millions of daily deliveries, including Amazon.com (AMZN.O) orders, electronic components and lifesaving prescription drugs, shipping experts warned. They added this also could reignite supply-chain snarls that stoke inflation.

Talks are deadlocked between UPS and the International Brotherhood of Teamsters union.

The Teamsters have vowed to strike if a deal is not ratified before the current contract expires at midnight on July 31.

“Consumers are going to feel this within days,” AEG CEO Patrick Anderson said of a potential strike, adding his analysis does not include the human cost of disruption to shipments of critical and perishable medicines to treat cancer and other life-threatening illnesses.

A sticking point in negotiations is pay increases for part-time workers who account for roughly half the UPS workforce. Tenured part-timers are particularly frustrated because they make just slightly more than new hires whose wages have jumped in a tight labor market.

Anderson said a UPS employee walkout would be a bigger risk to the U.S. economy than a work stoppage by UAW workers at the “Detroit Three” automakers, who started contract talks on Thursday.

He noted that the automaker talks cover fewer workers and have a limited geographic impact. In fiscal 2019, GM’s (GM.N) fourth-quarter profit took a $3.6 billion hit from a 40-day UAW strike that shut down its profitable U.S. operations.

UPS is urging Teamster negotiators to return to the bargaining table, but union officials say UPS needs to sweeten its offer for workers who risked their lives during the pandemic to help the company generate outsized profits.

UPS faces two unappealing choices, Stifel analyst Bruce Chan said in a recent note: Risk a strike and resulting customer losses or acquiesce to Teamster demands that could worsen the company’s labor cost disadvantage versus nonunion rivals in an inflationary environment.

“Both situations would create pain for UPS, so it could just be a question of when and how the company wants to take its medicine,” Chan said.

Reporting by Lisa Baertlein in Los Angeles, additional reporting by Priyamvada C in Bengaluru; Editing by Pooja Desai, Jonathan Oatis and David Gregorio

Our Standards: The Thomson Reuters Trust Principles.