PACCAR PCAR is slated to release second-quarter 2023 results on Jul 25, before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pegged at $2.11 and $7.95 billion, respectively.

For the current quarter, the consensus estimate for PACCAR’s earnings per share has remained unchanged in the past seven days. Its bottom-line estimates imply growth of 52.90% from the year-ago reported number.

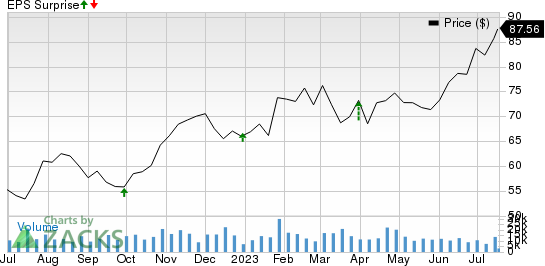

The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year increase of 17.12%. Over the trailing four quarters, PACCAR surpassed earnings estimates on all occasions, the average surprise being 16.58%. This is depicted in the graph below:

PACCAR Inc. Price and EPS Surprise

PACCAR Inc. price-eps-surprise | PACCAR Inc. Quote

Q1 Highlights

PACCAR topped the Zacks Consensus Estimate of earnings and revenues in its first-quarter 2023 results.

Its adjusted earnings per share of $2.25 surpassed the consensus metric of $1.82 and rocketed 95.6% year over year. Higher year-over-year pretax income from the Trucks, Parts and Financial segments resulted in the outperformance.

Consolidated revenues (including trucks and financial services) came in at $8,473.3 billion, up from $6,472.6 million in the corresponding quarter of 2022. Sales from Trucks, Parts and Others were $8,050.1 million, which surpassed the consensus mark of $7,623.9 million.

Earnings Whispers

Our proven model predicts an earnings beat for PACCAR in the quarter to be reported, as it has the right combination of the two key ingredients. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here, as elaborated below.

Earnings ESP: PACCAR has an Earnings ESP of +8.13%. This is because the Most Accurate Estimate is pegged 17 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PCAR currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors at Play

Leading brands, namely Kenworth, DAF and Peterbilt, might have driven the deliveries. The new DAF lineup has improved the company’s product mix.

The Zacks Consensus Estimate and our estimate for total truck deliveries are 52,994 units and 53,698 units, respectively, up from the 46,900 units reported in the prior-year quarter. The consensus mark and our forecast for revenues from the Truck segment are $6,279.7 million and $5,735.8, respectively, indicating a rise from $5,336 million recorded in the previous-year quarter. The Zacks Consensus Estimates and our projections for pretax profit from the truck segment are $833.7 million and $865.5 million, respectively, which is significantly higher than the $422 million reported in the year-ago period.

While PACCAR derives the bulk of its revenues from truck sales, it also produces and sells a wide range of parts, including its brand of engines. High truck utilization and an increased average fleet age are positively impacting PACCAR Parts’ results.

The Zacks Consensus Estimate and our projections for revenues from the Parts segment are $1,584 million and $1,582 million, respectively, indicating a rise from $1,434.7 million recorded in the previous-year quarter.

The Zacks Consensus Estimate and our estimate for pretax profit estimate from the segment are $463 million and $560 million, respectively, up from $353 million reported in the year-ago period.

Other Stocks With the Favorable Combination

Let’s take a look at a few other players from the auto space that, according to our model, have the right combination of elements to post an earnings beat in the quarter to be reported:

General Motors Company GM will release second-quarter 2023 results on Jul 25. The company has an Earnings ESP of +9.37% and has a Zacks Rank #2.

The Zacks Consensus Estimate for General Motors’ to-be-reported quarter’s earnings and revenues is pegged at $1.66 per share and $42.46 billion, respectively. GM surpassed earnings estimates in three of the trailing four quarters and missed once, the average surprise being 15.50%.

Oshkosh Corporation OSK will release second-quarter 2023 results on Jul 27. The company has an Earnings ESP of +21.36% and carries a Zacks Rank #2.

The Zacks Consensus Estimate for Oshkosh’s to-be-reported quarter’s earnings and revenues is pegged at $1.62 per share and $2.24 billion, respectively. OSK surpassed earnings estimates once in the trailing four quarters and missed three times, the average negative surprise being 4.37%.

Lear Corporation LEA will release second-quarter 2023 results on Aug 1. The company has an Earnings ESP of +3.16% and has a Zacks Rank #2.

The Zacks Consensus Estimate for Lear’s to-be-reported quarter’s earnings and revenues is pegged at $3.05 per share and $5.72 billion, respectively. LEA surpassed earnings estimates in all the trailing four quarters, the average surprise being 15.53%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report