SHANGHAI, July 28 (Reuters) – For foreign automakers in China, it is time to double down on a turnaround or cut losses after ceding their leadership of the world’s biggest auto market to local, upstart brands.

Announcements from some of the world’s largest automakers in recent days show they are taking a divergent path: some German brands and General Motors (GM.N) are betting on new electric vehicles, while Toyota (7203.T) and others have shifted to cost-cutting mode.

For the first time, Chinese brands are market leaders, taking a 53% share in the first half of 2023, data from the China Association of Automobile Manufacturers (CAAM) showed.

Global automakers, who for years have dominated the market along with their Chinese state-run partners, have been slow to pivot to the fast-growing market for EVs with competitive offerings.

That has been costly. Tesla (TSLA.O), which has its largest factory in China, was the only foreign brand to take share in the first half, topping BMW (BMWG.DE) in popularity, according to CAAM data.

With added pressure on China margins from a brutal price war this year, some automakers are scaling back with production cuts and layoffs, including Toyota and Mitsubishi (7211.T).

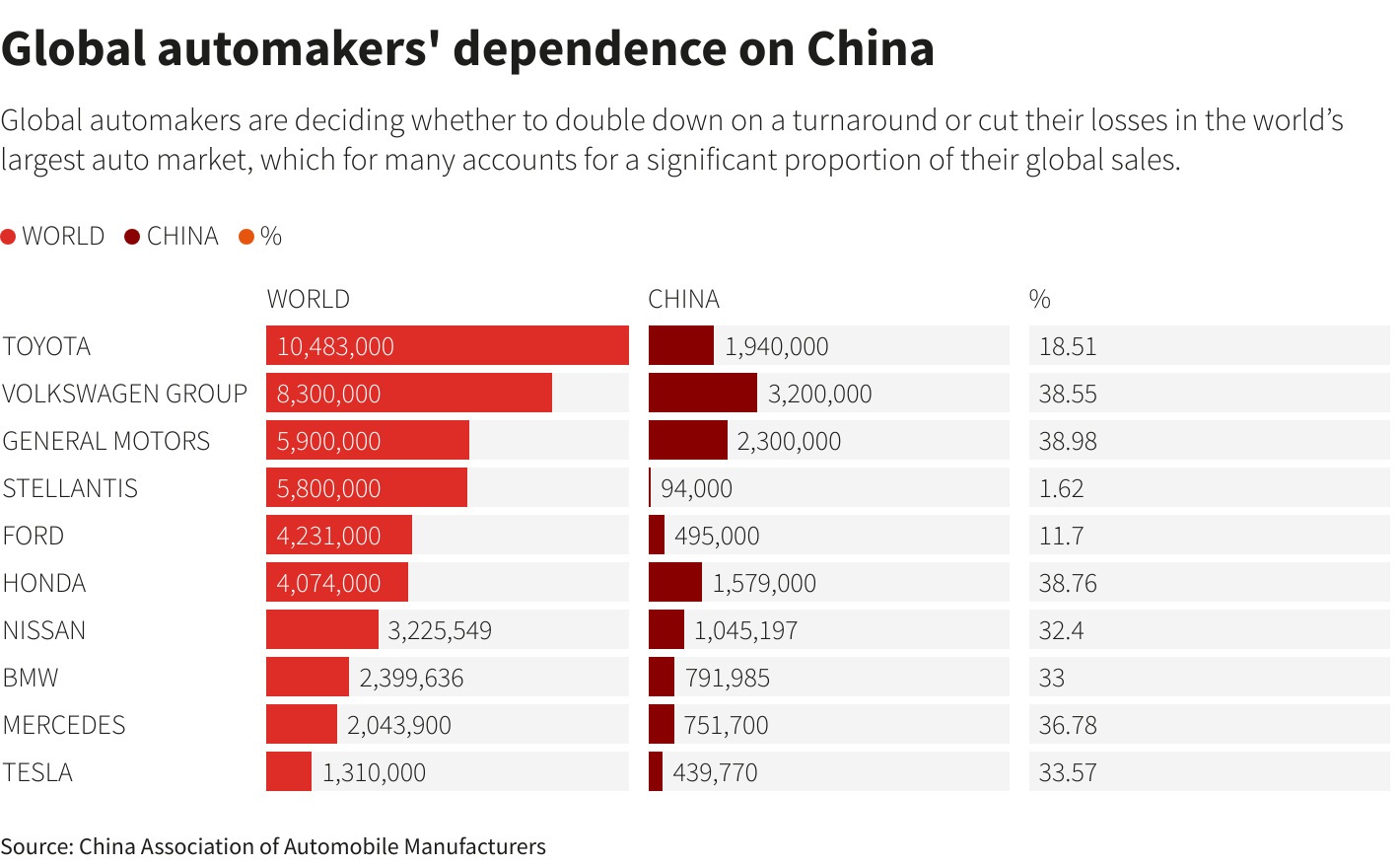

But brands that drew a third of their sales from China before this year’s wipeout have no choice but to double down, said Yale Zhang, managing director at Shanghai-based consultancy Automotive Foresight.

That includes Volkswagen (VOWG_p.DE) and GM.

Volkswagen, which has been outsold by BYD (002594.SZ) since late 2022, announced two agreements on Wednesday aimed at strengthening its position in China: a partnership with China’s Xpeng Inc (9868.HK) to build two new models from 2026 featuring Xpeng’s software, and plans to jointly develop Audi models and a new platform with its Chinese partner SAIC (600104.SS).

“This major collaboration between Volkswagen and Xpeng is a milestone for our electrification strategy ‘in China for China’,” said Ralf Brandstatter, a VW board member on his social media account.

GM, which saw a 9% decline in its Buick, Chevrolet and Cadillac sales in China in the first half, has been counting on EVs developed on its Ultium platform to turn things around.

It has sold more than 12,000 Ultium-based EVs since the first model, the Cadillac Lyriq, started sales a year ago. Last month, GM cut the price of the luxury Lyriq by 14% in China.

“We’ve got to have the right EVs at the right price with the right technology,” GM CEO Mary Barra told investors on a conference call on Tuesday, referring to the company’s China strategy.

‘CHINA EV INC’

“VW and GM, who have historically been leaders in the market, both believe they can salvage their positioning and protect the share they currently have,” said Tu Le, an analyst at China-based research firm Sino Auto Insights.

“It points to how important China is for their global ambitions and, to a lesser degree, the confidence that they can ultimately design, engineer and manufacture products that can compete with Tesla and China EV Inc.”

The price war has cut into margins for Chinese EV makers too, and many remain unprofitable. Their deeper pockets give established foreign automakers who are determined to fight for share in China, the ability to play a long game.

“We’ll allow our enemies to fight first, and we will come back with bags of money and technologies to take them,” Yang Honghai, chief operating officer of Kia China, said at an industry forum in June.

“We are not giving up on the market but only choosing to come back at a more appropriate time,” he said. Kia (000270.KS) is to enter China’s EV market with its first EV, the EV6 crossover, via imports in August.

German luxury brands BMW, Mercedes Benz (MBGn.DE) and Volkswagen’s Audi managed to hold share roughly flat in China in the first half after offering dealer discounts that topped 25% in some cases, according to sales data and analysts who track pricing.

BMW also announced an increased investment in product development in China with a new research and development hub in Shanghai to develop EVs to be sold globally.

“The German brands benefit from significant global scale,” said He Lei, CEO of Chinese EV trading platform xChuxing. “Meanwhile, they are continuously chasing Chinese competitors with China-developed products. How can they not be competitive?”

REVERSE GEAR

Some are pulling back. Mitsubishi Motors has closed a plant run with a joint-venture partner that makes the Outlander SUV while the two companies try to negotiate a restructuring after sharp sales declines.

Toyota, which fell to No. 3 in China in the first half, has slowed production at a joint-venture plant that makes its bZ4X EV and laid off 1,000 contract workers.

Nissan (7201.T), which will bring four new models to China, including an EV, said this week it would consider exporting cars from China to other regions to take advantage of China’s cost advantages, a strategy Tesla, BMW, Ford (F.N) and Renault (RENA.PA) have also pursued.

“China is not just a place to sell cars. It’s also a place to drive economies of scale, which lower your cost and improve your ability to compete internationally,” said Bill Russo of Automobility, an industry consultancy in Shanghai.

Reporting by Zhang Yan and Brenda Goh; Editing by Kevin Krolicki and Muralikumar Anantharaman

Our Standards: The Thomson Reuters Trust Principles.