Adient ADNT reported adjusted earnings per share of 98 cents for the third quarter of fiscal 2023. Earnings jumped from 8 cents recorded in the year-ago period as well as beat the Zacks Consensus Estimate of 39 cents. The outperformance largely stemmed from higher-than-anticipated revenues from the Americas segment. In the reported quarter, Adient generated net sales of $4,055 million, which increased 16% year over year and surpassed the Zacks Consensus Estimate of $3,806 million.

Adient currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

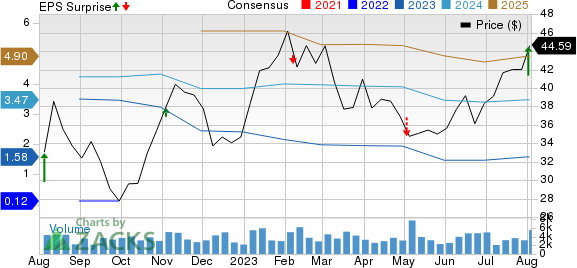

Adient Price, Consensus and EPS Surprise

Adient price-consensus-eps-surprise-chart | Adient Quote

Segmental Performance

Adient currently operates through three reportable segments — the Americas, including North America and South America; Europe, the Middle East and Africa (EMEA) and Asia Pacific/China (Asia).

In the reported quarter, the Americas segment recorded revenues of $1,900 million, an increase of 13.5% from the year-ago period, topping our projection of $1,613.2 million on improved volume and mix. The segment posted an adjusted EBITDA of $95 million, up from $70 million recorded in the prior-year period and slightly topping our estimate of $94.1 million, driven by the sales outperformance and increased equity income.

In the fiscal third quarter, the EMEA segment registered revenues of $1,438 million, which increased 18.3% year over year but fell short of our forecast of $1,467.5 million on lower-than-expected volumes. The segment recorded EBITDA of $103 million in the quarter under review, higher than the $31 million generated in the year-ago period and also outpaced our expectation of $81 million on the back of a non-recurring insurance recovery as well as forex benefits.

In the reported quarter, revenues in the Asia segment came in at $742 million, up 18.3% year over year and topping our estimate of $690.7 million on improved volume and mix. The segment’s adjusted EBITDA grew 56.25% to $100 million on improved sales and high equity income.

Financial Position

Adient had cash and cash equivalents of $908 million as of Jun 30, 2023 compared with $947 million on Sep 30, 2022. Long-term debt amounted to $2,532 million in the reported quarter, down from $2,564 million as of Sep 30, 2022. Capital expenditures totaled $60 million in the fiscal third quarter of 2023 compared with $53 million in the prior-year quarter.

Outlook

Adient updated its fiscal 2023 forecast. It envisions revenues of $15.4 billion, up from the prior guidance of $15 billion. Adjusted EBITDA is estimated to be $920 million, up from the previous projection of $850 million. Expected equity income and capex are forecast to be $80 million and $300 million, respectively. FCF is now estimated to be $275 million, up from the previous estimate of $215 million. Interest expenses and cash tax are now estimated to be $180 million and $95 million, respectively.

Peer Releases

Autoliv Inc. ALV reported second-quarter 2023 adjusted earnings of $1.93 per share, beating the Zacks Consensus Estimate of $1.45 and rocketing 115% year over year. Higher-than-expected revenues from the Airbags and Associated Products segment led to the outperformance. The company reported net sales of $2,635 million in the quarter, which topped the Zacks Consensus Estimate of $2,508 million and soared 27% year over year.

Autoliv had cash and cash equivalents of $475 million as of Jun 30, 2023. Long-term debt totaled $1,290 million. Net capital expenditure jumped to $124 million, compared with $139 million during the corresponding period of 2022. At quarter-end, FCF was $255 million against a negative FCF of $190 million in the year-ago period.

Allison Transmission Holdings ALSN delivered second-quarter 2023 earnings of $1.92 per share, which rose 52% year over year and topped the Zacks Consensus Estimate of $1.61 on higher-than-expected sales from the North America On-Highway segment. Quarterly revenues of $783 million grew 18% from the year-ago period and beat the Zacks Consensus Estimate of $743 million.

Allison had cash and cash equivalents of $351 million on Jun 30, 2023, up from $232 million as of Dec 31, 2022. Long-term debt was $2,499 million compared with $2,501 million as of Dec 31, 2022. Net cash provided by operating activities increased to $141 million from $64 million in the same period in 2022. Adjusted FCF in the reported quarter was $122 million, an increase from $34 million a year ago.

BorgWarner BWA reported adjusted earnings of $1.35 per share for second-quarter 2023, up from $1.05 recorded in the prior-year quarter. The bottom line also outpaced the Zacks Consensus Estimate of $1.14 per share. The automotive equipment supplier reported net sales of $4,520 million, which surpassed the Zacks Consensus Estimate of $4,395 million. The top line also increased by 20% year over year.

BorgWarner had $848 million in cash/cash equivalents/restricted cash at the quarter-end compared with $1,338 million as of Dec 31, 2022. Long-term debt was $4,191 million, up from $4,166 million recorded on Dec 31, 2022. Net cash provided in operating activities was $280 million in the quarter under review. Capital expenditures and FCF totaled $242 million and $38 million, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Adient (ADNT) : Free Stock Analysis Report