On August 4, 2023, BorgWarner Inc (NYSE:BWA) saw a daily gain of 2.71%, with its stock price standing at $42.52. The company’s Earnings Per Share (EPS) was reported at 4.05. But is the stock fairly valued? This article aims to answer this question through a comprehensive analysis of BorgWarner’s valuation. Let’s delve in.

A Closer Look at BorgWarner Inc

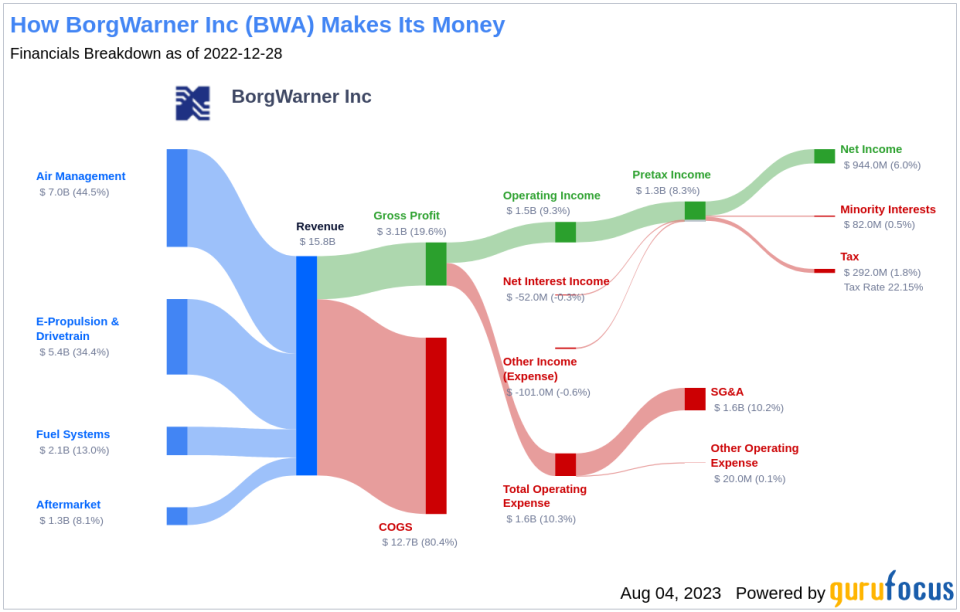

BorgWarner Inc (NYSE:BWA), a Tier I auto-parts supplier, operates through three main segments: air management, drivetrain and battery systems, and e-propulsion. The company’s largest customers include Ford and Volkswagen, contributing 13% and 8% of its 2022 revenue, respectively. With its global presence, Europe, Asia, and North America each accounted for approximately one-third of the 2022 revenue.

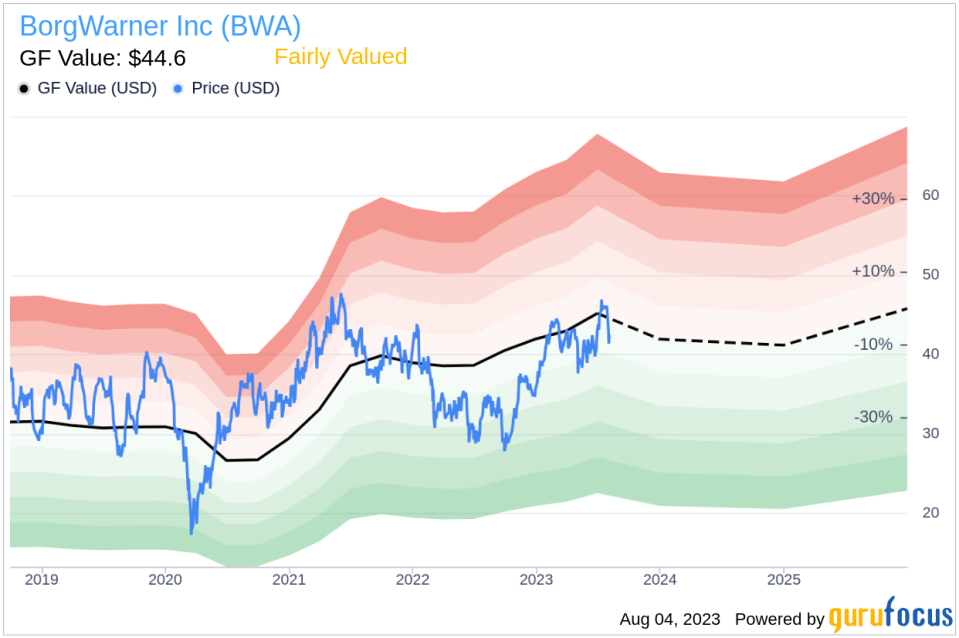

As of the date, BorgWarner’s stock price is $42.52, and the fair value, as estimated by the GF Value, is $44.6. This comparison sets the stage for a more in-depth analysis of the company’s value, intertwining financial assessment with essential company details.

Understanding the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It’s calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the stock’s ideal fair trading value.

For BorgWarner (NYSE:BWA), the GF Value suggests that the stock is fairly valued. This estimation is based on historical multiples, an internal adjustment factor, and analyst estimates of future business performance. If the stock’s price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. Conversely, if the stock’s price is significantly below the GF Value Line, the stock may be undervalued and have high future returns.

Given that BorgWarner is fairly valued, the long-term return of its stock is likely to align with the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

BorgWarner’s Financial Strength

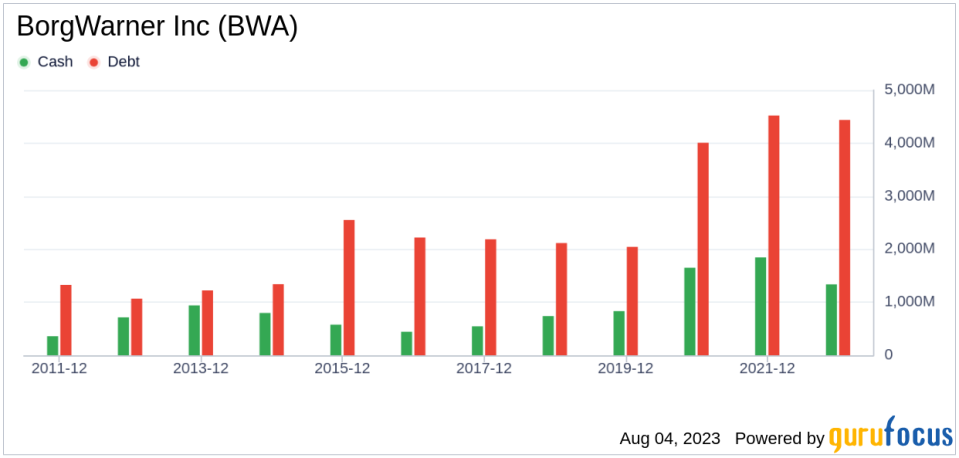

Investing in companies with poor financial strength poses a high risk of permanent capital loss. Therefore, it’s essential to review a company’s financial strength before purchasing shares. BorgWarner’s cash-to-debt ratio stands at 0.19, ranking lower than 75.66% of companies in the Vehicles & Parts industry. However, with an overall financial strength score of 7 out of 10, BorgWarner’s financial health is considered fair.

Profitability and Growth

Investing in profitable companies carries less risk, especially those with consistent profitability over the long term. BorgWarner has been profitable for 10 out of the past 10 years, with revenues of $16.9 billion and Earnings Per Share (EPS) of $4.05 in the past 12 months. Its operating margin of 9.57% is better than 77.49% of companies in the Vehicles & Parts industry. Overall, BorgWarner’s profitability is strong.

Growth is a crucial factor in a company’s valuation. BorgWarner’s 3-year average annual revenue growth rate is 10.7%, ranking better than 65.88% of companies in the Vehicles & Parts industry. However, its 3-year average EBITDA growth rate is 1.7%, ranking lower than 59.91% of companies in the same industry.

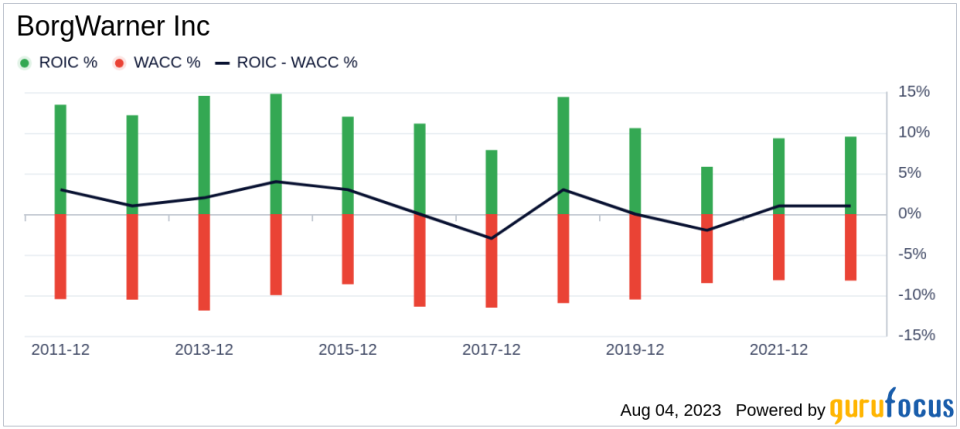

Return on Invested Capital vs Weighted Average Cost of Capital

Comparing a company’s Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to assess profitability. When ROIC is higher than WACC, it implies the company is creating value for shareholders. For the past 12 months, BorgWarner’s ROIC has been 9.84, while its WACC is 8.31.

Conclusion

In summary, BorgWarner (NYSE:BWA) appears to be fairly valued. The company’s financial condition is fair, its profitability is strong, but its growth ranks lower than 59.91% of companies in the Vehicles & Parts industry. To learn more about BorgWarner stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.