[1/2]The Roblox logo is displayed on a banner, to celebrate the company’s IPO, on the front facade of the New York Stock Exchange (NYSE) in New York, U.S., March 10, 2021. REUTERS/Brendan McDermid/File Photo

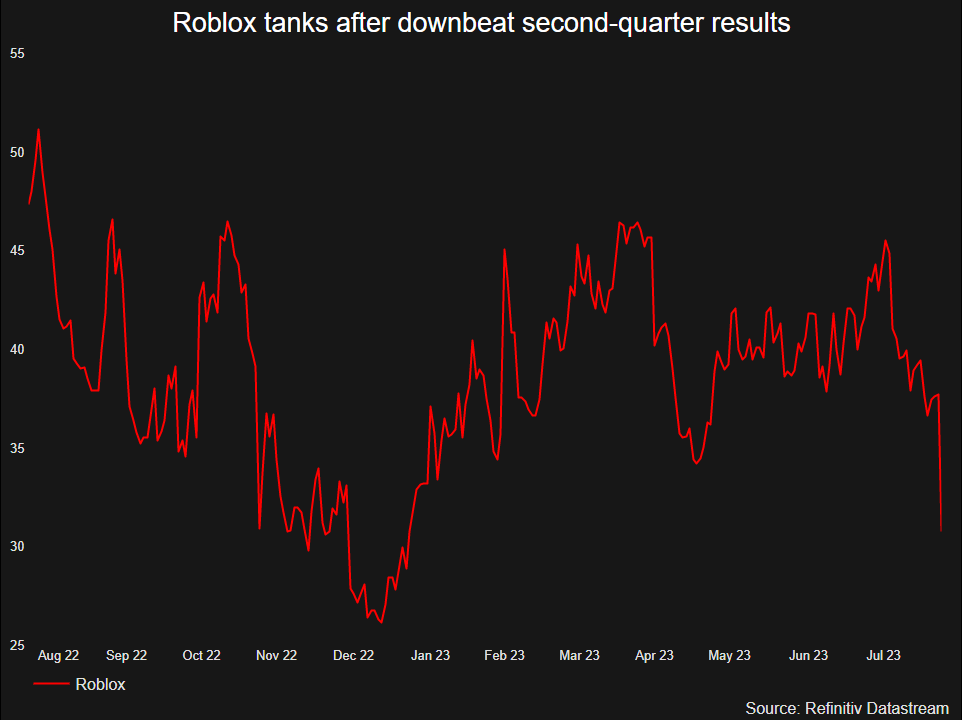

Aug 9 (Reuters) – Online gaming platform Roblox (RBLX.N) missed estimates for second-quarter bookings on Wednesday as waning demand for its online games and intensifying competition hurt growth, sending its shares down nearly 20%.

Shares of the company were set for their worst day in 10 months and on track to erase nearly all its gains this year, if losses hold through the session.

The videogame industry is struggling with a slowdown in spending as inflation-weary gamers become more selective in picking popular titles.

“We plan to slow our headcount growth rate and expect to generate operating leverage beginning in fiscal year 2024 and generally through the end of fiscal year 2025,” the company said in a regulatory filing.

Roblox, which operates a metaverse – an emerging virtual space where people play games and make transactions – reported 65.5 million daily active users in the quarter, with a long-term goal of reaching 1 billion daily users.

The company, popular for games such as “Adopt Me!” and “Brookhaven”, posted net bookings of $780.7 million in the quarter, missing analysts’ average estimate of $784.9 million, according to Refinitiv data.

Roblox reported a loss of 46 cents per share, slightly more than a loss of 45 cents per share estimated by analysts.

The company’s results come on the heels of downbeat forecasts from Electronic Arts (EA.O) and “Grand Theft Auto” publisher Take-Two (TTWO.O).

One of the more popular gaming sites for teens and tweens, it expects to make revenue this year from its advertising initiatives, which include advertisers like Spotify (SPOT.N) and H&M (HMb.ST).

“We’ve now done over 200 brand activations on the platform. And we’ll make revenue this year in advertising,” CEO David Baszucki said in a post-earnings call.

Roblox has also jumped on the AI bandwagon, with a robust pipeline of AI innovations for the next several years.

Reporting by Samrhitha Arunasalam in Bengaluru; Editing by Pooja Desai

Our Standards: The Thomson Reuters Trust Principles.