The S&P 500 has notched some very respectable returns this year, but there’s reason to believe it is only the beginning of a sustained multiyear rally.

At least, that is the opinion of ‘Shark Tank’ star Kevin O’Leary, who believes that while various sectors of the US economy will be dealing with a series of difficulties, the S&P 500 is poised to ride the momentum of increased government expenditure in the upcoming years. O’Leary anticipates that the CHIPS and Science Act along with the Inflation Reduction Act will inject a substantial amount of money into the US economy, leading to an increase in stock prices.

“That’s money we’re going to be printing,” says O’Leary, “and where’s it going? All into the S&P 500… You want to own the S&P while this much dry powder’s waiting.”

That is the kind of news investors like, and with that in mind, we pulled out of the TipRanks database 3 S&P members of different hues, but with one uniting characteristic – all are rated as Strong Buys by the analyst consensus. So, let’s find out what makes them names to bet on in a rising stock environment.

BorgWarner Inc. (BWA)

The automotive industry is going through a massive transformation, but no matter the changes, there will always be a need for good propulsion systems and that’s where BorgWarner makes its entrance. For more than a century, BorgWarner has led the way in these technologies.

The company is renowned for its focus on developing advanced propulsion technologies, including turbocharging systems, transmission systems, and electrification solutions. These technologies play a vital role in enhancing the efficiency, performance, and sustainability of vehicles, therefore contributing to the industry’s shift towards more environmentally friendly transportation options.

BorgWarner’s revenues have been steadily rising over the past several quarters and that was the case again in the recently released Q2 print. The top-line showed $3.67 billion (pro forma for the spin-off of PHINIA), amounting to a 22% improvement on the same period a year ago, yet slightly missing expectations by $1.71 million. At the bottom-line, the company delivered a nice beat with adj. EPS of $1.05 coming in ahead of the Street’s forecast by $0.13.

However, the auto parts supplier came unstuck with the outlook. The company sees net sales for 2023 hitting the range between $14.2 billion and $14.6 billion, falling shy of the $14.77 billion anticipated on Wall Street. Consequently, shares fell in the aftermath of the report’s release.

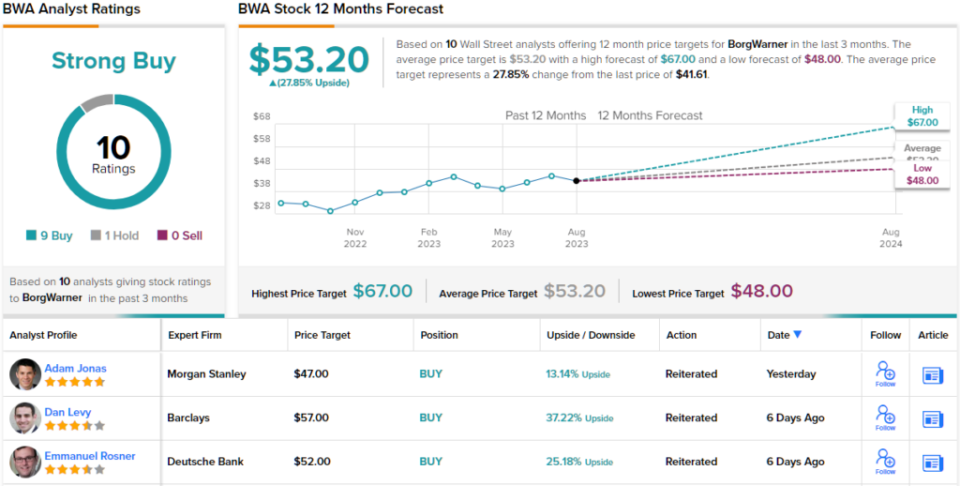

That said, Barclays analyst Dan Levy believes that a recent event could serve as a catalyst for the stock. In the beginning of July, the company successfully executed the spin-off of PHINIA, which encompasses its fuel systems and aftermarket business, forming an independent publicly-traded entity. This strategic step positions BorgWarner to concentrate on cutting-edge automotive technologies such as electric vehicles — a good move, according to Levy.

“With the PHINIA spin now complete, we believe the larger focus should be on BWA’s accelerated transition to an EV world,” Levy explained. “As we noted post BWA’s CMD (capital markets day) in early June, we believe BWA is accelerating its strategy to transition to an EV world – underscoring why we believe BWA is an underappreciated company and stock. And while there are certainly risks in the transition and progress won’t be linear, we nevertheless believe that ongoing progress in demonstrating that BWA can post robust growth and healthy margins in an EV world will ultimately be reflected positively in the stock price.”

These comments underpin Levy’s Overweight (i.e., Buy) rating on BWA, while his $57 price target suggests shares will climb 37% higher over the coming months. (To watch Levy’s track record, click here)

Overall, some stocks make a roundly positive impression on Wall Street’s analysts, and BWA is one of those. The company has a Strong Buy consensus rating, based on 9 Buys and 1 Hold. At $53.20, the average target implies one-year shares appreciation of ~28%. (See BWA stock forecast)

Alaska Air Group (ALK)

Let’s move away now from auto parts and pivot to the airline industry. Based in Seattle, Washington, Alaska Air emerges as a prominent figure among US airlines. In fact, it clinches the position of North America’s fifth-largest airline in terms of scheduled passengers transported.

Anchored in a partnership with regional counterparts, Horizon Air and SkyWest Airlines, Alaska Air orchestrates an extensive network primarily geared towards connecting cities along the western US coast. This intricate web extends its reach to over 100 destinations within the contiguous United States, along with reaching as far as Guatemala, Belize, Canada, Costa Rica, and Mexico. While it is known for its extensive network of domestic and international flights, Alaska is also appreciated for its commitment to quality service and customer satisfaction.

It’s well known that the airline industry was hit hard by the pandemic, but demand is back on tap, as was evident in the record revenue generated in Alaska’s recent quarterly update, for 2Q23. Revenue reached $2.84 billion, representing a 6.8% year-over-year increase that came in ahead of the estimates by $70 million. There was a conclusive beat at the other end of the scale as adj. EPS of $3 beat the forecast by $0.30.

That said, as fare prices have been on the backfoot, the outlook was a bit disappointing. Revenues for the year are anticipated to rise by 8% to 10% vs. 2022 but the Street was looking for growth of 11%.

For Raymond James analyst Savanthi Syth, one other metric represented a negative development, although that doesn’t detract from the company’s value proposition.

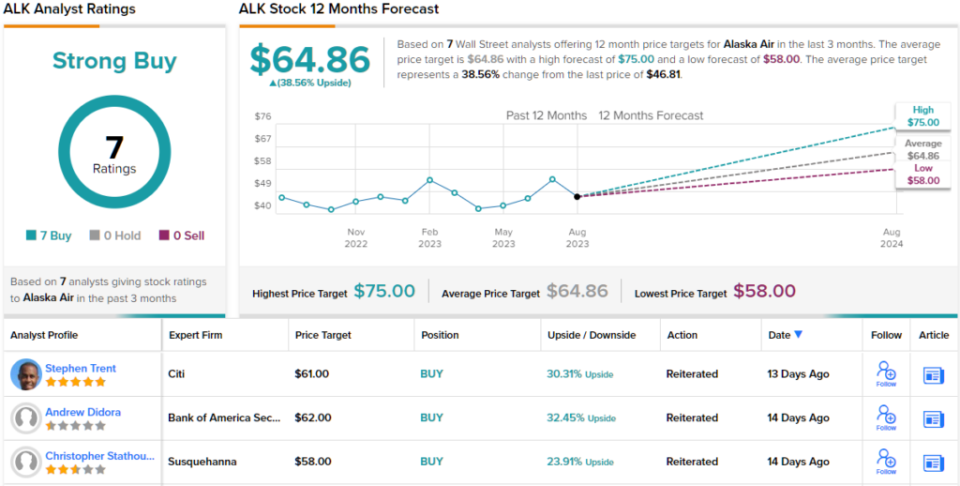

“Uncharacteristically,” noted Syth, “Alaska’s CASM (cost per available seat mile)-ex (non-fuel unit cost) update {Alaska reiterated the 2023 (1)-(3)% CASM-ex view} was somewhat disappointing, but it continues to have among the best y/y trends in 2023 and likely into 2024. In turn, we expect it to maintain U.S. industry-leading pretax margin and among the best balance sheets over 2023-25. As such, along with an attractive risk-reward, we reiterate our Strong Buy rating on ALK.”

That Strong Buy rating is backed by a $75 price target, implying upside potential of 60% from current levels. (To watch Syth’s track record, click here)

No one is arguing with that take on Wall Street. The stock’s Strong Buy consensus rating is based on Buys only – 7, in total. The forecast calls for one-year gains of ~39%, considering the average target stands at $64.86. (See ALK stock forecast)

Rollins, Inc. (ROL)

We’ll change course once again and head back down to earth for a look at Rollins, a company that specializes in pest control and related services. Since being established in 1948, Rollins has emerged as a leader in the pest management industry, known for its commitment to providing effective solutions to a wide range of pest-related challenges. Headquartered in Atlanta, Georgia, Rollins operates through a network of subsidiary brands, the most notable being Orkin, one of the best-known pest control brands worldwide.

The company serves more than 2.8 million customers (residential and commercial) across North America, South America, Europe, Asia, Africa, and Australia and that client base generated Rollins revenues of $820.75 million in the recently reported Q2 print, a 14.9% increase on the year-ago quarter. The figure also beat the consensus estimate by $15.01 million. The result wasn’t quite as good at the other end of the scale, with EPS of $0.23 falling shy of expectations by $0.01.

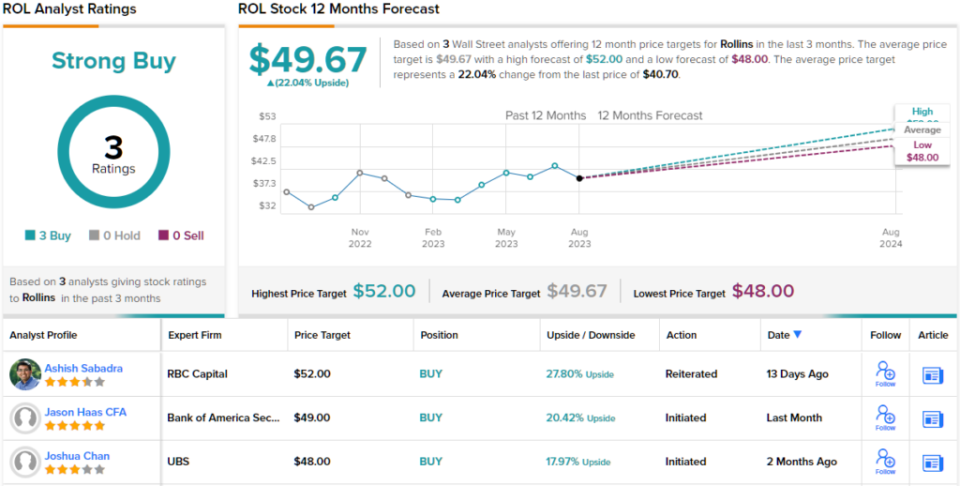

Investors were not all that keen on the mixed report, and the shares trended south in the subsequent session. That said, RBC analyst Ashish Sabadra sees plenty to like here and thinks investors should take advantage of any pullbacks.

“Revenue came in well above our/consensus expectations despite an unusually slow June, which we had expected. Although residential organic growth was modestly below our estimates and slowed down from 1Q23, a strong start in July bodes well. Operating margins were pressured by one-time items. Looking ahead, we expect the topline to continue to grow in the hsd %, for margins to expand, and for ROL to leverage its balance sheet to create shareholder value. We remain buyers on any near-term weakness in the stock,” Sabadra opined.

Sabadra adds an Outperform (i.e. Buy) rating to his commentary, and completes his stance with a $52 price target, indicating his confidence in ~28% upside for the next 12 months. (To watch Sabadra’s track record, click here)

Two other analysts have recently chimed in with ROL reviews, and they are also positive, providing the stock with a Strong Buy consensus rating. Analysts see shares rising by 22% in the months ahead, given the average target currently stands at $49.67. (See Rollins stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.